Surfactants Monthly New Year 2022

It all begins with an idea.

Happy New Year

As promised, we have here our monthly blog for the remaining part of December and an end of year short story. The story is set on New Year’s Eve and starts in the control room of a specialty chemical plant. If you don’t want to be bothered with the story and associated moralizing, you can skip straight to the news section which is clearly marked. OK? So here we go then…

Oh and by the way, the story is fiction. It's not based on any real events or places. Although - you may recognize some characters, thoughts and feelings from your own life. Alright here we go...

The Story

Emerald - A New Year’s Eve Short Story

John gazed at the pale green screen. It yielded nothing of interest. Nothing at all really. No phones. No books or magazines even, allowed in the plant control room at Veritas Chemical, ever. Not even New Year’s Eve, when basically nothing was happening. Well, nothing that the control room cared about. There was some last-minute shipment being drummed off out there for a customer in Thailand or Taiwan or someplace round the world. That’s Karl’s thing, drumming. He liked getting up close and personal with the product out on the plant floor, like a real working man. Couldn't stand the control room for too long - in there with the computers and the other expensive crap that would break if you looked at it the wrong way. John liked it there though. It was high-tech-ish. Everything at his fingertips, under his control, except Karl’s little drumming empire, the last redoubt of true manual labor at Veritas.

Karl burst into the control room with a flourish and sample in his hand.

“OK Johnny boy. Last sample of the last shipment of the year for analysis and then it’s what…. Johnny what is it?” Karl grinned expectantly.

“erm… a mega piss-up, Karl?”

“No Johnny. The mega-est piss-up of the year with the entire Westside motorcycle club in attendance and their wives and girlfriends and significant others and Lisa, that chick from behind the bar at Murphy’s who will be my arm candy for the evening and maybe more if the lucky lady plays her cards right – know what I mean, Johnny”

“Yes Karl, I believe I do. Good luck then”

“And you Johnny boy – stopping by the club later are ya? Lisa might bring her mate with the boots; you know the one…”

“Erm actually I have a date tonight, Karl, so er probably won’t make it over there this time. Thanks though” hell why did he have to mention the date?

“A date? Like a proper date with a girl...?” Karl inquired with a rising tone of utter disbelief

“Who is it then?” he challenged before John could respond.

“Just someone I met and er yeah so, we’re going to a movie and dinner and her name’s Kat and… are you going to analyse that sample and get those drums out of here so we can go home?”

Karl loaded the sample into the GC “Kat eh? From in there?” he waved in the general direction of the Veritas offices and smirked “with the green hair – who does accounting and stuff – wow Johnny boy – nicely done buddy. Outta my league for sure. I mean not looks-wise, although she’s very good looking, v-e-r-y and I mean very nicely proportioned if you know what I mean – but you know she’s a bit too intellectual (he almost spelled it out) for me. I think she’s like studying for some business degree at night - so quite brainy you know” He added in the sort of hushed tones that one might use to mention an unfortunate physical defect.

“Yeah well she seems nice and maybe it’s a bit much to bring her to the club on a first outing, you know, Karl”

“Sure, that’s cool man. You wanna stay on the right side of the tracks with that brainy intellectual one, tonight. I get it”

“Ok then” Karl stared at the display and did his dopey imitation drum-roll thing “ Analysis says…. 98.5 .. another award winning batch of H-105 from the Veritas Chemical Company, courtesy of Karl-Heinz Rickenbacker the best drummer this side of the Hudson River”

“There’s not really that much this side of the river Karl, but actually - did that say 98.5? It looked like a 93 from here man”

“John, John John” Karl intoned as he switched off the GC and filed the sample with the week’s batches “The spec is 98 minimum, as you know, and so the analysis on this new year’s eve, approximately 119 minutes from my ron-day-voo with the lucky and lusty Lisa and approximately 179 minutes from when Interfreight swings by to get this last shipment of 2021 on its way to China, is of course a full 98.5 my boy. No question”

“I thought it was going to Taiwan, Karl”

“Same thing bud. Says it right here on the Commercial Invoice – Republic of China - so just pop that 98.5 on the C of A and we outta here man – time to find out if green is that Kat’s real hair color, eh? know what I mean Johnny eh?” Karl cackled like the 15-year-old trapped in a 40-year old’s body that he was.

“I’m pretty sure that it’s not her real color, Karl and OK I guess 98.5 it is if you are absolutely sure about it?”

“Sure as you are about your girlfriend’s hair”

“She’s just a date, mate, come on. Here’s your C of A then and I’ll see you next year ok? All the best to you er don’t drink too much eh?”

“Planning on it Johnny! Happy New Year mate!”

Shower, new jeans and a splash of Paco later, John is sat across from the green-haired Kat at Murphy’s, Guinness in hand and feeling mildly buzzed after pre-game shots with this brother before heading out. Kat observed her first date for a year since moving across the country to start again, again. And it had to be some guy from work, didn't it – although John didn't really count because he worked over there in the plant with dirt under his fingernails and that coarse skin on his large strong hands. She snapped out of her bodice-ripper moment but not before glancing at John’s nails which were surprisingly well manicured – for a plant guy. Stereotypes aren’t what they used to be, she shrugged inwardly. Just as well. This guy seemed nice enough – certainly better than his buddy out there on the plant who almost had her calling HR in her first week at Veritas.

Some old guy put Thin Lizzy on the jukebox. The dueling Celtic riffs of Emerald ricocheted around the pub.

“Good song” said John

“Great song”

Wow thought John

“How about being black and Irish?” pondered Kat

“Is that a trick question? Erm – I dunno. Guinness - that’s black and Irish”

“Er haha – no. Phil Lynott the lead singer of Thin Lizzy. He was black and Irish and a huge figure in 70’s rock - all over the world. Have you heard the words to this? It’s about the Irish struggle to regain what was rightfully theirs...”

Down from the glen came the marching men, with their shields and their swords

“Sure, I know the words, but you know some of them bother me – this bit coming up”

When they left the town was empty. Children would never play again

John warmed to his theme

“I mean they’re supposed to be singing about the good guys, right? but they have to bring kids into it. It’s pretty sad that lyric – a bit disturbing”

“True John, but that’s life, isn’t it? It’s like the Passover story. Before the Jews could get out of Egypt, all the little first-born boys of the Egyptians had to be killed, didn't they? And it was God did that – so if it’s good enough for God, it’s good enough for the Irish right?”

“Yeah, I guess but, I never liked that story either Kat. I guess the Pharoah had lots of chances to do the right thing, but I suppose things just got out of hand. One mistake compounded on another and pretty soon it’s the ultimate horror”

“Wow look at us being all deep and morose and philosophical. I need another drink and so do you. same..?

Kat returned from the bar with a Guinness, a Cider and two shots of something that looked and smelled like Bushmills. What a first-class young lady, thought John. We need to cheer things up round here, thought Kat. These shots’ll fix it – or not.

Aaah – nice – the golden liquid did its job

“– so, John you from round here originally?”

“Westsider all my life. In fact I reckon I was born in this pub..”

“Conceived maybe” observed Kat wryly with a raised eyebrow.

Funny girl – and yes, kinda clever.

“And you, Kat. Where are you from?”

“New York, then Cali, then New York again. Moved around a bit you know. I’m hoping this is home for a while at least”

“You like it at Veritas?”

“It’s OK. Not bad. It pays the bills and I’m learning – a lot really and I’m getting my MBA at night... so yeah, I guess I like it. And I can more or less be myself as long as the job gets done. The people aren’t bad either – no real jerks that I’ve come across – although do you know the owner, Flannery Jr? They say he’s a piece of work, when he shows up”

“Yeah – the new owner you mean. He’s Flannery’s son. Took it over from Mr. Flannery last year. Stay away from that guy. He’s the opposite of his dad. Basically, a playboy. Only wants money from the company and leaves the running of things to the execs on the 3rd floor. “

“Oooh a single rich playboy then?” Kat did that thing with the twirly hair and pouty lips “maybe I should meet him. Wouldn't need to bother with the MBA then..ha”

“More like a married rich sleazeball. I’d say I feel sorry for the unlucky Stella – Heinz Rickenbacker Flannery, but I hear she gives as good as she gets in the sleaze department, so I guess they’re a perfect match”

“Oh – Rickenbacker – that's your buddy in the plant? No relation though, right?” Kat laughed

“Unfortunately, yes, the relationship is that he’s the idiot step-brother of the the evil step-sister Stella. And look, despite what you might think” Kat untwirled her hair and rolled her eyes “he’s the most decent one of the bunch. He’s a good guy underneath all the macho-talk. He wouldn't hurt anyone – unless he thought they were going to hurt a friend of his – and he’s fundamentally honest. He can’t lie really – which has gotten him into a few fights over the years, but he’s a straight up honest guy who well.. at least I thought so until”… John’s voice trailed off and he gazed into the bottom of his now empty Guinness glass.

A moment passed. Bob Marley filled the dead air.

Exodus… movement of ja people

“Er hello.. John… where’s John? Did he disappear into the Guinness glass, like Alice?” Kat squawked like a cross between the Red Queen and Dame Edna.

“Yeah, no, I’m good. Just something at work earlier. Anyway, no big deal. It’s New Year’s so..”

John offered a far-too-weak smile and stared back into the glass, looking for something.

Open your eyes and look within

“Hey look, if this is your broody-mysterious schtick – it doesn't get you into my jeans. Just so you know...”

“Kat – no. Good grief. I got no schtick, believe me. No it’s stupid. Anyway, I get paid by the hour and right now I’m not on the clock – I’m on your clock – the cute funny smart-girl clock. So, let’s get going or we’ll miss the movie”

He peered uncertainly into her eyes, which he noticed were exactly the same color as her hair, which was weird, but cool. He kept peering.

Are you satisfied with the life you’re livin’

“Ooops I lost you again. You’re behind my eyes now. What are you doing there you naughty boy” Red Queen / Edna asked

“I think… Karl... might have lied to me this afternoon”

“Goodness. Saint Karl told a lie?” Kat’s mock incredulity hit hard

John ploughed on

We know where we’re goin’

“That last batch of H-105. He told me it analyzed at 98.5 but honestly Kat, to me, from where I was sitting, it looked like a 93 and I know he was dead-keen to get out for New Year’s and see that Lisa ‘n all so maybe he just fudged it and, well, I’m the one who put it into the system, so I fudged it as well” John eyes refocused on Kat’s. “What does that H-105 do anyway? You probably see all that with your work in the office. It’s going to Taiwan, which is not China erm...”

“Yeah I know it’s not China, John... H-105 - that batch is going to EVA air. The last shipment I set up before leaving tonight - actually goes into a lubricant – for aerospace. So – basically keeps airplanes flying - so yeah I guess pretty important”

We know where we’re from

“Ooof Kat. We gotta do something. That stuff can’t go out tonight. What if an airplane falls out the sky and … it’s all on me”

“What, John. What are you going to do? Call the nightshift from Murhpy’s on New Years Eve and shout above the pub-noise to tell them not to ship the 105.? It’s getting picked up in an hour from now and I don’t think your boozy phone call would go down well over there”

“Kat – you’re smart and work in the office. What can we do?”

“Oh right, I’m smart-and-work-in-the-office so I can just wave my magic wand right – well… hmmm... maybe – ‘cos I kinda have a magic wand right here on my phone. It’s the ERP app for Veritas. Does the pub-where-you-were-conceived have a wireless network?

“Er... yeah it’s StJamesGate and the password is … er well let me just enter it for you here”

Within seconds, Kat’s fingers were dancing across the glass surface of the phone and in less than a minute...

“Alright then – all relevant boxes are now unchecked which means that it’s physically impossible for those drums to leave the shipment holding area without basically taking out a wall – which I don't think our nightshift is going to do so… so now what John?”

Kat smiled at him but it wasn't an entirely nice smile. There were elements of a grimace to it

“Well, great, I think Kat. Right, I mean we can sort it out next week right? After New Year’s?” he ventured hopefully.

“Well, John, what’s now is that within some number of hours I’m going to catch holy hell which I’ll promptly pass along to you because without that shipment tonight, the year’s sales don't reach the magic number and the execs on the 3rd floor don't get their ridiculous bonuses and Flannery Jr. doesn't get his truly obscene payout and Stella-Heinz-Rickenbacker-Flannery doesn't get her pink Lambo. Actually, I’m kidding about that last bit. It’s probably not pink, but the rest is true and that’s the downside of me having time to read and not enough work to do. I just know this stuff. So – now what John.?”

We’re leaving Babylon

“We get over there Kat, back to Veritas, pull the raw analysis data out of the control room archive and see what that batch really came in at – 93.5 or 98.5. Then er… then we’ll see for sure what happened. Get us an Uber Kat, eh? I know this is maybe not the date you envisioned, but you’re with me, right?

“I guess, John. 5 minutes out front”

And we’re going to our father’s land

Snow had started falling and the Veritas plant parking lot looked quite beautiful, coated a perfect, crisp and even white. Inside the control room John and Kat made an unlikely pair of heroes with green hair and the smell of pubs and Paco offending the sober senses of the night-shift team. Nonetheless, they seemed to be getting somewhere when the sweet odor of champagne, Chanel and cigars invaded the space, followed by a teetering Stella and a Lurching Vincent Flannery Jr.

“What the fuck?” Flannery asked the room in general

Silence ensued, then...

“Hello Mr. Flannery” Kat spoke flatly, guessing correctly that the Bonnie and Clyde in fur, Louboutins, diamonds and tux were the same Flannery’s she’d just learned about from John.

“OK – so who the fuck are you and what the fuck... are you doing with the China shipment?” Flannery menaced.

Kat stared at him. She’d been talked to like that all her life and knew by now that the fight and the flight options were never the best response. Nor was the often-useful crying. Still, it was hard to control biology and evolution and she felt tears push hard behind her eyes as she clenched her thumbs inside her fists. But the flat voice didn't fail her.

“Mr. Flannery. The ERP system is showing an inconsistency with the analysis for this batch and so the barcoding won’t let it out of the plant. John here, brought me over to determine if this can be addressed this evening. I’m Kat by the way, from accounting”

“Yeah I know” Flannnery seemed a bit put-off by the absence of fight, flight or crying “But you see, Kat-from-accounting, my good customer in China really needs this very important shipment of H-104 to go out tonight. “

“erm It’s going to Taiwan, Mr Flannery and it’s H-105 for Eva Air for airplanes” John tried to interject matter of factly.

“OK right – Tie-fucking-One and they need to keep the fucking planes flying so let’s get this shit outta here now!” Flannery got back into his groove bullying John.

“Right well, I was working here this afternoon with Karl and…”

“Oh – my idiot brother-in-law- why am I not surprised he’s involved” Flannery scoffed.

“and” John continued “I’m concerned that the right analysis for the H-105 was not entered into the C of A by... er… me so I asked my colleague here in accounting to pause the shipment until the uncertainty could be resolved – which is what we’re doing here”

“Smart boy” giggled Stella. Flannery glowered, promptly ignored John, and turned back to Kat.

“Well if the green goddess here can pause the shipment, she can certainly un-pause it, which if she does in the next... hmm... 9 minutes, there’s a very nice year-end bonus in it for her and for you all – if she does what she needs to do. If not, well you’re all fucking fired – so get to it Katey” Flannery stared somewhere off to the left of Kat, not daring to lock eyes.

“Of course, sir. I can easily un-pause the shipment, as you say, by checking and verifying the analysis in the system with the number on the C of A and that should take, oh about 10 – 20 minutes.” An even deeper silence ensued as Flannery’s champagne addled intellect grappled with the seeming fact that, as 10 – 20 was a greater number of minutes than the now, 8 minutes in which the Interfreight pickup window would close, his obscene year-end payout would be significantly less obscene than planned and his wife’s Lamborghini would just have to wait one more year.

“Guys, I don't understand. What happens if you just ship the drums” asked Stella, rather innocently, in John’s opinion.

“Mrs. Flannery” began John “Stella, darling... call me Stella”

“Er... Stella” John looked sideways at Flannery and continued “If the analysis is wrong and we ship the drums and they are used in an airplane lubricant system, something could go wrong with the plane and then it might crash and all those people, mams and dads and kids would be gone –because of us - because of me”

“Vincent darling – this young man and his colleague are trying to save lives so what’s the harm if we wait another few minutes. Daddy will hardly mind if we’re a little late for his party...?”

Flannery couldn't figure out if he’d been checkmated by his wife or the green-bitch or were they working together. Any case…

“Fine. Fuck” he growled. Which everyone took to mean go head and pull the records and make the comparison.

Time passed as it should. Interfreight came and left, without the drums. Flannery’s blood pressure went beyond boiling point and Stella found a fifth of bourbon in the back of the limo which she shared with Kat. More snow fell. They gathered back in the control room.

“It’s 98.5” said John and he couldn’t decide whether to be elated, because Karl hadn’t lied, or dejected because he, John, was an idiot.

“But the display, I can see it even now, it said 93, I swear. I don't understand” He looked forlornly at Kat.

“Well obviously” said Tommy, lead night operator. “The display’s fucked – sorry Mrs. Flannery – but it is. If you look at it from over there, he waved left, 8’s are 3’s and 0’s are 1’s and from over there, he waved right, it’s just dots. You can only read it from right in front – and even then, you know, you really can’t trust it can you? Should have been replaced months ago but no-one listens to the nightshift so…” he glanced from under his eyelids at Flannery.

“So, I’m not crazy?” concluded John with relief.

“Oh, you’re crazy alright” began Flannery “and…”

“And, darling… these lovely young people, Kat and her boyfriend, did a wonderful thing to avert a potential plane crash and you must be very proud they work for you!”

Boyfriend – John liked the sound of that.

“So let’s celebrate Darling. You’ll buy me that Lambo you promised, and you’ll pay for Kat’s MBA she’s been talking about and erm get John whatever he wants – and these fine nightshift people! Wonderful!”

“That’s OK, Mrs. Flannery. We don’t need anything” Wait what ? I need something, thought John. “I’m just pleased that John here didn't want one mistake to build on top of another and the ultimate horror to result. Just knowing that he thinks that way and acts on it and that now we are still only not even half-way through a date, well that’s more than enough for me.”

Alright. I actually don't need anything because right there, what Kat just said, that’s all I need, thought John

“OK green goddess let’s go then. We’ve got a date to finish. I think we were discussing a Thin Lizzy song…?”

~The End~

The News

First up – do you guys read the Indian Chemical News? (https://www.indianchemicalnews.com/) . I started getting their emails about a year ago and didn’t unsubscribe. You get some decent snippets each day and a fair bit is surfactant related. For example the published recently that :

Indorama Ventures Public Company Limited (IVL) [the new proud owners of Oxiteno – although I don't think the deal has officially closed yet ] has opened its new 10,000-square-foot office and technology center at Marwah Center in Mumbai. The new facility is part of the company’s high-growth Integrated Oxides & Derivatives (IOD) business segment [that’s the part that acquired Oxiteno], serving global customers in India and the Asia-Pacific. Alastair Port, Chief Operating Officer - IOD business, Indorama Ventures said, “IVL is committed to growing our IOD business sustainably in India and Asia-Pacific and this new business and technology center in Mumbai is a key driver. Having support functions as well as an R&D center under one roof in the heart of Mumbai is convenient for customers to collaborate with us to create better solutions.” The new R&D center is the company’s hub for the Indian Subcontinent and SouthEast Asia to develop products supporting downstream markets, such as home, personal and industrial care and cleaning, agrochemicals, energy, lubricants, mining, and coatings. The center will also work closely with IVL’s global R&D team to exchange information and accelerate product development cycles. The business’s commercial and technical functions, including supply chain, finance, sales, and R&D are integrated at the new facility. The integration enables closer collaboration across functions and faster improvements to address changing customer needs. Indorama Ventures Public Company Limited portfolio comprises Combined PET, Integrated Oxides and Derivatives, and Fibers.

Of course, most of our news comes, as always, from the great folks at ICIS Chemical Business. You should subscribe, as I do. That was a not – so – subtle promotion for my conference partners, I know. But I wouldn't have produced 11 years-worth of surfactant conferences with them, if I didn't think they were a quality shop. They are. Join us in May, in person, in Jersey City, in person (did I mention that). The event launches soon, so stay tuned and also let me know if you you would like to present. If you think you could be the next Martin Herrington (hard to imagine, I know), then let me know.

More news, from ICIS. : The year in oleo could not have ended with a more appropriateheadline – “No end in sight for European fatty acids, fatty alcohols tightness”. The article, by the talented and informed Samantha Wright, goes on to report that:

European fatty acids and fatty alcohols are expected to face further shortages and strong demand through the first and second quarters of 2022. Ongoing logistical issues are likely to continue and players face fresh fears over rising COVID-19 cases. In the European fatty acids market, the tightness that has plagued the market for most of 2021 looks likely to continue into the first quarter. In the palm-based market, players are already negotiating Q2 contracts amid ongoing shortages.

Palm oleic acid has been very tight throughout 2021 and there are no indications that tightness will ease in the first quarter or even in the second.

Most palm-based producers are already sold out of oleic acid for the first quarter. Supply constraints have been caused by a combination of vessel delays, high freight costs from Asia and stronger demand amid tallow shortages. [interesting – I don’t recall reading about that recently. Although Tallow seems to have gone through the roof along with other commodities] The vessel delays are expected to last through the first half of 2022 as coronavirus-related logistical issues continue. Palm stearic acid availability was becoming more balanced towards the end of 2021. While there may be some tightness at the beginning of the first quarter as demand picks up following the holiday period, overall palm stearic supply is likely to be fairly balanced for the first and second quarters. Tallow-based material is still very tight, with oleic acid supply shorter than stearic acid. The tallow-based shortages arose from a lack of meat production combined with strong demand from the biodiesel industry for raw tallow. While meat production increased slightly in the second half of 2021, there were still low slaughter rates. This saw some increase in the fourth quarter, with December a typically strong month for meat demand. However, demand from the biodiesel market remained very firm, and there was very little additional tallow material seen in the fatty acids market during the fourth quarter. This is likely to continue into the first quarter and even into the second quarter, and could be a structural issue in the tallow market if slaughter rates do not increase to a level where biodiesel and fatty acids demand can both be fulfilled. Demand for all grades is expected to be stable at firm levels throughout the first and second quarters.

There may be an uptick in buying interest in January as players look to restock following the new year, but overall demand should be steady as all applications in the food, cosmetics and personal care industries are currently healthy. One source said: “I think production is pretty good… when you look at demand in general it is also very good. I do not see [tightness] easing unless demand reduces, which we do not think will happen.” Automotive demand is currently set to remain healthy, though there are ongoing concerns that increasing COVID-19 restrictions in Europe could cause a drop in activity again in several industries, including the automotive sector. The European Commission announced in the fourth quarter that it had launched an anti-dumping investigation into fatty acids from Indonesia. The probe is expected to last for the whole of 2022, so it is unlikely there will be any direct impact in the next year, but players will be keeping a close eye on the proceedings.

On Guard Against the Fatty Acid Dumpers

In the European fatty alcohols market, shortages are set to continue through the first quarter. The market has faced tightness throughout 2021 amid vessel delays from Asia, logistical issues within Europe and high freight costs. Supply constraints are expected to remain in the first quarter and possibly into the second. Vessel delays are not likely to improve in the first half of 2022. One source said: “Vessels are supposed to be arriving in February and they are not even on the water yet. There are [still] hiccups in the supply chain, definitely.” This is compounded by very strong demand from the downstream surfactants and end-use detergents markets. Players are expected to have firm buying interest in January as they look to build stocks after the year-end destocking. This is likely to be even stronger than in previous years as some market participants are looking to build stocks in case there are further coronavirus-related issues in 2022. “I believe people intend to produce whatever they can produce in order to have material ready before wave number five hits and they are forced to lock down again,” said a source. There are coronavirus-related issues with the palm oil complex in Asia that are causing issues for producers securing feedstock and are expected to continue into 2022. It is unclear yet if there will be more logistical issues in Europe during the first quarter if COVID-19 restrictions tighten, but ongoing concerns over a lack of truck drivers are likely to continue.

Where are they Now?

After selling its North American surfactant business to Indorama (who soon thereafter gobbled up Oxiteno to form a major surfactants player), Huntsman is back on the deal trail again (as if they are ever really off of the trail). ICIS reports that Huntsman is considering selling its Textile Effects division as part of a strategic review of the business. Huntsman will start the review early in the first quarter of 2022, the company said. The division is based in Singapore. Huntsman does not have a timeline or deadline regarding when it could finish the review.

Huntsman expects the division will report nearly $100m in adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) in 2021, the company said. The division makes dyes and textile chemicals used in pretreatment, colouration, printing and finishing. Huntsman operates 11 synthesis and formulation production sites in Asia, Europe and the Americas. Raw materials include amines, ethoxylates, acrylics and sulphones. In 2020, Textile Effects accounted for 10% of the company's revenues and 5% of its adjusted EBITDA. Huntsman's other divisions include Polyurethanes; Performance Products, which makes amines and maleic anhydride (MA); and Advanced Materials, which makes epoxy resins and curing agents.

Textiles on Sale

Meanwhile over in Asia, ICIS reports that The Asian and south Asian linear alkylbenzene (LAB) market actually drifted lower in the fourth quarter of 2021 as demand as a whole failed to ignite. With the new Omicron COVID-19 variant now threatening to disrupt economies once more, sentiment among LAB players remains cautious. The slump in energy prices towards the end of 2021 and the Chinese government’s efforts to combat inflationary forces and curb power costs also weighed on the LAB market. Buyers adopted a cautious stance and bought on a need-to basis. Some suppliers held on to their offers but gave discounts for deals, while others focused on their own domestic markets at the year-end, citing soft demand in Asian export markets. Maintenance shutdowns in China were completed by November, but suppliers mostly continued to focus on the local market, citing tepid buying interest in Asia and India. However, some Chinese parcels could still find their way into Asia in the weeks ahead, especially after local Chinese appetite has been satiated.

In India, local demand perked up in November after the Diwali festivities in early November, but buying momentum fizzled at the end of the year. Buyers anticipated a weaker market from weak upstream energy and benzene markets, and kept mostly to the sidelines. Supply seems likely to dictate the tone of the market in 2022, as demand appears little changed. Even with Asian economies easing pandemic restrictions and initiating global vaccinated travel lanes, the expected pick-up in usage of cleaning solutions in the hospitality and aviation/transportation sectors is perhaps counter-balanced by people’s acceptance of living in an endemic COVID-19 situation, with appetite for hand sanitizers and cleaning liquids down from the earlier part of this year. Nevertheless, planned turnarounds in the fourth quarter of 2021 and the first quarter of 2022 are expected to keep supply in check across the region, while providing some support to the market. The wild card could be Chinese supply, which - though limited in late year - could become more abundant in the first quarter as output stays high. This may be especially true post Lunar New Year in early February, when LAB plants in China come back from the holidays in full swing.

Wild Year of the TIger in LAB

Meanwhile, with the new COVID-19 Omicron variant starting to make its way through to Asia as well, a possible re-imposition of restrictions sometime in the first half of the new year will again be a dampener on demand. Potentially lower upstream markets from this deflationary economic bout could exert downward pressure on the LAB sector, as relative demand-supply goes out of balance. The elevated freight market, which looks likely to prevail into the new year, will continue to hinder a good portion of the arbitrage play of Asia suppliers trying to move volumes to destinations outside the region, such as Europe, in a bid to capture a higher value market. Consequently, any excess cargoes will likely remain within the Asian region and add to overall availability.

Don't See This Often

The year in Fatty Alcohols ended with may supply chain woes as outlined by the great Lucas Hall at ICIS. He notes that : Freely-negotiated US Q1 fatty alcohol contract negotiations have largely been finalised against the backdrop of bullish cost pressures and worsening supply chain constraints. Freely-negotiated contracts for standard balance material have largely been heard at a 30-50% premium from their Q4 settlements, with Mass Balance (MB) material largely heard at a 30-50% premium over standard balance material.

Short and long chain single-cut alcohols are particularly tight. Overall production costs remain bullish despite a moderate downward correction in feedstock costs across the oil palm complex in recent days associated with year-end inventory balancing. Vessel space is tightening against the backdrop of soaring freight costs, with shipping companies informing southeast Asian exporters they are no longer taking booking for January. This will defer containers that have amassed in ports throughout the region to February or later, further delaying imports. Current lead times for container shipments are at a minimum of three to six months.

Long chain alcohols are largely imported in containers. Few suppliers have the ability to process and store long chain alcohols in bulk, further supporting the market.

Imports Important

Malaysia's palm oil market remains fundamentally tight, with lower import taxes in India, adverse weather conditions in southeast Asia and the resurgence of the pandemic with the rise of the Omicron variant of the coronavirus all expected to pressure costs in Q1. The premium on palm kernel oil (PKO) because of the above pressures - in addition to growing concerns regarding the traceability of sustainable volumes in Malaysia - may continue to discourage PKO consumption for oleochemicals production, adding to the pressure. Increased scrutiny against Malaysian-origin material over forced labour allegations remains a major concern, as the traceability of Roundtable on Sustainable Palm Oil (RSPO) MB-certified material becomes more difficult, supporting higher premiums for MB PKO for oleochemicals production.

The Underpinning

As a result of these cost pressures, many southeast Asian oleochemicals producers are planning maintenance during and after the Lunar New Year, further tightening the market. Domestic US fatty alcohols production capacity, as we know, is insufficient to make up for the import shortfalls against the backdrop of similar supply chain constraints, further supporting the market. Downstream demand in many end-markets remains pent-up because of continued supply chain disruptions, with many players working on an as-needed basis to fill backlog demand for the foreseeable future. Downstream surfactants price increases remain on the table with little to no pushback from customers.

Prices have largely been heard at a 30-50% premium from their Q4 settlements, based on market feedback. Long chain alcohols in containers have been heard much higher, given persistent and worsening supply chain constraints in that market. Contracts increasingly include terms subject to changes in freight and demurrage costs, given these constraints. Some players have less volume available for their traditional quarterly contract customers, as they prioritise inventory-building and annual contract customers over smaller volume customers ahead of upcoming maintenance and ongoing supply-chain disruptions globally.

Q4 contract ranges*

ProductPrice (cents/lb)INCOLocationC12-C1597-112DELUSGC16lower 110s-140sDELUSGC18lower 110s-140sDELUSGC16-18114-134DELUSG

*The prices in the table represent a range of settlements for standard balance material heard throughout the quarter for the majority of market participants. Prices above and below those listed in the table were heard throughout the quarter but excluded as they were not viewed as representative of the wider market.

Prices for synthetic [petrochemical] alcohols were heard at both ends of the above ranges amid the ongoing force majeure at Shell's Geismar site. At least one buyer settled its Q4 C16-18 contract below the $1/lb DEL (delivered) US Gulf (USG) range. The same buyer settled its Q4 C18 contract below the $1/lb DEL USG range. In the wider market, multiple producers have switched their contract terms from a DEL to an FOB + freight basis or to terms subject to changes in freight and demurrage, given the ongoing shipping logistics constraints.

Hmmm...

US Surfactant bellwether, Stepan [hmm I don't think I’ve used that phrase before. It sounds right though] - So - US Surfactant Bellwether, Stepan announced a full slate of price increases, which it is probably useful to list here. So, as ICIS reported: Although the announcement did not cite a reason for the increases, demand for surfactants into cleaning supplies is expected to increase with the emergence of the Omicron variant of COVID-19. In addition, demand from oilfield activity remains strong amid elevated crude oil and natural gas prices. In addition to the product price increases, Stepan seeks a separate 1.5 cent/lb transportation increase. Transportation costs throughout the US supply chain have risen sharply, due to insufficient trucks, railcars, and containers; high gasoline prices; and labour shortages.

Stepan seeks price increases for surfactants in the following product categories: [Take a look. There are some very wide ranges there – note on the dry products and on some of the smaller volume items like phosphate esters, amides and betaines. ]

Product Category Price

Increase ($/lb) Alkyl Benzene Sulfonic Acids $0.03Alkyl Benzene Sulfonates and

Dry Sulfonates $0.03-0.11Short Chain Alcohol and

Ether Sulfates $0.075-0.09 Lauryl Alcohol Sulfates and

Dry Sulfates $0.09-0.26 Low Active Alkyl Ether Sulfates $0.07-0.11 High Active Alkyl Ether Sulfates $0.10-0.16 Ether Sulfates - Phenol $0.07 Olefin Sulfonates and

Dry Olefin Sulfonates $0.03-0.10 Sulfonated Methyl Esters $0.11 Hydrotropes $0.04 Amides $0.08 - $1.19 Betaines, Sultaines and other

Amphoterics $0.14 Amine Oxides $0.14 Sulfoacetates $0.26 Sulfosuccinates and

Sulfosuccinate Blends $0.09-0.23 Methyl Esters $0.05-0.84 Biocidal, Industrial and

Cosmetic Quats $0.03–0.21 Softeners $0.06-0.22 Phosphate Esters $0.05-0.57 Alkoxylates $0.015-0.18 Specialty Polyesters $0.02-0.08 Specialty Esters $0.03-0.61 Transportation $0.015*

*Note: Price increase is

independent of and in

addition to any

increase above

Blends and derivatives of these products are also subject to the increases.

Don't be that Surprised!

Finally some news from a bunch of companies that we don't normally talk about here. US specialty chemicals company Polyventive has acquired the surfactants and dyes and pigments businesses of Canada’s Tri-Tex from SK Capital Partners for an undisclosed sum. The acquired businesses, with plants in Quebec, Canada and Los Angeles, California, produce surfactants, dyes, pigments, and water-based polymers used in textile, personal care, cleaning and industrial applications. Polyventive is a portfolio company of Arsenal Capital Partners. In a related deal, another Arsenal company, Meridian Adhesives Group, on Monday acquired Tri-Tex’s adhesives business.

So that’s it. Happy New Year to all my great readers. I love it when I hear from you about something you’ve read here. So please feel free to get in touch. You know how. I will see many of you at ACI in Orlando at the end of the month and of course in May in Jersey City.

I guess, it wouldn't be a surfactant blog if we didn't end the year with some music. So what am I listening to these days? Thin Lizzy of course. Here’s the aforementioned Emerald.

It’s inspiring but still a little disturbing with the lyrics no? Just like the Passover story.

And here’s the gorgeous Parisienne Walkways with the legendary Gary Moore on guitar. Oh man..I really can’t think of anything more French than this.

And check this out. It’s Ted Nugent introducing the band playing live at the Rainbow in 1978. The crazy thing is, if you listen carefully, Nugent introduces this great Irish band as “London Boys” Ugh…They play on regardless.

Of course, we have to include this high-point of the movie Eddie the Eagle

And finally, who hasn't been to an Irish pub and sung along to this one? Wait what - You haven’t? Get out there man…!

And finally finally, I just listened to this one from the ’73 album Vagabonds of the Western World. Remember this? The Rocker. Serious guitar break..

Happy New Year!

Surfactants Monthly – January 2022

It all begins with an idea.

Like many others in our industry, I’ll be marking the end of the pandemic and the beginning of the endemic with a trip to Florida and the American Cleaning Institute Meeting. That may or may not be wishful thinking. Not the going to Florida part. That will have happened as of your reading this. The endemic part. That’s when you stop writing and talking about it except in the historical sense – like “hey do you remember that.. can you believe we were doing … such and such”. Let’s see. By the way, you’ll get no gossip or tittle-tattle from the ACI in this blog. Our motto is, as you know, that “you gotta be there”. So..

Another place you gotta be is our great ICIS / Neil A Burns LLC World Surfactant Conference, which is back in person in Jersey City, NJ May 9 – 11th. It’s 1.5 day conference and a 1 day optional course. Of course, we also have the great Surfactants Awards for which nominations are now open. After two years of, frankly, unsatisfying meetings over zoom and somewhat nervous get-togethers at various meetings, I am really looking forward to this singular event in the surfactants calendar. I will also add that we have a huge new sponsor that I really can’t say much more about until closer to the time, so that’s enough from me on that. I will say that you should book now. The usual Hyatt venue, although large, has a finite capacity and it looks like we will sell out very quickly. We’ll have some firm favorites speaking and some new and unexpected names. You’ll get information and insights that you just can’t get anywhere else – and the best networking you’ll experience in 2022. You gotta be there, so.. See you there!

We're Back

End of commercial. Beginning of News

Credit for most of the news here goes again to our partners ICIS. Check them out. I’m a subscriber. Maybe you should be too.

A nice piece of news from Locus Performance Ingredients, (Locus PI), well known participants in our conferences. Dow and Locus have struck a deal in which Dow will sell the Locus sophorolipid biosurfactants in global home and personal care markets. The Dow deal sits within the company’s homecare solutions business. Locus PI is part of parent company, Locus Fermentation Solutions. Best of luck to both companies. Teaming up like this, makes a lot of sense.

More biosurfactants news from Evonik, another regular speaker at my conferences. This courtesy of C&E News: The specialty chemical maker Evonik Industries will spend what it describes as “a three-digit million-euro sum” to build a rhamnolipids plant at its site in Slovakia. Evonik says the plant will be the world’s first commercial-scale facility for the biosurfactant. Rhamnolipids, as readers know, are biodegradable surfactants made via fermentation and feature rhamnose sugar groups with fatty-acid tails. In addition to strong environmental bona fides, rhamnolipids are effective cleaners at lower concentrations than conventional surfactants while being gentler on skin and hair.

Evonik already has customers in mind for the new capacity. “Our initial focus is on applications in personal and home care based on foaming, sensory, and mildness benefits as well as a pressing need to improve the sustainability profile of surfactants in these markets,” the firm says. The investment builds on a partnership between Evonik and the consumer product giant Unilever [about which more at the end of the blog], which launched a dish soap using Evonik’s rhamnolipids in Chile in 2019. Unilever says rhamnolipids are an important part of its push to remove all fossil-derived ingredients from its cleaning products by 2030. Evonik also launched an industrial cleaning ingredient based on rhamnolipids in 2021.

Evonik makes its rhamnolipids by fermenting sugar using a genetically modified Pseudomonas putida bacteria. In February 2021, Stepan bought an idle 20,000 t plant in Louisiana where it plans to make rhamnolipids. The specialty chemical fermenter Jeneil Biotech says it already manufactures rhamnolipids in industrial-sized equipment.

A Next Big Thing

Crazy volatile times in feedstocks, especially oleo. BTW – we’ll have a detailed PhD level explication of all that exclusively at the conference with the legendary Martin Herrington. In the meantime, ICIS’ Helen Yan reports from Asia that Asia’s fatty alcohols market is likely to find support from elevated upstream crude palm oil (CPO) and palm kernel oil (PKO) values, despite sluggish demand during the Lunar New Year holidays. Spot offers for the mid-cut C12-14 blend have been revised up to $2,900-3,000/tonne FOB (free on board) southeast (SE) Asia for February and March shipments, due to continued erosion in margins from expensive feedstock PKO costs.

On 19 January 2022, spot prices of C12-14 blend averaged $2,780/tonne FOB SE Asia, up $80/tonne from the previous week, ICIS data showed.

Supported at $2,750 +

“We have no choice but to further increase our offers for the mid-cut C12-14 blend as margins have been severely squeezed from the high raw material costs, with PKO rising to around $2,300/tonne while buyers continue to seek lower prices,” a regional supplier said. Spot interest has waned due to the upcoming Lunar New Year or Spring Festival holidays. The Chinese market will shut from 31 January to 6 February for the Spring Festival, but factories have already shut in China in the run-up to the festive holidays.

Market activities in other countries in Asia have also wound down as players have retreated to the sidelines to wait for a clearer outcome post-holidays. South Korea, Indonesia, Malaysia, Singapore and Vietnam also celebrate the Lunar New Year, which falls on 1 February this year. Demand has also not rebounded as expected due to the economic fallout from the highly infectious Omicron coronavirus variant on the global economy. Spot appetite for C12-14 has been tepid as the global economic recovery has been hampered by restrictions reinstated to contain the spread of the Omicron coronavirus variant, which emerged in late November 2021. Lower-than-expected growth in the world’s two largest economies, the US and China, is expected to dent global growth in 2022 sharply, the International Monetary Fund (IMF) said on Tuesday.

Global GDP growth is now expected at 4.4% in 2022, said the IMF, half a percentage point lower than its prior forecast issued in October 2021. Global GDP growth in 2021 stood at 5.9%. The IMF, which delayed the publication of its World Economic Outlook by three weeks to assess the impact of the Omicron coronavirus variant, said the world had started the year “in a weaker position” than expected.

By contrast, LAS pricing in South Asia remains weak in line with demand, as reported by ICIS. In India, domestic LABSA spot market remains at around Indian rupees (Rs) 93/kg, with production staying low. Market participants attributed the low LABSA output to the weak detergent market. “Usually demand for LAB will peak in February, but this year buying interest is very weak,” said a LAB producer in India. Some participants in this sector cited soaring costs of soda ash in the last quarter for dampening demand of LABSA and detergents. “Soda ash makes up around 30% with the remainder being LABSA for manufacturing detergents,” said a trader in India. This resulted in lower demand for detergents as prices (LABSA and soda ash) rose last year. With reduced demand for detergents, there was lower output of LABSA. Due to weak downstream LABSA market, some local makers of LAB are considering exporting LAB due to an overhang of supply domestically. India is a net importer of LAB.

A rare downtrend in pricing since July

On the other hand, the LABSA/LAS market in Pakistan seems to be faring better with demand overall staying decent, with the spot market for LAB at around $1,700/tonne CFR Pakistan. Tufail Chemicals, a key LABSA producer in Pakistan, added to its capacity in Q4 2021, bringing its total output to around 110,000 tonnes/year. The company plans to add another line in 2023 with more cargoes available for export.

However, the export destination of SE Asia continues to experience slow demand. The LAS market hovered at around $1,430-1,500/tonne CFR SE Asia, but some participants anticipate some downward pressure if the India market fails to recover in the near term.

“The weak LABSA and LAB market in India is impacting sentiment across the region,” said a producer in northeast Asia.

And another one more markedly so

Back in the US, detergent range alcohol prices follow a familiar trajectory – up – way up. ICIS’ Lucas Hall reports that bullish feedstock and soaring freight costs against the backdrop of persistent shipping logistics constraints globally continue to underpin US fatty alcohols markets, with demand for multiple fatty alcohols chains continuing to outstrip supply. Short chain C8 and C10 as well as long chain single-cut C18 alcohols are particularly tight, depending on the supplier. Mid-cut alcohols availability has improved following supply chain disruptions that eased in December. The majority of these supply chain constraints stem from import disruptions from southeast Asia associated with persistent shipping equipment shortages and tight vessel space against the backdrop of soaring freight costs. Bullish feedstock costs across the oil palm complex stemming mostly from tighter production in Malaysia because of weather and coronavirus-related labour issues in the country are adding to concerns, with production costs rising faster than producers can pass down increases and forcing some to cut back operating rates.

Steady rises

Tightening availability of mass balance-certified (MB) material in the US because of increased scrutiny against Malaysian-origin material over force labour allegations in the country is also supporting the market, particularly for palm kernel oil (PKO) and PKO-derived material. Ongoing import bans have heavily increased the demand for MB material outside of Malaysia, supporting premiums in that market. Rising PKO premiums are sustaining demand for coconut oil (CNO) and CNO-derived material. Logistics issues also persist in the US, particularly in truck markets, where an ongoing labour shortage is keeping truck availability tight. Domestic production is insufficient to make up for inconsistent import market, underpinning the wider market.

A reliably volatile folow

Downstream demand remains overall healthy. Demand in the spot market has somewhat waned from 2021 as downstream players increased their contract allotments in an effort to prioritise security of supply. Demand for mid-cut alcohols in Mexico remains limited because of persistent ethylene oxide (EO) shortages in the country, supporting demand for ethoxylated material instead.

It's been a while since prices this high

An interesting snippet here on the continuing role of private equity in our industry: US private equity firm OpenGate Capital has acquired Chemsolv, a regional distributor of commodity and specialty chemicals based in Roanoke, Virginia, for an undisclosed sum. Chemsolv, with distribution centres South Carolina, Tennessee and Virginia, distributes more than 1,000 chemical products to customers in construction, roofing, chemical intermediates, paints and coatings, automotive and other markets.

Its products include solvents, plasticizers, coolants, lubricants, surfactants, diesel exhaust fluid, additives, among many others. OpenGate acquired Chemsolv from the Austin family. Glenn Austin founded Chemsolv in 1979, and the family will continue to retain an ownership stake and a role in the company. Regular readers will recall that OpenGate is the investor that bought the, now, Verdant out of Solvay and combined them with Baze and DeForest, last year.

Interestingly, US EO pricing continues to fall. ICIS reports that US December ethylene oxide (EO) contracts fell for the fifth consecutive month, tracking a lower same-month feedstock ethylene settlement. US December EO fell by 3 cents/lb ($66/tonne).

Feedstock ethylene prices fell due to greater steam cracker production and easing derivative demand. Lower feedstock costs in December hastened this price decline. As readers know, the majority of EO contracts are formula-based, and price movement comprises 80% of the change in the ethylene price and an additional conversion fee, or adder.

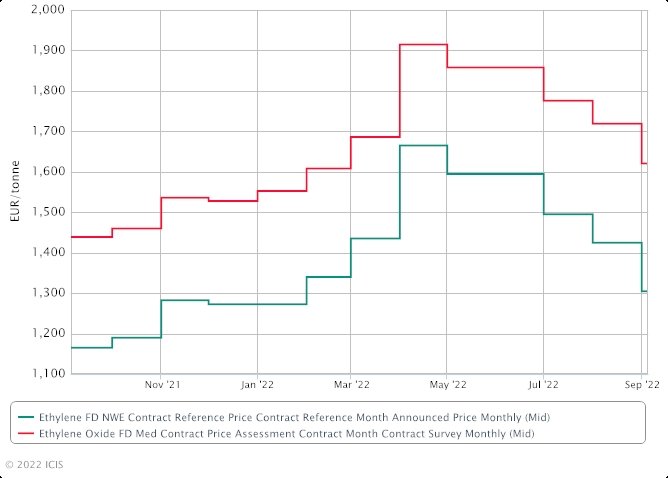

Another downtrend

By contrast, the European picture for EO is a bit different as reported by the hugely talented Melissa Hurley at ICIS. European ethylene oxide (EO) contract market players are awaiting the upstream ethylene contract price settlement for January to inform formula pricing. Sellers remain concerned with margin pressure amid continued high energy costs. Stable to double-digit increased adder fees are being discussed for 2022, depending on starting point and account. Some multiyear EO contracts are also not up for renewal next year so fees are steady in these instances. According to Alice Casagni, ICIS deputy editor for European Spot Gas Markets, “a tight supply outlook and weather-driven demand will remain the key drivers in control of European natural gas prices in the first half of 2022.”

Not a great time for gas users

High ethylene prices have also dominated the market this year, impacting seller margins. Downstream demand is mixed depending on sectors, and there was some end-of-year slowdown amid destocking activity.

Feedstock spread - Ethylene and EO Europe

A tight spread means a loose market

Supply was constrained at the end of 2021, but this is expected to improve in January.

There was an unplanned outage at the beginning of December in the Netherlands at Dow's Terneuzen EO facility, which is not expected to be resolved by the end of this year. Upstream ethylene supply remains balanced-to-tight. The status of BASF's Antwerp EO and ethylene glycol (EG) facility is also unconfirmed, although glycol sources believe it is back running again at the end of December 2021. There is a wait-and-see attitude to how demand pans out at the start of 2022.

The peak?

In the downstream monoethylene glycol (MEG) market, there is interest in spot material stemming from the downstream polyethylene terephthalate (PET) market due to good demand. Most are covered by contractual requirements for the time being but if demand continues to perform well or strengthen, MEG consumption could increase.

PET makers could opt to run production harder, leading to increased interest in the spot market. For coolants, demand has been impacted by poor automotive industry performance. A buyer added it was covered for material until the end of the year.

There was mention of additives typically used in coolants being placed on allocation from a local European supplier which could impact downstream conditions, depending on how long the situation lasts. This was not confirmed by the company. There is a planned turnaround at Lavera, France impacting glycol ethers, according to sources, which is expected to finish by the end 2021. In the ethanolamines market, difficulties concerning the supply chain are widely expected to persist into 2022. Ethoxylate demand has performed well during the year.

OK – so there’s the main surfactant news. Some interesting things there right? But here’s the really big story of month and my favorite by far. I love a good corporate thriller and this one is shaping up to one of the best and, of course, I’m talking about Unilever. For those of you who have been sleeping under a rock or too absorbed by the Real Housewives of [fill in the blank], here’s the story.

Silicone, botox and extensions. Not real and not even housewives; but still morbidly fascinating right?

The problem is this: Unilever’s moribund stock over the past 3 years, compared to that of peer P&G . In the chart below, P&G is in blue and Unilever in black

Says it all

The solution? Nelson Peltz, activist investor (i.e. one that cares) and, until recently, a board member of P&G, a seat he gained the old-fashioned way, that is via a proxy fight (one of the most expensive and hard-fought ever). During Peltz’s tenure on the P&G board, the stock roughly doubled. He plans now to do the same or better with Unilever.

I really care about your / our stock price

On January 23rd, the Wall Street Journal reported that Trian Fund Management LP, the activist hedge fund run by Nelson Peltz, acquired a stake in Unilever PLC, adding pressure to the packaged food and consumer goods giant in the wake of its failed $68-billion bid for GlaxoSmithKline PLC’s consumer-health business. Apparently, Trian started buying Unilever shares well before its bids for the GSK unit surfaced earlier this month. Unilever’s shares have been under pressure in recent months as it has struggled to boost volumes. Analysts say it has underperformed some rivals during the Covid-19 pandemic in areas such as hygiene and packaged food and hasn’t launched any blockbuster innovations in some time. The company faced strong opposition from investors to its plan to buy the GSK healthcare business, with analysts pointing to its mixed record on several other big acquisitions. Critics said the London-based company would be overpaying for the GSK business, and that it should focus on turning around its existing categories rather than taking on new ones in which it had little experience.

Stick to the knitting

Jefferies [IBank] analyst Martin Deboo said he thinks Trian will push Unilever to sell food brands more quickly or to sell or spin off the unit entirely. “The force and temperature of debate around Unilever now looks set to rise by several notches, with Trian likely to find a sympathetic audience,” among Unilever shareholders, said Mr. Deboo, adding that the episode would increase pressure on [Unilever CEO] Alan Jope.

Interesting right? So what happens next? Well, no coincidence, I’m sure, but a mere 2 days after the Trian story broke, Unilever announced a major reorganization. The company said it would restructure its operations into five stand-alone divisions, reshuffle top executives and cut jobs in a sweeping reorganization aimed at accelerating sales growth.

Let's move things around a bit and see what happens..

The company said it would now run as five, category-focused divisions—beauty and well-being, personal care, home care, nutrition, and ice cream—rather than its three previous units of food and refreshments, beauty and personal care, and home care.

Unilever Chief Executive Alan Jope said the overhaul would allow the company to be more responsive to trends and create more accountability. “Growth remains our top priority and these changes will underpin our pursuit of this,” he said. Still, while the restructuring—particularly separating ice cream as a stand-alone unit—should make it easier for Unilever to sell slower-growing businesses, the overhaul doesn’t go far enough and will likely disappoint investors, some analysts said. Unilever shares traded flat in London in the wake of the announcement [uh..oh]

Reshuffling won't help

Unilever said its beauty and well-being division would include vitamins—an area where the company has been beefing up—as well haircare, skin care and its prestige business, which houses upscale beauty brands. The personal care division will include skin cleansing, deodorants, and oral care brands, and be led by Unilever’s current head of North America, Fabian Garcia.

Vitamins and beauty

The nutrition arm will include ingredients lines such as Knorr, and a group of foods Unilever is describing as healthy snacking such as its Graze brand. Also included in the nutrition business: so-called functional-nutrition products, such as its Horlicks malt drink, plant-based meat alternatives, and its business that sells ingredients to restaurants and offices. It will be led by Unilever’s current head of food and refreshments, Hanneke Faber.

The company said it expects its new operating model to reduce senior management roles by around 15% and more junior management roles by 5%, which it said amounts to around 1,500 roles globally. Unilever employs about 149,000 people. Unilever also said its head of beauty and personal care, Sunny Jain, who joined the company in 2019 from Amazon.comInc., will step down. Its Chief Operating Officer Nitin Paranjpe will take on a new role as chief transformation officer while also heading up human resources.

Analysts have previously said they expect Mr. Peltz to push for Unilever to sell or spin off its food business. Now that that has been split into ice cream and nutrition—with the latter housing some higher-growth categories such as health snacking—RBC analyst James Edwardes Jones said he thinks the company could focus on selling off ice cream. Despite this, Mr. Edwardes Jones said he isn’t convinced the reorganization will work. “The new operating model announced today might make divestments easier, but we would prefer them to focus on reinvesting cost savings behind their brands and categories,” he said. He also criticized the lack of fresh faces, noting that the new divisions are all headed by Unilever incumbents.

Same old...

And so it starts. “You have to change course in a big way now” says Nelson. “We’re doing it already. We’re ahead of you” says Alan “It’s too little and too slow” says Nelson. “You need me on the board and to get rid of the tired old incumbents” “No” says Alan “We got this. We know what we’re doing”. “It hasn’t looked like it for the past 3 years” says Nelson. Does this remind you of anything? It’s a replay of Peltz’s drama with P&G that we blogged about extensively in our year end editorial of 2017 (Check it out here. It’s a classic). It’s early days, but I fully expect Trian to get Unilever in a stranglehold as they did P&G. It hasn’t appeared yet, but watch out for a “white paper” to appear on the Trian Website. It’s then up to Jope how to proceed. Reach an accommodation, tap out or …

Like Ted and that riff. Nelson's hard to Ignore

Surfactants Monthly – February 2022

It all begins with an idea.

It often feels weird writing about surfactants when there are huge other things going on in the world. Then I think, yeah but who wants to hear from me about the affairs of the day. Everyone has their own opinions and the news surrounds us 24/7. I also think that, if the business of surfactants is how you’ve bought (OK still buying) a house and sent (still sending) some kids to college, then that’s a huge thing so.. And I think that, at least folks read this business blog and get something out of it. Some even find the humorous bits funny and one or two enjoy the musical interludes. If I told you what I think about Ukraine, I’m not sure you’d gain anything at all and maybe you’d resent the airspace here being taken up with something that doesn't add to what you get on the telly or your newsfeed. I will say, though, that I have a concern about World War 3. I hear the phrase used at least once a day, these days. Having read and heard enough about WW2, I think 3 would be bad. The technology’s more effective and the people, as a society and individuals seem more fragile. Those people, our parents and grandparents, back in 1939 – 45, they were tough and could put up with a lot. Today, I don't see that so much – in myself and the people I encounter. The technology though. That’s tough, tougher. It gets the job done. Cold. Ruthless. No matter what. Two trends, correlated, different directions. A bit of a concern.

Some lighter fare. Readers enjoyed the Unilever piece last month so I have eagerly tracked the wires for updates on the Trian / Unilever battle and honestly there’s not that much although I think it’s fair to say that the pressure on Uniliever CEO Alan Jope, seems to be building, albeit slowly – and some might say, inexorably. Activist Shareholder, Nelson Peltz has been quiet since last month – actually have you noticed how some people manage to get a prefix permanently attached to their names? When did Nelson transition from just plain old Nelson to Activist Shareholder Nelson. When did Neil Young adopt the prefix Aging rocker or more recently, Sanctimonious Aging Rocker..Anyway, A.S. Nelson has been quiet but other shareholders of Unilever have not.

From the Financial Times of February 6th: Bert Flossbach, [by the way, was there ever a name that screamed out for the prefix Old Money?] founder and chief investment officer at Flossbach von Storch [yep], an €80bn Cologne-based asset manager and a top-10 shareholder, said the FTSE 100 consumer group should consider overhauling its structure, which consists of three divisions for beauty, food and household products. “Unilever should seriously think about splitting the company,” he said. “Talk of synergies between different businesses is usually theoretical and designed to keep the status quo, and smaller than the efficiency gains that you would get from a split.” [ouch! Old Money Flossbach makes a point though]. “If you’re a food manager, you’re thinking differently from a household products manager or a beauty manager,” he added. “If you run these businesses under one structure capital allocation can become a problem. And you’re very diverse in a negative sense because you don’t know precisely what you stand for.” Flossbach said one option could be to keep the food business under the Unilever name and spin off other divisions. “You increase efficiency and enhance the spirit of a company when it has a clearer mission. Cost-cutting is not enough on its own.” He added: “The best defence against any kind of hostility is a high enough stock price.”

Another top-20 shareholder [not named by the FT] called for the removal of the Unilever’s chair, Nils Andersen, reflecting concerns that he and the board allowed chief executive Alan Jope to make increasing bids for the GSK division, a potential deal whose size and timing blindsided investors and provoked a backlash. The top-20 shareholder said a new chair should be appointed from outside the board. He added that a replacement for Andersen could then evaluate both Unilever’s strategy and whether Jope and its chief financial officer Graeme Pitkethly were appropriate for their positions [ouch again, right?].

Interesting developments, I think you’ll agree, but I know you, my dear readers. You’re looking for something more. Some other, perhaps orthogonal, information that will keep you thinking and musing the rest of the day. Well, we deliver that here at the blog. For the really interesting stuff, we have to go to another British newspaper with a slightly wider appeal than the FT, although still a serious paper, and that is the Evening Standard. In a February 11th article beautifully headlined “ Who is Nelson Peltz? The Wall Street billionaire stalking Marmite maker Unilever” [see how they use a prefix for Unilever there. Not sure how complimentary that is. You know Marmite. You either love it or hate it.] the paper goes on to note that “….Nelson Peltz is used to interesting meetings. Still, the first sit-down with his daughter’s soon-to-be in-laws must have stood out. [Former Spice Girl] Victoria and [Footballer] David Beckham flew out to meet the Peltzes at their 44,000sq-ft Floridian mansion over Christmas. The house will soon host Nicola Peltz’s wedding to Brooklyn Beckham. Of course, the rendezvous took place on the elder Peltz’s territory: the 79-year-old founder of Trian Fund Management is used to getting his way.”

Daddy's most valuable asset

The paper then goes into all the business stuff that we covered above and in last month’s blog. So for a complete detailed exposition of the family angle to this story, we have to go to, where else, to the Inimitable UK Paper The Daily Mail. I encourage you to read the whole article here (published on January 19th) for a master-class on prurient interest journalism served up with a comprehensive raft of detail and diligently sourced visual documentation (i.e. lots of photos). The headline itself says so much and can you spot the 2 prefixes without the suffixes? “Brooklyn's marrying up! Billionaire Trump-loving future father-in-law and his model wife put David and Victoria in the shade - boasting a multi-million dollar property empire, several private jets and ten children between them” Again the whole article is well worth reading for those that are interested in such things. However, I will provide here the Daily Mail’s own 5 bullet point summary of the story. :

Brooklyn Beckham will be marrying into a family whose net worth dwarves his own parents' £769million fortune, with Nicola's businessman father Nelson Peltz, 79, estimated to be worth £1.3 billion

The father-of-ten was born to a Jewish family in Brooklyn, and dropped out of the University of Pennsylvania's Wharton School - later attended by Trump - in 1962 to become a ski instructor, but instead ended up being a delivery truck driver

Nelson, a former top Trump supporter, shares eight of his ten children with his third model wife of 35 years Claudia Heffner Peltz, and the pair count a 27-bedroom mansion complete with ice hockey rink and a flock of albino peacocks, as well as a £76million, 44,000sq ft home in Palm Beach - the reported wedding venue - as their homes

Despite being born into wealth, Nicola's siblings have also carved out their own successful careers, with her brother Brad, 32, an ice hockey player, and Will, 35, an American actor, and sister a former figure skater

Nelson used to commute to work from Bedford to downtown New York in a helicopter until he lost a legal battle with his neighbours about the noise

An Interesting Alliance

So, my finely honed business instincts tell me (plus I really, really hope) that this family angle will continue in some way to play a role in A. S. Nelson’s pursuit of Marmite Maker Unilever. Let’s see. If nothing else, Unilever might think they have Peltz problems but they should consider what it would be like as a young couple to have Nelson Peltz as your father-in-law and Victoria Beckham as mother-in-law. Puts your problems in perspective now, doesn't it? Although, hmm.. maybe they kinda already do.

Tell me what you want, what you really really want!

On to Surfactants News: This month, as always, most of what you read here is provided courtesy of my partners, the great ICIS, with whom I also co-produce the World Surfactants Conference… so..

As things are so volatile today for the obvious reasons, I am starting at the end of February (& early March) and working backwards for the news. If the early February news seems irrelevant or largely superseded, I’ll just skip it.

On March 2nd, the talented and prolific Lucas Hall of ICIS reported in depth on the supply chain situation for US fatty alcohols and fatty acids: US fatty acids and alcohols markets face major upward pressure from higher feedstock costs against the backdrop of supply chain concerns globally.

US contract survey fatty acid prices held steady pending feedback

US Q2 fatty alcohols contracts face upward pressure amid bullish feedstock costs

Prices face upward pressure on bullish costs pressures, supply concerns

Feedstock prices bullish amid supply chain disruptions globally

Fatty Acids

US contract survey prices were held steady pending further feedback.

March tallow-based acids face upward pressure from higher average bleachable fancy tallow (BFT) costs in February. March C16 palmitic acid costs face upward pressure from higher feedstock costs across the oil palm complex against the backdrop of balanced supply and demand rationalization/destruction in the market. February tall oil fatty acid (TOFA) prices face upward pressure from higher feedstock costs, tight supply and strong demand. Multiple chains of US fatty acids are tight, including C8, C10, C8-10, C14, tallow based C18-oleic and stearic acids, and TOFA. Tallow-based stearic acid markets are tight following the fire at the packaging facility at PMC Biogenix's US Memphis, Tennessee, site. The fire has put increased demand on tollers and imports to make up for the shortfalls as PMC Biogenix makes repairs in the short-to-medium term.

TOFA markets are tight alongside tight supply of competitive tallow-based C18 oleic markets in the domestic market.

Clear enough trend for you?

Fatty Alcohols

US Q2 fatty alcohols contracts face upward pressure from higher feedstock costs across the oil palm complex against the backdrop of supply chain concerns globally.

Discussions for Q2 contracts have been heard at a sharp premium from Q1, tracking the above pressures. Multiple chains of US fatty alcohols are tight, including C8, C10, C8-10, C16-18 blends and C18, depending on the supplier. Mid-cut alcohol supply has been ample to meet demand following supply chain disruptions in the latter-half of 2021 that prompted some players to increase their volumes for Q1. While some players have carryover volumes heading into Q2, increased uncertainty given increased geopolitical uncertainty is prompting some players to hedge alongside major upward pressure in upstream feedstock markets.

And another one

Feedstocks

Feedstock costs are bullish. A major disruption in Ukrainian sunflower supply to Europe with the Russia-Ukraine conflict has put major upward pressure on global palm, soybean and canola markets in recent days. Palm markets have been under upward pressure in recent weeks because of new export curbs being implemented in Indonesia to help curb local cooking oil prices. Coconut oil (CNO) is trading at a discount to palm kernel oil (PKO), encouraging more CNO in the feed-slate. CNO produces about the same amount of C12-C14 and C16 alcohols, but significantly less C18, pushing C18 production tighter.

And another

Supply Concerns

Imports also face further disruptions with the increased crackdown from the US Customs and Border Patrol on Malaysian imports from Sime Darby Plantation Berhad. Reports of imports being detained have been heard but not confirmed. Feedstock cost pressures are squeezing production margins in southeast Asia, posing further potential import disruptions in the near-to-medium term.

Finally, vessel space may be further constrained with increased demand for energy imports in Europe given the disruptions to supply from Russia. While some importers use carriers that only handle vegetable oils and oleochemical products, increased vessel demand may nonetheless put further upward pressure on freight rates.

Meanwhile in Europe, fatty acids and fatty alcohols second-quarter contract discussions are ongoing, while shortages continue to plague the market. In the fatty acids market, tallow-based negotiations are off to a slow start as players were waiting for producers to announce available volumes. Initial talks have now begun with early settlements heard for stearic acid. Palm-based discussions have been ongoing for several weeks and while some market participants were waiting to check tallow prices, most palm fatty acids players are now negotiating final volumes. Availability has been limited since 2021 due to vessel delays and high freight costs from Asia. Most players do not see these logistical issues easing before the second quarter of 2022.

Fatty acids and fatty alcohols market participants are keeping a close eye on the Russia-Ukraine conflict as this is already driving up crude oil and vegetable oil prices. Any impact on the fatty acids and alcohols markets are as of yet unknown. In the fatty alcohols market, second-quarter discussions are in very early stages, with no settlements taking place this week. There have been a lot of enquiries about available volumes for the second quarter, though most negotiations have not progressed to discussing prices yet. Supply constraints continue to be a concern, with at least one producer already sold out of material for the second quarter. Some players are focusing on captive use instead of selling on the market due to very high demand for downstream alcohol ethoxylates and other surfactants. Tightness in the fatty alcohols market is also caused by vessel delays and high freight costs from Asia. The majority of both fatty acids and fatty alcohols second quarter settlements will have taken place by the end of March or early April.

Also in Asia, Fatty Alcohols follow the same trajectory as reported by ICIS’ Helen Yan: Asia's fatty alcohols offers continue to increase on the back of rising cost of upstream palm oil and supply disruption due to Indonesia’s export restrictions.

Upstream markets surging amid heightened Russia-Ukraine tensions

Shipments delayed, limited spot availability in Indonesia

Market impact of Indonesia export curbs likely short term