Surfactants Monthly - July 2024

July 2024 Surfactants Monthly

Promos:

If you’ve been following our many Linkedin posts you’ll know the multitude of companies already participating in our Asian Conference in KL in Novmeber. Everyone will be there. You should be too. I’m talking about our great return to Asia for the 10th Asian Surfactants Conference. We’ll be in Kuala Lumpur, November 19 – 21, with the original surfactant business essentials course Tuesday 19th and the conference November 20th – 21st. This is our first time in Malaysia for the conference – long, long overdue. The lineup of speakers and partners is already incredible. We’re at the legendary ParkRoyal Collection Hotel in the heart of Bukit Bintang. Please book early to ensure attendee rates at the hotel – and to secure a delegate place – we may cap at a couple hundred. This promises to be our biggest and best Asian event yet.

Register here: https://events.icis.com/website/14105/home/

Truly Asia

The News

Macroeconomics:

We like draw on IBank Evercore’s work periodically. Mid June’s newsletter - I’ll just lay out their first 6 bullet points here and let you think on them. [my comments are in the square brackets].

The US economy shows signs of slowing and inflation is cooling; the lagged impact of monetary tightening is starting to work

o Evercore ISI Survey of State Sales Tax Receipts declined significantly in June, suggesting weak retail sales. [may hit P&G et al next quarter?]

o Evercore ISI Company Surveys edged down from 50.6 to 48.6, due to broadly slower data at consumer and industrial companies

o The Company Survey Diffusion Index (Industrials) has been choppy this year, and remains negative

o Bank deposits plunged by -$67bn & slowed to +1.0% y/y; the yield curve remains inverted for 439 days [this seems a big deal]

o US consumer sentiment fell to an eight-month-low

o US consumer inflation expectations edged down to +2.9%

By the way, their headline on China is “Struggling”. Bound to continue to put more excess Chinese chemical production onto the world market.

China Struggling

Stepan Results – Second Quarter 2024. Despite EBITDA growth and volume growth in core markets, Stepan had some rough developments to report. Quoting now from the press release:

Second Quarter 2024 Highlights

Reported net income was $9.5 million, down 25% versus prior year. Adjusted net income(1) was $9.4 million, down 22% versus prior year, largely due to a higher effective tax rate in 2024.

Pre-tax earnings were negatively impacted by $18.9 million due to higher operating costs at our Millsdale site, primarily related to a flood event ($11.8 million), pre-commissioning expenses at our new Alkoxylation investment in Pasadena, Texas ($3.6 million) and expenses related to a criminal fraud event at a subsidiary in Asia ($3.5 million).

EBITDA(2) was $47.9 million and Adjusted EBITDA(2) was $47.7 million, up 3% and 4% respectively, year-over-year.

Global sales volume was up 4% year-over-year. Surfactant and Polymer sales volume was up 5% and 2%, respectively.

Cash from Operations was $29.5 million during the quarter. Free cash flow(3) for the quarter was slightly negative due to the higher expenses noted above.

The Company is on track to deliver its $50 million cost out goal for 2024 and recognized $2.7 million in pre-tax savings, net of the higher operating costs at Millsdale, in the second quarter.

First Half 2024 Highlights

Reported net income was $23.4 million, down 19% versus prior year. Adjusted net income(1) was $24.1 million, down 16% year-over-year, largely due to a higher effective tax rate in 2024.

EBITDA(2) was $98.0 million and Adjusted EBITDA(2) was $98.9 million, up 3% and 5% respectively, year-over-year.

Global sales volume was up 2% year-over-year. Global sales volume, excluding declines in our Agricultural and commodity Phthalic Anhydride businesses, was up 5%.

"Second quarter earnings were significantly impacted by higher operational expenses at our Millsdale site, start up costs related to our new Pasadena investment and a criminal social engineering event that targeted one of our Asia subsidiaries, leading to unexpected expense in the quarter. We are actively investigating this fraud event with the assistance of outside counsel, and to date, we have not found any evidence of additional fraudulent activity," said Scott Behrens, President and Chief Executive Officer. "From a top line perspective, we continue to be pleased with several of our core markets continuing to deliver volume growth. Surfactants experienced double-digit volume growth within the Laundry and Cleaning, Construction and Industrial Solutions and Oilfield end markets and also with our Distribution partners. Latin America Surfactant volumes grew double digits as we recovered Consumer volumes in Mexico and we experienced strong volume growth within several end markets in Brazil, inclusive of double digit Agricultural growth. North American and European Agricultural volumes remained soft and below our second quarter expectations. Rigid and Specialty Polyols volumes grew during the quarter. Global margins were in line with expectations despite unfavorable product mix. Despite the significant expenses incurred during the quarter, we delivered adjusted EBITDA growth of 4%."

Here are the key stats by segment:

Surfactant net sales were $379.8 million for the quarter, a 3% decrease versus the prior year. Selling prices were down 8% primarily due to the pass-through of lower raw material costs, less favorable product mix and competitive pricing pressures in Latin America. Sales volume was up 5% year-over-year as double digit growth within the Laundry and Cleaning, Construction and Industrial Solutions and Oilfield end markets and with our distribution partners was offset by lower Agricultural demand due to continued customer and channel inventory destocking. Foreign currency translation had a negligible impact on net sales. Surfactant adjusted EBITDA(2) for the quarter increased $4.0 million, or 13%, versus the prior year. This increase was primarily driven by the 5% growth in sales volume and slight margin improvement that was partially offset by pre-operating expenses at the Company's new alkoxylation facility being built in Pasadena, Texas and higher expenses associated with operational and infrastructure issues at the Millsdale plant.

Polymer net sales were $159.8 million for the quarter, a 3% decrease versus the prior year. Selling prices decreased 6%, primarily due to the pass-through of lower raw material costs. Sales volume increased 2% in the quarter as a 2% increase in global Rigid Polyols demand and a 28% increase within the Specialty Polyols business was partially offset by lower commodity Phthalic Anhydride volume. Foreign currency translation positively impacted net sales by 1%. Polymer adjusted EBITDA(2) decreased $2.8 million, or 11%, versus the prior year driven by a non-cash Phthalic Anhydride-related catalyst write-off at the Millsdale site and higher costs incurred at Millsdale due to operational and infrastructure issues.

Specialty Product net sales were $16.9 million for the quarter, a 29% decrease versus the prior year, primarily due to lower prices. Sales volume was down 2% versus the prior year while adjusted EBITDA(2) increased $3.6 million, or 69%. The increase in adjusted EBITDA(2) was primarily due to higher unit margins within the medium chain triglycerides product line.

Laundry and Household - Still Strong

Chemical Distribution:

I read an excellent newsletter (Summer 2024) from investment bank, Grace Matthews. The whole thing is available for download here. The key subject is chemical distribution which continues to have a hot streak in the deal space. Some interesting points:

· From 2010 to 2020, an annual average of 40 chemical distribution deals were completed globally [that’s average of 40 per year!]. From 2021 through 2023, that figure rose to an average of 65 deals per year, a 60%+ increase.

· A recent survey of chemical manufacturers by Boston Consulting Group found that 76% of principal suppliers expect the share of their outsourced sales to increase within the next three years. [We’re going to dig into that BCG report in just a bit]

· Chemical distribution is also a highly fragmented market. According to the most recent ICIS list of top chemical distributors published in May 2024, the top 5 distributors in North America had a market share of 54%. This figure is even lower in Europe, at 32%. The reality is that there are hundreds of independent distributors, collectively fulfilling a critical role in the supply chain. The sheer number of companies, coupled with well-capitalized strategic and private equity buyers, creates a recipe for consolidation through M&A

· In this sector as in others, as we have reported in the last two months, specialties are worth more than commodities. Note the recent announcement by Brenntag, that they would separate financial reporting of the company into two segments – Brenntag Essentials and Brenntag Specialties. The Essentials segment is focused on process and industrial chemicals and last-mile services [commodities – sorry!], while the Specialties segment consists of performance chemicals and ingredients sold into the nutrition, beauty & care, pharma and material science markets.

· This plan makes sense in the context of the trading EBITDA multiples for IMCD and Azelis, two distributors in Europe focused on specialty chemicals and ingredients end markets that have traded at meaningfully higher valuations relative to Brenntag in recent years. One key driver of this differential is the relative growth rates of the markets they serve. Specialties markets, such as life sciences, personal care, nutrition, and ingredients are growing at above-GDP growth rates. By separating Essentials and Specialties reporting, Brenntag investors now have better visibility into the performance and growth trends of both segments to compare to industry peers. [Prelude to a split? In my opinion doubtful. There are scale beneifts that the commodities brings upstream and in the back office ]. Here’s a really informative chart from Grace Matthews that illustrates the point.

Very telling

And another one from the same newsletter, which underlines the scorching page of distribution M&A just in North America in the last 5 years. Interesting right?

Scorching

While we’re on the chemical distribution subject, I should point you to the latest BCG (Boston Consulting Group) study called, improbably, “The New Age of Winning” (my guess? An intern came up with the title – ironically - and a manager with a sense of humor let it go through. Kudos). It’s a good piece of work, surveying 300 chemical distributors and came up with 8 findings:

1: APAC is key driver of positive outlook for the chemical distribution market

2: We [i.e. BCG] see significant increase in the use of third-party distributors across all regions and sectors

3: An increasing outsourcing share comes along with a set of expectations toward distributors

4: Principals push for a diversified distributor portfolio

5: While principals are willing to diversify their distributor base, they expect excellent distributor performance in return.

6: Principals are less accepting of performance issues and are therefore willing to switch distributors.

7: Sustainability has become an important factor in chemical distribution, yet distributors are making only moderate portfolio adjustments.

8: Dynamics in China are different from the rest of the world regarding third-party chemical distribution

While the headlines are not exactly shocking or surprising, the data in the report and is interesting and shows some nuance. Worth a read.

Winning indeed

BTW – why am I writing about this? Surfactants are consistently in the top three product lines carried by distributors. The most common other two? Caustic and solvents. So – there you go. Key channel to market for surfactant suppliers and, I would argue, a solid route into specialties for a distributor. If you have any additional perspectives from the field feel free to get in touch and let me know – for publication, attribution or neither. Up to you.

Big Changes in Indian LAS: One of our readers in India alerted me to the a new SOP regulation issued by the Indian Government Pollution Control Authority regarding Disposal of Spent Acid Generated while producing LAS 90% in Batch Sulfonation plantr using Oleum. This is expected to impact a large part of the Detergent Industry as most of it in India uses this type of LAS. If you are involved in this sector you should become familiar with this. Many companies may end up changing technologies.

The full title of the document is: Standard Operating Procedure and Checklist of Minimal Requisite Facilities for utilization of hazardous waste under Rule 9 of the Hazardous and Other Wastes (Management and Transboundary movement) Rules, 2016 - Utilization of spent sulphuric acid (SSA) [generated from Linear Alkyl Benzene Sulphonic Acid (LABSA) process] in manufacturing of Single Super Phosphate. I’m going to put it right here for your easy access and download.

More biosurfactants news: Ruby Bio, who we have written about in these pages previously had a very nicely written and footnoted article about their biosurfactants in Personal Care Magazine. You should read the whole thing here. A particularly interesting graphic compares the cmc of one of their surfactants with popular benchmarks – interesting right?

And more biosurfactants: AOCS Journal of Surfactants and Detergents recently published an excellent article entitled “Surfactants produced from carbohydrate derivatives: Part 2. A review on the value chain, synthesis, and the potential role of artificial intelligence within the biorefinery concept.” Read it here. Part 1 is good also. I draw on both and other sources and primary research for an article I just completed for HPC Today magazine. It’s not published yet, but I can share that in compiling a list of companies active in biosurfactants (that’s those involved in fermentation – not including bio-based or those using enzymatic catalysis) I got to 26. Have we reached peak bio? Not even close. Although I expect some of these companies won’t make it and others, quite significant ones, will join in. Here’s an interesting figure from the AOCS article laying out raw materials and some structures for bio and bio-based surfactants based on carbohydrates.

Not the whole picture but good part of it.

The Chevron Doctrine – No this has nothing to do with a renewed interest in alpha olefins. An article in Bloomberg Law this month was headlined “Supreme Court Rulings Boost Odds to Win Chemical Rule Challenges” and notes that 3 recent rulings tip the balance of power in favor of companies who challenge regulations. I’ll try and summarize (without AI help). The supreme court’s decision in Loper Bright Enters. v. Raimondo overturned the 40-year-old Chevron doctrine that had directed federal courts to defer to reasonable agency interpretations of ambiguous or silent statutory provisions. Now, however, the final interpretation of laws is the “province of the courts,” the Supreme Court said. A ruling in Corner Post Inc. v. Bd. of Governors of the Fed. Rsrv. Sys. said parties have six years after being injured to challenge a federal rule under the Administrative Procedure Act, meaning some chemical regulations could be challenged years after they’re in effect. And a third ruling, SEC v. Jarkesy, gave companies the option of having juries resolve some enforcement disputes. Opinions differ, obviously, on how good or bad these ruling are. There does seem to be consensus agreement that there’ll be quite a bit of litigation around TSCA regulations in the coming years. Some I bet will involve surfactants. Checks and balances. Let’s see.

Checks and balances

The great Jen Novakovich of the Ecowell (Google both. She produces excellent material, including literally all day events in cosmetic science – free) interviewed me for a podcast. I droned on for an hour and so I hope she’s a good editor. Rest assured we’ll link to it here when it’s released. She also let me know about a couple of studies run by Good Housekeeping and Cosmetics and Toiletries magazines, that debunk the myth that sulfates cause colr washout in dyed hair. And here, I’ll admit that I thought that this was the only flimsily valid complaint one might have about these workhorses of personal cleansing. Turns out – maybe not. I quote from Good Housekeeping: “Keep your 'do from fading fast with the Tresemmé shampoo and matching conditioner that best helped retain color in the GH Beauty Lab's most recent test — the pair was also the consumer tester favorite. Though a sulfate formula, hair samples showed the least color change after 20 washes and 10 hours of UV exposure in Lab evaluations. Plus, this color-safe drugstore duo was the most affordable option we tested.” So there you have it. Know what? I’m done with sulfate free.

Just an excuse for this oldie but goodie

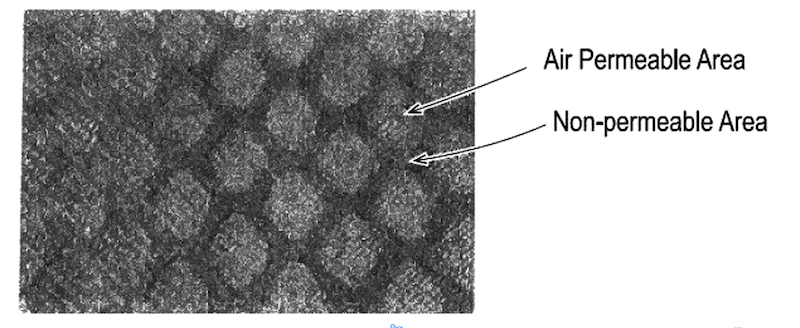

More P&G technology news. The company is on a tear in dry products. P&G’s newly awarded US Patent No. 12,029,799 B2 covers a dissolvable solid fibrous structure for a solid format hair conditioner. Very nice. Looks like a kind of Tide Evo for the head. Here’s an image from the patent as published by HAPPI. Looks somewhat familiar right?

Continuous innovation

Cepsa, the LAB and LAS (among other things) company has been doing some excellent marketing around their Bio Mass Balance LAB products, Nextlab. I know bio mass balance has its detractors but I have to admire how CEPSA explains the concept and the real benefits in terms of product carbon footprint. They did a nice webinar recently and it you missed it, try to get hold of the slides. I am not sure I should share them here. I will however, share a piece of data, I did not fully appreciate.

Did you know this?

News from Adani Wilmar, from the world of oleochemicals, courtesy of India’s Chemical Weekly: Adani Wilmar Ltd (AWL) has announced the acquisition of a 67 percent stake in Omkar Chemicals Industries Pvt Ltd (OCIPL), a Gujarat-based speciality chemicals firm. AWL, a joint venture between Adani Group and Singapore’s Wilmar, is a leading player in oleochemicals and one of the largest food-FMCG companies in India.

In a stock exchange filing, AWL said it has signed a share purchase agreement with OCIPL for an enterprise value of Rs. 56.25 crore to be paid in cash. OCIPL operates a manufacturing plant in Panoli, Gujarat, with an annual capacity of around 20,000-mt of surfactants, and is planning to scale up its capacity for other products, AWL said. In FY2023-24, OCIPL reported a turnover of Rs. 13.95-crore [about $1.7 Million]. Its plant commenced operations in FY2023-24 and its capacity utilisation was below 10 percent.

Big facility!

It’s the most wonderful time of the HPCI year. Happi’s Top 50, 2024 is published here. It’s a favorite since many of you were in diapers, like the Cadbury’s selection box. It’s bit of a quaint holdover in that the keep the “international” companies, like Unilever and Henkel for the “International Top 30” list. Anyway, surfactants sales and marketing folks – this is part 1 of your tier 1 target account list.

A good selection

It seems that California was blindsided by NY States sneak attack on dioxane in consumer products. Now, however, it looks like they got their footing back. The state is working on proposed action and gives some notice in this recent publication, which references an earlier (Jan 2024) detailed program plan. Note for interested parties – that there is a workshop on August 20th concerning this matter, so no doubt ACI and perhaps other groups will be representing industry interest there. Speaking of ACI, they are publishing regularly on dioxane. Check their site.

All the leaves are brown - no doubt from dioxane

More Innovation in Laundry: We’ve written a fair bit about Tide Evo in the blog. The great Plastics Today magazine has published an article on 2 more products in the same category, including one I had not heard of, Tru Earth. According to the article: Tru Earth announced a challenge on July 1 aimed at firing up consumers to act against plastic pollution. Participants in the Tru Earth Challenge are asked to make a plastic-free pledge, and they get the chance to win $10,000 or a one-year supply of Tru Earth Laundry Eco-Strips. Tru Earth estimates it has eliminated 185,791,997 single-use plastic containers to date by using paperboard packaging for its laundry eco-strips. They are a B Corp, so.. And I have to note that while this blog has been accused by some of publishing content meant to appeal to prurient interest (Google it), we have nothing on the marketing folks at Tru Earth, some material from whom I feature here for your education. Apparently their tagline is “one strip is all it takes for your laundry to come out fresh and clean”. Yep...

We neither condone nor condemn this marketing.. but we do wish we’d thought of it.

Even more innovation in Laundry: The Cooldown has written about the Washing Machine Project, which is bringing cheap hand-cranked washing machines to those who are still washing by hand. Apparently, Over half of the global population washes clothes by hand. It's a time-intensive and physically demanding process that often falls disproportionately on women. But now, home appliance manufacturer Whirlpool has announced it's partnering with the Washing Machine Project, a global nonprofit, to deliver 10,000 manual, off-the-grid washing machines around the world. That will free up millions of hours and improve the quality of life for many people, according to the company. Here’s a brief video explainer.

This is not directly related to surfactants but I have to draw your attention to this article in the The Edge, Malaysia. It is written by Qua Kiat Seng, a long time member of the oleochemical industry and now a professor at Monash University in Malaysia. He is engaged in a direct consumer education effort with Malaysian consumers on cooking oils - under his own steam and financing. I admire this. Check it out.

Procter & Gamble, one of the world’s largest users (and makers) of surfactants, reported decent results for their recently finished FY ’24. : Q4 ’24: Net Sales 0%; Organic Sales +2%; Diluted EPS -7%; Core EPS +2% FY ’24: Net Sales +2%; Organic Sales +4%; Diluted EPS +2%; Core EPS +12%. Some business details from the press release [decent results in a a tough-ish period:

Beauty segment organic sales increased three percent versus year ago. Skin and Personal Care organic sales were unchanged as growth from increased pricing was offset by lower sales of the super-premium SK-II brand and in Greater China. Hair Care organic sales increased high single digits driven by increased pricing and favorable product mix due to growth of premium products.

Grooming segment organic sales increased seven percent versus year ago driven by increased pricing primarily in Latin America and volume growth from innovation.

Health Care segment organic sales increased four percent versus year ago. Oral Care organic sales increased high single digits due to premium product mix and volume growth in North America and Europe. Personal Health Care organic sales were unchanged as growth due to pricing and volume increases were offset by unfavorable mix due to lower incidence of cough and cold.

Fabric and Home Care segment organic sales increased two percent versus year ago. Fabric Care organic sales were unchanged as volume growth driven by North America and Europe was offset by lower pricing due to increased promotional spending. Home Care organic sales increased high single digits due to volume growth from innovation and favorable product mix.

Baby, Feminine and Family Care segment organic sales declined one percent versus year ago. Baby Care organic sales decreased mid-single digits due to volume declines from share losses, partially offset by premium product mix. Feminine Care organic sales increased low single digits driven by increased pricing and favorable product mix. Family Care organic sales were unchanged as volume growth was offset by unfavorable product mix.

Doing OK

Oleochemical Logistics: There’s some major disruptions affecting ocean logistics affecting many things, including the oleochemical building blocks, fatty alcohols and fatty acids, used in surfactants. Here’s what’s going on as best as I can see.

The Port of Singapore, is currently experiencing significant shipping disruptions that are impacting various industries, including the chemical and oleochemical sectors. These disruptions are part of a broader global supply chain issue with several underlying causes.

Causes of Disruptions

Red Sea Crisis: The ongoing attacks by Houthi rebels in the Red Sea have forced many vessels to reroute around southern Africa, leading to longer transit times and reduced global shipping capacity. This has indirectly affected Singapore's port operations, as it is a transshipment hub for vessels traveling between Asia and Europe.

Increased Vessel Traffic: The number of vessels arriving at the Port of Singapore increased by 66% in May 2024 compared to May 2023. This surge in traffic has put significant strain on the port's infrastructure and handling capacity.

Off-Schedule Arrivals: Approximately 90% of container vessels are arriving off-schedule at Singapore's port, compared to an average of 77% in 2023. This high rate of late arrivals has led to a "vessel-bunching" effect, causing congestion and longer waiting times.

Extended Port Stays: Vessel port stays in Sinagpore have increased by 22% compared to the same period last year due to higher demand and increased container re-handling requirements.

Impact on Trade and Chemical Industry

The disruptions at the Port of Singapore are having and are expected to continue to have the following effects:

1. Delayed Shipment: The congestion and longer waiting times at the port will lead to delays in chemical and oleochemical shipments, potentially disrupting supply chains and production schedules for manufacturers relying on these materials.

2. Increased Costs: The need for vessels to reroute and spend more time at ports will likely result in higher shipping costs. These increased expenses may be passed on to consumers, potentially affecting the pricing of chemical products.

3. Supply Chain Volatility: The unpredictable nature of vessel arrivals and extended port stays may lead to increased volatility in chemical supply chains, making it challenging for businesses to maintain consistent inventory levels.

4. Capacity Constraints: With vessels spending more time at the port, there may be reduced capacity for chemical shipments, potentially leading to backlogs and further delays in the movement of goods.

5. Global Ripple Effects: As Singapore is a major transshipment hub, disruptions here can have cascading effects on other ports and regions. This may impact the global chemical trade network, affecting markets beyond Southeast Asia.

6. Equipment Shortages: The congestion and rerouting of vessels have led to equipment shortages, particularly empty containers, in key export markets. This could further complicate the shipping of chemicals and other goods.

Mitigation Efforts and Outlook

To address these challenges, several measures are being implemented:

· Singapore has reinforced its frontline capacity and commissioned new berths at Tuas Port.

· Reactivation of berths and yard space at Keppel Terminal to increase handling capacity.

· Expansion of port networks and ecosystems to enhance global presence and improve cargo flows.

Despite these efforts, the situation remains volatile, and disruptions are expected to persist in the near term. The chemical industry and related businesses should prepare for continued challenges in shipping and logistics, potentially requiring adjustments to supply chain strategies and inventory management practices.

Documented Impacts on Oleochemicals:

The current shipping disruptions around Singapore have had documented impacts on the oleochemical industry, particularly affecting supply chains and market dynamics.

1. Supply Constraints and Delays

The oleochemical market has faced significant supply constraints due to vessel delays from Asia. These delays are primarily due to a lack of ships and workers resulting from geopolitical disturbances such as the Red Sea crisis, which has forced vessels to reroute and caused congestion at the Port of Singapore. This has particularly impacted the supply of palm oil-based fatty acids and fatty alcohols, which are major feedstocks for oleochemicals.

2. Increased Freight Costs

The disruptions have led to increased shipping and delivery costs. The tight shipping market has resulted in higher freight rates, affecting the cost of transporting oleochemicals. For example, the supply of fatty alcohols to both Europe and the USA has grown tight, with shipping and delivery costs doubling in some cases. This is due to the heavy reliance on Southeast Asia for natural alcohols and on Europe for synthetic alcohols.

3. Market Dynamics and Price Increases

The oleochemical market has experienced upward pressure on prices due to the supply chain disruptions. For instance, crude glycerine prices have seen significant increases. This price hike is attributed to the reduced production of biodiesel, which is a major source of glycerine, and the overall uncertainty in the supply chain.

4. Impact on Specific Oleochemicals

- Fatty Acids: The supply of palm oil-based fatty acids has been particularly hit by vessel delays from Asia. This has led to significant price hikes, with oleic acid prices seeing the biggest increase. The market has also faced severe shortages in the tallow fatty acid market, further driving up demand and prices for palm-based fatty acids.

- Fatty Alcohols: The tight shipping market has also impacted the fatty alcohol market, especially in the USA, where production is located far from feedstock sources. The delays and increased freight costs have added pressure on the supply chain.

5. Regional Impacts

- Europe: The European market has faced severe disruptions due to the rerouting of vessels around the Cape of Good Hope, adding significant delays to deliveries from the Middle East and Asia. This has led to production cuts and challenges in fulfilling orders for companies relying on oleochemical imports.

- USA: Similar to Europe, the USA has experienced delays in the supply of fatty alcohols and other oleochemicals, with increased costs and logistical challenges further complicating the situation.

Further Reading:

https://www.globaltrademag.com/psa-singapore-boosts-capabilities-to-tackle-global-supply-chain-disruptions/

https://www.porttechnology.org/news/shipping-delays-surge-at-singapore-port/

https://sourcingjournal.com/topics/logistics/port-of-singapore-congestion-90-percent-late-off-schedule-container-shipping-global-trade-transshipment-red-sea-517284/

https://www.channelnewsasia.com/singapore/shipping-delays-freight-rates-containers-ports-asia-singapore-congestion-e-commerce-4371021

https://sourcingjournal.com/topics/logistics/singapore-port-congestion-7-day-delays-linerlytica-maersk-red-sea-dhl-schedule-reliability-container-shipping-513075/

https://crsreports.congress.gov/product/pdf/IF/IF12657

Note: Data for the above piece on Oleochemicals Logistics was collated and analysed with the help of Perplexity.ai.

Queueing up in Singapore

Having just finished this writeup on logistics, I notice that Avery Hood of P&G put a rather more succinct summary on Linkedin. Here it is is here.

More in the renewables space. I just became aware of a Belgian company, Terra Mater Renewables. The are targeting renewable mid-cut and other alcohols via novel routes. The website gives you the basics. More to the story, though. One to keep tabs on.

And finally, in enzyme news – Novonesis (which I have belatedly determined is pronounced Nessis – like the Loch Ness Monster) introduce an enzyme called Luminous in a carefully worded Linkedin post. It is intended to maintain whiteness and brightness of laundry and touts itself as an alternative to petrochemical products that it does not name, curiously. I figured they must be talking about PAA (polyacrylic acid). The post is here.

Pronunciation guide

Now to the market news:

Due to my data aggregator taking a summer break and the enormous volatility in Southeast Asia markets profiled above, I’m putting this section on summer break this month. Normal service resumes next month.

AI Corner

In a July 9th briefing, Goldman Sachs outlined how P&G is using AI. Quite interesting. According to John Moeller, P&G CEO: The point is not simply to find ways to use AI, but rather to find ways that AI can be used — to create delight [with consumers].

“The outcomes are consumer, customer, employee, societal, and shareholder delight, period,” Moeller said on June 6 at The Forum with Ashish Goyal from the Fundamental Equities US Equity Team in GSAM. [societal delight sounds like something Aldous Huxley may have come up with but we’ll give him a pass on that one.]

Moeller cited the ability of technology, including new AI tools, to improve quality control processes [OK that’s more like it]. Existing methods for establishing that a product meets standards might involve testing it in a warehouse weeks after it’s manufactured. That has obvious drawbacks, since the company might have to scrap or rework an entire production run after a problem is uncovered. Better to incorporate sensors and algorithms that can identify quality problems as they occur.

Innovation in consumer products can be time consuming and very expensive, Moeller said. Conceptualizing an innovative idea may be the easy part, but then the company has to figure out how to make the product on an industrial scale, building a production line that “operates faster than your eye can even follow.” Then there is the expense of bringing a product to market and figuring out how to reach the consumer. Here again, Moeller said there may be a role for AI and a potential advantage. A large company like Procter & Gamble has deep experience with advertising and extensive data on what works.

Moeller also said there may also be potential for the use of AI in Procter & Gamble’s laboratories. “We’re increasingly moving innovation from the lab bench to very sophisticated computers,” he said. This may help the company to speed up molecular discovery, explore more areas for innovation, and come up with more successful product ideas.

Societal delight per Dall-E

Music Section

OK – so now, I am taking a huge risk this month by handing over the music choice for this section of the blog to a reader. Our blog-DJ this month is a long-time reader and well known senior figure in our industry - chair of his own very successful company. He has consistently encouraged me to broaden the musical horizons of the blog and so here we go, with his own recommendations. Let me know what you think!

From here on in, you are reading excerpts from this music commentary, interspersed with videos that I found on YouTube. :

“I hope that one future issue you will investigate and highlight some of the great 1960’s and 1970’s Soul Music/ Motown Sound. For me it is the music I still listen to and the last music I could dance to. There were some great groups and individual soloists, some purely entertaining and some delivering a message.

My top standout group, the Temptations, so many hits, so much talent such tragic endings. My Girl is my favorite,

The Way You Do the Things You Do, Just my imagination all of those are easy listening and good dancing.

Smokey Robinson with and without the Miracles were huge talents. Great love songs and slow dance songs, they had many hits. Smokey wrote and produced many of the songs other Motown groups sang. I would say he was a pilar of Motown’s success. Smokey has his own channel on Sirus XM now.

Not widely know The Dells and the song Stay in My Corner is a standout ballad.

I talked about the Motown groups but then we have the Philadelphia soul music. The sound originated from Philadelphia International Records. If you are ever trapped in Philadelphia Airport there is an excellent display on the Philly Sound. Performers like Teddy Pendergrass, Harold Melvin and the Blue Notes, The O’Jays, The Spinners, The Stylistics, Patti LaBelle and the Delfonics to name just few.

A group from that time that delivered some great messages, great songs was from right here in Chattanooga TN, The Impressions, check them out.

I will say this Neil, there are plenty of good songs from the Motown era that your older readers will enjoy and bring back great memories as you weave them into the current chemical news.

Between you and I, I have never forgiven the British for the British Rock invasion sending all those rock groups over here to displace the Soul Music/ Motown Sound. Music started downhill from there for me.”

[Oh man, you’re killin’ me. But I get it]

Your feedback is welcome and if there are others out there who would like to guest-DJ on the blog, please let me know.

That’s it for this month! Get signed up for the Asian Conference now. See you there in KL - November 20 – 21 (Course on the 19th).