Surfactants Christmas 2021 Double Issue

Christmas Double Issue December 2021 The cynics among you may conclude that we’re calling this a Christmas Double Issue because we’re very late publishing the November blog. And the cynics would, on this rare occasion, be right. The last few weeks have been tough for reasons good and bad and so this blog – gives you the news up to mid-December and includes some Christmas musings. We’ll be back in January though, so don’t worry. You’ll get your money’s worth! By the way, don’t forget to save the date. May 9 – 11th for our great 2022 World Surfactants Conference. Live and in-person in Jersey City, NJ. Same great place and bigger and better than ever. More details to all registered blog readers, very soon. Christmas Musings: I’m standing outside our lab in Connecticut, waiting for a car. It’s late, dark and cold. It’s been a physically, mentally and spiritually demanding week. Not that different from a lot of weeks you have in the course of your daily business – but I’m beat and ready to get home to a nice warm fireplace and dinner and wife and night’s sleep. A minivan pulls up. Chrysler, old-ish model, a bit dirty,…

Christmas Double Issue

December 2021

The cynics among you may conclude that we’re calling this a Christmas Double Issue because we’re very late publishing the November blog. And the cynics would, on this rare occasion, be right. The last few weeks have been tough for reasons good and bad and so this blog – gives you the news up to mid-December and includes some Christmas musings. We’ll be back in January though, so don't worry. You’ll get your money’s worth!

By the way, don’t forget to save the date. May 9 – 11th for our great 2022 World Surfactants Conference. Live and in-person in Jersey City, NJ. Same great place and bigger and better than ever. More details to all registered blog readers, very soon.

Christmas Musings: I’m standing outside our lab in Connecticut, waiting for a car. It’s late, dark and cold. It’s been a physically, mentally and spiritually demanding week. Not that different from a lot of weeks you have in the course of your daily business – but I’m beat and ready to get home to a nice warm fireplace and dinner and wife and night’s sleep. A minivan pulls up. Chrysler, old-ish model, a bit dirty, sounding a little bit rough. Not my ride, clearly. The inside light goes on and a young lady, puffer jacket, wooly hat, starts pecking away on her phone. Lost. Obviously. I watch. If she asks me anything other than a couple of huge landmarks, I’m useless. I just work here. But Google’ll help her. Or Waze. I keep watching and the shape of a child-seat resolves from the dimly lit back seat. A young child, 3 or 4 is in it. Next to him, his little sister. How do I know? I don’t but blue hat and pink hat so…two kids in the back seat. Mom driving. Is that the protocol? Youngest behind the driver – or what? It’s been over 20 years since I had a child seat.

Phone pecking stops. Mom turns to look at me through the passenger side window. She thinks for a moment and then gets out the car, walks round the back and opens the hatchback – chilly draft enters the van and I’m glad the kids have their hats on – pulls out a cardboard box and continues around the car toward me. She’s young and seems very small in the big black parking lot. “P2 Science”? she says with an accent. “yeah this is P2. Is that for us?” I guess looking at the package of what might be lab supplies or glassware. “Delivery for P2 Science. Are you P2 Science?” “Yes, I am” and then something weird and not heretofore encountered in my 60 years becomes apparent. This young mom with the old minivan and the two kids with the blue hat and the pink hat, is outside my building in the dark, in the cold in the empty parking lot, opposite the dental supply place with its empty parking lot, trying to deliver a package for some company – maybe the lab supply company, maybe Amazon, maybe.. She tries to scan the barcode with her phone. It doesn't work until I hold it at just the right angle. She says "thank you sir” as I imagine she learned just the other day from a company manual or training app. I don't know how I feel about this – what is going on here. I feel a bit.. off.

Joe, the cleaning guy pulls up in his white van – bang on time, 7.00 PM. He sees me with the package. “here Neil, I got that – I’m going in there now. I’ll put it on the front table.” “Cheers Joe, I appreciate it” He takes the package. Mom looks at both of us and then at me “Is he P2 Science” – “yeah he is also. He’ll put it with the other packages” “What is his name?” She’s poised to enter that into the delivery record. “Oh it’s Neil – put in N-E-I-L” I don't want her now to get into trouble from the company or the app. Joe is not exactly P2. He’s our cleaning service. My name should be good. Mom seems OK with that. She walks back around the van, closes the hatchback and gets back in. More pecking on the phone-thingy and then back out the lot, a little more quickly than I would have liked.

Joe and I stand for moment, thinking, just a little. He says to me “She’s out there delivering packages with two little kids. Little kids in the van – tonight” – with rising incredulity. I can only nod. He says “God Bless America”. It doesn't sound good. It’s not like how you say it in a good way or a proud way. I don’t want to agree with the sentiment but I can’t figure out how not to. So I say nothing. He heads in to the building. My car comes and I get in. That young lady. Maybe this is the first rung on the ladder. Maybe she earns enough to scrape together a deposit on an apartment before Christmas. Maybe the kids go to a nice school somewhere next year. Maybe the next Einstein or whoever, is in the back of that van. I doubt it though. Those kids should be in a nice warm home, getting read to by someone with a sweet voice. Maybe they have something stodgy and warm to eat, some veggies even though they don't like them. A toy car, a doll, a laugh. Christmas lights. Out there in the minivan in the dark and the cold with the app and Mom worried, worried about a delivery and the company and the name of the person. That’s not the place for those kids. Whose fault is it? It's her’s right? She took the job. True. I wonder what the alternatives were? Did any of the alternatives include dinner and reading and a warm fireplace and biscuits and a laugh about a silly toy car? So who’s fault then? America, Amazon, you, me? I dunno. I can’t change America or Amazon or you.. but me... I can do that.

7.00PM on a Cold WInter's Night in Connecticut?

News: In mid-November, ICIS’ great editor, Joe Chang did one of his superb interviews with the CEO of Clariant, Conrad Keijer. You can read the whole thing here https://subscriber.icis.com/news/petchem/news-article-00110706321 (subscription may be needed) but here’s an interesting snippet: “An excellent example is the joint venture we recently announced with India Glycols. This is actually making us one of the leading players in the India surfactants market and it also makes us one of the global players in green ethylene oxide (EO) derivatives,” he added. In July, Clariant and India Glycols completed the creation of their 51/49 JV Clariant IGL Specialty Chemicals Pvt Ltd.

The deal combined India Glycols’ renewable bio-EO derivatives business, which includes a multi-purpose production facility including an alkoxylation plant located in Kashipur, Uttarakhand, India, with Clariant’s Industrial and Consumer Specialties business in India, Sri Lanka, Bangladesh and Nepal. “There are definitely opportunities outside southeast Asia for these biosurfactants. What we essentially offer is 100% renewable-based green ethoxylated products,” said Keijzer.

Green EO - Starts Here - That's Molasses

Speaking of India; here’s an ICIS report from our EU and Asia Surfactants Conference that is timely and interesting: Sustainability is at the forefront of concerns among surfactant companies in India, as the pandemic turns a corner in the country to some degree, and consumption is set to rise. India’s economy is growing, and demographic advantage makes the industry players confident of robust growth in demand in the long term. Plastic consumption is projected to spike in the developing world over the next 10 years, at a point where the focus on developing a more circular economy for the materials is becoming more intense. The key end use for surfactants is in cleaners, disinfectants and personal wash products.

According to Galaxy Surfactants' Avinash Nandanwar, the role of surfactant players in India lies "in reducing plastics" and to use "less plastics in the supply chain", as well as to tap into "recycled plastics in the supply chain". In their green efforts, Nandanwar said the company is also persuading customers to shift from taking small barrels or drums. He is the head of sourcing at Galaxy. "Why not take supplies in bulk shipments [instead]?" Nandanwar suggested during a panel discussion at ICIS European & Asian Surfactants Conference in October.

India is targeting net-zero carbon emissions by 2070 under a five-point plan, which includes raising the country’s non-fossil energy capacity to 500 Gigawatts (GW) by 2030 so that half its energy requirements would start coming from renewable sources.

“By 2070, India will achieve the target of net-zero emissions,” Prime Minister Narendra Modi said at the United Nations Climate Change Conference of the Parties on 1 November. The 26th COP (COP26) was held in Glasgow, UK, from 31 October to 12 November. Modi vowed to reduce the carbon intensity of India’s economy to less than 45% and reduce its total projected carbon emissions by 1bn tonnes by 2030.

India is the last of the world’s major carbon polluters to announce a net-zero target, which is set 10 years after China’s 2060 target and 20 years after the 2050 target of both the US and EU. The southern Asian nation relies on coal - a highly polluting fossil fuel - for about 70% of its power generation. Its net zero emissions pledge is two decades beyond what scientists say is needed to avert catastrophic climate impacts.

India ranks third in greenhouse gas emissions after China and the US. COP26 looks to building on agreements reached at previous conferences, including the Kyoto Protocol and Paris Agreement.

Just like elsewhere in the world India’s oleochemicals market is facing major supply-side and cost issues that will continue to affect the industry as it grapples with logistical challenges stemming from the COVID-19 pandemic. Like the rest of the petrochemical chain, the surfactants industry is not immune to turbulent times dogged by record-high raw material prices, as well as plant maintenance of fatty alcohols in the last quarter of the year, Nandanwar said. "The challenge from last year continues," said Nandanwar, referring to expensive freight costs, high Brent crude prices, and longer delivery period.

He added that such factors have "impacted feedstocks used in surfactants... it's a complicated situation". China has also affected the supply value chain, according to Nandanwar. "It's a tightrope to walk. We have to ensure our operations run sufficiently," he said. Several feedstock fatty alcohol and ethylene oxide (EO) plants in China were shut or were running at reduced rates following the implementation of the dual control policy. As such, Chinese spot interest for fatty alcohol imports increased recently to replace the shortfall in its domestic market. The dual control policy places tighter limits on energy consumption and intensity in parts of China to enable the nation to reach a 'carbon peak' in 2030 and carbon neutral by 2060.

All things considered, the outlook on surfactants demand in India remains bright, supported by rapid urbanisation and a youthful populace, coupled with the fact that per capita consumption in the country is far below the developed world’s level, thus holding a lot of promise of growth. “Demographics [are] still on India's side and we will see that this pandemic has not actually hurt India, and India will bounce back and in fact the consumption story is still intact,” remarked Sadanand Palnitkar, associate vice president marketing of Godrej Industries. He added that the advancement of e-commerce has helped fuel "lifestyle and aspiration" changes, with residents from outside the metropolitan cities moving to catch up on the latest fad such as new shampoos.

"The consumption story is strong. I'm bullish on India," Palnitkar said.

Flying High

We’ve been tracking the PCC / Petronas JV for a while and at the end of November the official news came from ICIS that the JV has begun construction work on a planned project to produce non-ionic surfactants and polyether polyols at Kertih in Malaysia’s Terengganu state. The 70,000 tonne/year plant by the 50:50 JV, PCG PCC Oxyalkylates, is expected to be commissioned for commercial production in Q3 2023.

It will be integrated with other PETRONAS facilities at Kertih. The joint venture project would enable PCC Group to access emerging markets in East and Southeast Asia, CEO Peter Wenzel said in a statement. Financial details were not disclosed.

Duisburg, Germany-based PCC is focused on chemical feedstocks and specialties. It also has a container logistics business. [I love this news for both PCC and Petronas. Much success to the companies involved. ]

New Plant in Nice Neighbourhood

More investment from PCC hit the ICIS pages about a week later: Poland’s PCC Rokita and PCC Exol have announced a zloty (Zl) 351m ($86.1m) investment in building a manufacturing complex that will combine the production of ethoxylates and polyols.

The 50,000 to 55,000 tonne/year facility, to be located in the Brzeg Doly Chemipark in southwestern Poland, is to be ready for a launch in 2026, the companies—subsidiaries of Germany’s PCC Group chemicals, logistics and energy corporation—added in a press release published last Friday. PCC BD, a unit held 50:50 by Rokita and Exol, is to implement the project. “The new installation will be the first of its kind in Poland, combining flexible production of ethoxylates and polyols,” said Wieslaw Klimkowski, CEO of PCC Rokita.

The plant is to produce a range of ethoxylates, polyether polyols and other ethoxylated products, including biodegradable products, Rokita and Exol said. For feedstock, the installation will use ethylene oxide supplied by Polish group PKN Orlen. Separately, PCC Rokita, also a producer of chlorine, sodium hydroxide and surfactants, said it plans to invest in renewable energy sources to reduce its corporate carbon footprint.

Another Nice Neighbourhood

At the top of December, ICIS’ great Lucas Hall reported on the alcohol market as: US Q1 fatty alcohol contract negotiations are ongoing, with discussions heard at a sharp increase from Q4. Discussions have been heard approximately 40-50% higher from their Q1 settlements, tracking bullish feedstock costs across the oil palm complex, namely palm kernel oil (PKO). Increased scrutiny against Malaysian-origin material over forced labour allegations remains a major concern, as the traceability of Roundtable on Sustainable Palm Oil (RSPO) Mass Balance-certified (MB) material becomes increasingly more difficult, supporting higher premiums for MB PKO for oleochemicals production. Premiums for mass balance-certified (MB) material were heard at 8-14 cents/lb over non-certified material. Supply of MB material continues to tighten following the US ban on palm oil from Malaysian palm oil giants Sime Darby Plantation Berhad and FGV Holdings Berhad in 2020 against the backdrop of ongoing pandemic-related disruptions throughout southeast Asia. In addition to the ban on Sime Darby and FGV, in the August-September period, US Customs and Border Protection (CBP) denied entry to at least two Malaysian-origin vessels carrying oleochemicals from another producer.

Stong and Selective Arms of the Law

These disruptions have primarily impacted palm oil and refined glycerine imports from Malaysia, in addition to some short-chain fatty acids and alcohols. However, they have raised concerns among market participants of expanding scrutiny against Malaysian-origin material as RSPO MB markets continue to tighten.

There are conflicting reports as to whether these issues are easing. One producer is heard to be purchasing large volumes of Indonesian-origin PKO to sustain oleochemical production in Malaysia given the ongoing scrutiny on palm oil production in the country.

In the meantime, market players in Malaysia are working to reorganise their supply chain to avoid further disruptions, given the latest CBP action. Ongoing delays and supply chain disruptions globally are adding to the pressure - particularly in container markets, where shipping costs remain bullish. Heavy chain alcohols are largely shipping in containers, as few importers have bulk processing/storage capabilities in the US. As such, discussions in these markets vary widely, depending on import capabilities. The rise of the Omicron variant of the coronavirus in recent days has spurred bearish market sentiment in southeast Asia, putting downward pressure on feedstock costs across the oil palm complex and pushing some fatty alcohols players to the sidelines as they await a clearer market outlook on the virus.

Yep

The bearish sentiment has had a more immediate impact on mid-cut alcohols, where imports are more consistent versus in heavy chain alcohols, where supply of both single cut C18 and C16 alcohols is tight because of the above constraints. Despite lower feedstock costs, US demand is expected to continue to outpace supply into Q1 as pandemic-related delays and shipping logistics constraints dominate the market in a snug-to-tight supply environment. The US is unlikely to reinstate major pandemic-related restrictions like lockdowns in the near-term, sustaining demand for fatty alcohols and other raw materials as many players continue to work hand-to-mouth to catch up to pent-up demand stemming from persistent supply chain disruptions globally throughout most of 2021. US production disruptions are heard to be easing, with producers are running as hard as they can to make up for the inconsistent import market against the backdrop of their own feedstock and other supply chain disruptions locally. Overall production is insufficient to meet total market demand, keeping the wider market snug to tight. Southeast Asian producers will have maintenance in Q1, keeping supply snug to tight next quarter. Demand in most end-markets remains healthy to strong, including cleaning, personal care and industrial end-markets.

ALCOHOL PRICES

Q1 discussions

Q1 bulk contract discussions have been heard at a major increase from Q4, tracking the above cost pressures, namely higher PKO costs. Heavy chain alcohols in containers have been heard even higher given the critically tight container market.

Prices for synthetic alcohols were heard at both ends of the above ranges amid the ongoing force majeure at Shell's Geismar site. At least one buyer settled its Q4 C16-18 contract below the $1/lb DEL USG range. The same buyer settled its Q4 C18 contract below the $1/lb DEL USG range. In the wider market, multiple producers have switched their contract terms from a DEL to an FOB + freight basis or to terms subject to changes in freight and demurrage given the ongoing shipping logistics constraints. Some players have fewer volumes available for their traditional quarterly customers because of upcoming maintenance and ongoing supply chain disruptions globally. as they prioritise stock building full-year commitments given the increasing supply chain constraints.

Spot

Bulk mid-cut, C16, C18 and C16-18 spot prices have been heard approximately 40-50% higher than Q4 contract settlements, tracking the above cost pressures. Heavy chain alcohols in containers have been heard even higher given the critically tight container market.

The Asia Fatty Alcohol market, which had been on a relentless price upward spiral since early September, is now facing slowing demand in China – reported ICIS. Mid-cut C12-14 prices had increased by 56% from 1 September to average at $2,850/tonne FOB (free on board) SE (southeast) Asia on 17 November, ICIS data showed.

[insert Asia Alcohol Price Chart]

Prevailing tight supply and firm demand had been lending strong price support, but current high prices are now causing buyers to adopt a cautious stance on the market and hold back purchases. Spot appetite has waned despite elevated prices of upstream crude palm oil (CPO) and feedstock palm kernel oil (PKO). Regional fatty alcohols producers have been focusing on term business and have little spot volumes available for the rest of the year. “Discussions are ongoing for next year’s first-quarter contracts and demand is stable and healthy,” a regional producer said. With Europe in lockdown amid surging COVID-19 infections and Asia demand slowing down, the upward price momentum has withered, market sources said. Suppliers are keeping offers steady or firm in view of margin erosion and prevailing tight supply. “It is still an evolving situation. It depends on how serious the Covid surge is in Europe - whether Europe will be locked down for a longer period and the impact on demand is still unclear,” a supplier said. A buyer said: “With the fuels prices cooling, which have impacted the vegetable oils markets including palm, there is no buying interest.”

“The general market trend is downward,” a trader said.

Falling Palm Causing Problems?

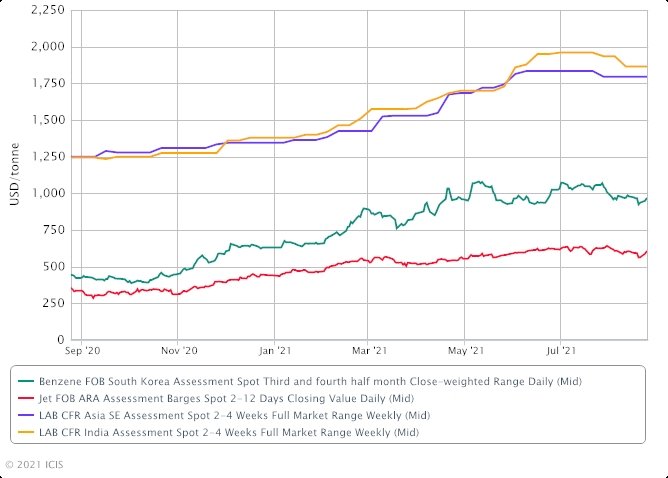

Meanwhile, in Asia LAB markets, things are, by comparison, pretty quiet. ICIS reports that activity in the Asian linear alkyl benzene (LAB) market slowed with the year-end holiday lull approaching. At the same time, the widening gap between buyers and sellers continue to keep trade muted in the region. While suppliers have largely held on to offers, buying momentum appears to have wane for spot cargoes, with buyers in a wait-and-see mode. The recent weakness in the upstream crude oil and benzene markets weighed on sentiment with buyers expecting a softer LAB market in the near term. Spot prices in southeast Asia remain at $1,760-1,850/tonne CFR (cost & freight), with products quoted in a wide range, depending on the parcel size and origin, ICIS data showed.

An Unusual Shape Today

“The spot market in Asia remains slow with few deals heard,” said a trader in northeast Asia. Meanwhile, output in China has lengthened with scheduled maintenance shutdown at plants completed in November. However, these suppliers are understood building up inventories and meeting the requirements of local users. Consequently, export availability from Chinese sellers is expected to be limited in December. Over in India, domestic demand weakened over the past two weeks, as users have accumulated some stocks post-Diwali in early November. Domestic offers declined to around Indian rupees (Rs) 143/kg ex-tank, down from Rs148/kg ex-tank for November.

“Spot and contractual offtakes have slowed recently, and hence offers from suppliers have come off,” said a producer in India. Some sellers have also left the Indian market for the time being and refocused sales elsewhere, in view of the tepid demand in the import segment. “We are currently focusing on countries around us; buying momentum in India remains slow,” said a producer in the Middle East.

Continuing our survey of the hydrophobes, ICIS reported that Asia’s fatty alcohol ethoxylates (FAE) market is expected to slow in December on worries that the Omicron variant of the coronavirus will further weigh on demand amid the run-up to the year-end festive holidays. Spot interest waned as buyers held back their purchases and adopted a cautious stance on worries that the highly infectious Omicron variant will impede the global economic recovery.

It's All Greek Though..

“Omicron will trigger a knee jerk reaction and it will subside soon. Raw material volatility is an issue, but as the calendar year is at its end many companies are taking stock of their positions and taking a cautious call, and pushing everything to next year,” a trader said. Following the emergence of the Omicron variant, crude oil has dropped significantly, prompting a fall in vegetable oil prices. With upstream crude palm oil (CPO) and palm kernel oil (PKO) prices declining, as well as falling feedstock fatty alcohol C12-14 prices, buying interest in southeast Asia and China has taken a backseat.

A Trend and a Departure

Chinese demand has also slowed due to ample inventories following the arrival of imports which were booked earlier in October. The slump in the Chinese domestic feedstock ethylene oxide (EO) market has also curbed spot interest in fresh FAE spot imports. “December is usually a low demand season in China,” a trader said.

Adding to the woes of market players are ongoing logistics issues, including delayed shipments, congested ports, sky-high container freight rates, constrained manpower, and demurrage.

Wow

“Supply chain disruptions and container freight rates, which have surged by four or five times since pre-pandemic times, have all added to business costs,” a regional supplier said. Business will likely pick up in January after the year-end festive holidays and before the Lunar New Year, which falls on 1 February 2022. In the meantime, market activities are likely to pause and players will mostly welcome a well-deserved rest from a most challenging year.

Shifting to the hydrophile side of the ledger: US November ethylene oxide (EO) contracts fell for the fourth consecutive month, tracking same-month feedstock contracts. ICIS assessed US November EO lower by 0.2 cents/lb ($4/tonne) from the previous month. Despite the steady decreases, US EO contracts remain 18% higher year on year.

Still Higher Than Last Year

Same-month ethylene contracts settled lower by 0.25 cent/lb. Average spot ethylene prices were mostly steady from the prior month but a decline in average production costs pushed the settlement lower. The majority of EO contracts are formula-based, and price movement comprises 80% of the change in the ethylene price and an additional conversion fee, or adder. Like ethylene, EO contracts are settled at the beginning of the month for the previous month’s price.

By the way in positive news for US EO, here is a plant status report: Shell’s Geismar, Louisiana plant which makes linear alcohol (195 KMT/yr) and ethoxylates, is back up from force majeure. The fm was declared in early September following the impact of Hurricane Ida on raw materials availability and operations at the Geismar and Norco sites.

Like many of you, we here at the blog have been seeing a lot of price increases for products and services. We can’t print all of them here (actually we could but that would be boring) but here’s a representative one that Dow sent around last week: Dow nominated higher pricing for its surfactants products effective 1 January. The company is seeking price increases of 6-8 cents/lb for products including surfactants and specialty alcohol alkoxylates. So there you are. One among very many. What’s the craziest increase you have seen. Here’s one I got last week. A carboxylic acid that I last bought 3 years ago, was quoted to me with a price increase of 130%. Note – that’s not a 30% increase; that’s double the price then add another 30%. Can you top that?

Finally – here’s a company we don’t talk about often. Pu Feng Biotech of Taiwan (http://pf-bio.com/en#2) has introduced a surfactant called Surpetant 13 made from recycled PET bottles. It’s a 99+% active liquid with an HLB of 13. Applications include laundry. Interesting.

End of news. This edition has no music section. Go back up to the top and read the musings and let me know your thoughts. Next month - we'll have some New Year's Music to listen to. In the meantime: Merry Christmas and a Happy New Year to all our readers. All the best and see you soon.

Surfactants Monthly – October 2021

Surfactants Monthly – October 2021 Great month for surfactants. We had our European and Asian Surfactants Conference – a huge success. And we were able to announce that the the next conference will be live and in person 9 – 11th of May of 2022 in Jersey City, NJ. Stay tuned and we’ll get further information to all registered blog readers. So – let’s see. There’s a lot going on with Sasol these days, which we heard about at the conference and which they also talked about at their capital markets day. Check out the details at the end of the post. You’ll also notice, as you read through the news, that there is a lot of talk about inflation and supply chain disruptions. Shortages, high prices, stuff like that. Even Stepan’s mighty surfactant machine experienced problems this year as they discussed on their earnings call (see below). Hmm.. we went back to Manhattan for the first dinner / play / night-over since the pandemic. One thing struck me – the aroma of the city. It’s changed from what it was a couple of years ago. Today the prevalent aroma is one of marijuana and urine. Pot and piss, you…

Surfactants Monthly – October 2021

Great month for surfactants. We had our European and Asian Surfactants Conference – a huge success. And we were able to announce that the the next conference will be live and in person 9 - 11th of May of 2022 in Jersey City, NJ. Stay tuned and we’ll get further information to all registered blog readers.

So – let’s see. There’s a lot going on with Sasol these days, which we heard about at the conference and which they also talked about at their capital markets day. Check out the details at the end of the post. You’ll also notice, as you read through the news, that there is a lot of talk about inflation and supply chain disruptions. Shortages, high prices, stuff like that. Even Stepan’s mighty surfactant machine experienced problems this year as they discussed on their earnings call (see below).

Hmm.. we went back to Manhattan for the first dinner / play / night-over since the pandemic. One thing struck me – the aroma of the city. It’s changed from what it was a couple of years ago. Today the prevalent aroma is one of marijuana and urine. Pot and piss, you may want to crudely say. The city is a piss-pot, where people without a pot to piss in are pissing, wherever they like, or can or, perhaps more accurately, must. How come? I don’t know. I did learn that you can avoid the piss-aroma by taking a hotel room way up on the 20th floor – but evidently the pot-aroma still rises well above street level. We did not find pot escape height on this visit. So why all the crudity in this family blog? I hope I haven’t offended any readers, but the experience got me thinking – mostly in one syllable words. I guess first: Is there a correlation? That is between the piss and the pot? I am not aware of one. Is alfresco micturition purely the purview of the piss-poor partaker of pot? I doubt it. I understand that pot can drive both snacking and hair loss but have not heard that uncontrollable urination is a side-effect of this particular drug. The outdoor urination to my untrained eye seemed to be function of homelessness. Was homelessness also causing the pot-smoking or the other way around or are they independent phenomena? I’m guessing independent although a THC infused night on a subway grating has to be little more pleasant that one spent stone cold sober, I guess.

Crime? Didn't see any honestly. Nor were we accosted by anything other than the aforementioned aromas. But the smells themselves sent a message Someone remarked that today’s NYC experience is more akin to the 70’s than the 2000’s and that has a certain sense to it. Inflation, shortages, the smell of anarchy – it’s the New York of The Warriors rather than of, say, Sex and the City. And of course those who remember that 1979 movie classic will recall that public bathrooms were never the safest of places so maybe outside relief is the most sensible choice.

Careful in there..

Am I ready to write off the city for a few years until the next crimebusting mayor takes charge, as he or she surely will? Not quite yet. Maybe this time it’s different. With so much pot in the air, the violent extremes of the Warriors years may just not be possible. And the urine? Well, I’m told that with a smouldering great spliff wedged between your teeth it’s hard to smell much of anything. On second thoughts, maybe we’ll stick to the Jersey Shore. What’s the worst you could encounter there?

This is..

For those readers still with me.. thank you. And here now is the news you came for.

Not only did Melissa Hurley of ICIS make an outstanding presentation during our virtual European and Asian Surfactants Conference, she penned an outstanding analysis of the European ethylene oxide situation: At the beginning of October, European ethylene oxide (EO) market players were in the early stages of negotiating contract terms and adder fees for 2022, ahead of this year's virtual European Petrochemical Association (EPCA) event, Melissa reported. Apparently, high ethylene prices are a bone of contention, especially for non-integrated players, due to the adverse impact on seller margins. The EO price includes a conversion fee over the cost of ethylene, which is negotiated at the beginning of the calendar year. Formulas can also vary in terms of ethylene cost pass-through and some contracts are agreed on a multiyear basis.

In 2021, production costs are also high due to the record high gas prices, having a detrimental impact on energy prices and cost of production. The EO manufacturing process is very energy intensive so this is an important factor to consider.

Over the past ten months, the relentless rise in ethylene prices has led to a 24% rise in average EO formula contract prices.

The long march of EO and Ethylene

The only decrease in feedstock costs was last month and it provided little relief in September. In October, ethylene resumed its upward trend due to the rally in crude and naphtha prices. This shows a marked difference to the conditions of 2020, a year plagued by lockdowns and demand reductions, particularly in the first half of the year. During 2020, EO contracts decreased by 11.3% on average, according to ICIS data. Lower annual adder fees were agreed in January 2021 due to the structurally relaxed supply situation despite short-term unplanned production issues experienced at the start of the year. So far for 2022, there have been indications of a bullish approach to the adder fee talks but negotiations are still in the early stages. Despite the importance of utility and production costs, supply remains key.

Consumers will also be looking at the expected supply balances for the fourth quarter and beginning to look at next year's cracker maintenance schedule. "[Adder talks] It's more based on availability", added a market source. EO supply is mainly as expected, with a couple of planned turnarounds happening at the end of the third, beginning of the fourth quarter. Clariant's EO partial maintenance at Gendorf continues in October. The exact dates of the turnaround are unknown. A turnaround at BASF's Antwerp EO/EG facility is expected to take place in the fourth quarter. The exact dates are unconfirmed by the company, but market sources indicate November. Future investments in Antwerp and for Clariant are so far unclear and there have been no official updates on when these are expected. BASF planned to add 400,000 tonnes/y in 2022 to its production by building a second manufacturing unit at the Antwerp site, which will also be able to process purified ethylene oxide. Clariant previously announced plans to increase EO capacity in Gendorf, Germany with an increase of high purified ethylene oxide (HPEO) in 2018. There were no further details of the expansion officially published.

Meanwhile on the other side of the surfactant molecule, ICIS’s Sam Wright reports that The European fatty alcohols Q4 contract price range widened amid fluctuations in feedstock prices through the third quarter, combined with tightness, which worsened as the fourth quarter approached. Prices decreased by €75/tonne on the low end and increased €20/tonne on the high end to €1,650-1,850/tonne FD (free delivered) NWE (northwest Europe).

A jump then a march..

There were some lower prices seen in the market compared with the third quarter resulting from fluctuations in palm kernel oil (PKO) prices during the quarter. Shortages also worsened as the third quarter progressed, leading to higher prices settled approaching the fourth quarter. Logistical issues surrounding shipping delays from Asia continue to cause problems for the European market. Given the issues over exporting material from Asia currently, some players are preferring to send cargoes to local markets such as China. This has led to a decrease in imports into Europe for the fourth quarter. At the same time, demand for downstream alcohol ethoxylates has been very strong. There is a shortage in this market as well, caused at least partly by the constraints in the fatty alcohols market.

Over in the US, Lucas Hall reported on the fatty alcohols market. US Q4 fatty alcohols contracts were assessed mixed from Q3. Freely-negotiated contracts for mid-cut alcohols decreased now that demand into consumer cleaning markets has stabilised from the panic-buying seen in the early days of the pandemic. Multiple surfactants producers had carryover volumes from Q3. decreasing their demand for Q4. However, rising feedstock costs across the oil palm complex in recent days against the backdrop of tightening supply globally is causing the market to reverse direction, increasing demand for spot volumes and putting upward pressure on the market. Demand has also increased in Mexico with increased ethylene oxide (EO) in the country in the last several weeks.

Shell remains on force majeure into October because of lingering feedstock constraints following Hurricane Ida in late August but has increased its allocation levels from September. Freely-negotiated contracts for heavy chain alcohols settled at a sharp increase, tracking tight supply, strong demand and bullish shipping container freight costs. The ICIS US C16-18 fatty alcohols quarterly price assessment is assessed on a bulk basis or bulk equivalent basis. Because few suppliers have bulk storage capabilities in the US, bullish container freight costs prompted a wide range of prices this quarter. A limited number of suppliers have tank storage capacity in the US to process and store heavy chain alcohols in bulk. Mid-cut alcohols are less susceptible to these disruptions, as they are largely shipped in bulk.

Prices for petrochemical alcohols were heard at both ends of the above ranges amid the ongoing force majeure at Shell's US Geismar, Louisiana, site. In the wider market, multiple producers have switched their contract terms from a DEL (delivered) to a FOB (free on board) plus freight basis because of volatile and bullish freight markets. Spot prices have been heard at least 5-7 cents/lb above Q4 contract levels.

Mass Balance (RSPO) Premiums widened to 7.0-13.5 cents/lb over standard balance material from 7.0-13.0 cents/lb the previous week. Supply of mass balance (MB) material continues to tighten following the US ban on palm oil from Malaysian palm oil giants Sime Darby Plantation Berhad and FGV Holdings Berhad in 2020 against the backdrop of ongoing pandemic-related disruptions throughout southeast Asia. In addition to the ban on Sime Darby and FGV, in the August-September period US Customs and Border Protection (CBP) denied entry to at least two Malaysian-origin vessels carrying oleochemicals from another producer. While these disruptions did not hugely impact US fatty alcohols markets, they have raised concerns among market participants of expanding scrutiny against Malaysian-origin material as RSPO MB markets continue to tighten. Rising premiums are making coconut-based material competitive with MB material, in turn increasing demand for coconut-based fatty alcohols, especially given the bullish container freight market.

Coconut-based alcohols do not fall under the same environmental scrutiny as palm-based material [true - but give it time], making them a viable alternative to MB material when pricing becomes competitive in sectors where sustainability labelling is common, like personal care and cosmetics. In the meantime, market players in Malaysia are working to reorganise their supply chain to avoid further disruptions, given the latest CBP action.

Protecting the homeland from Malaysian Oleochemicals... don't you feel safe now?

The other big hydrophobe, LAB, made news in India this month. Interest in the linear alkylbenzene (LAB) import market in India perked up, following the recent announcement of a 6-month delay of the Bureau of Indian Standards (BIS) deadline of mandatory certification requirement on imports. The BIS in April this year announced that various chemicals and polymers have 180 days to meet the deadline for the implementation of mandatory certification requirement on imports. The deadline has since been pushed back another 180 days from 8 October for LAB and some other chemicals. Suppliers in Asia and the Middle East have shunned the Indian market in recent weeks as the deadline loomed, with most not having been certified. However, sellers interest has been rekindled this week with some preparing to make offers to the subcontinent. “With the deadline now pushed back, sellers will likely refocus sales to India,” said a trader in Asia. However, with competition on the Indian import front likely to heat up, some participants anticipate some downward pressure on the market. Already, a Middle-Eastern producer has fired the first salvo with a lower offer to India this week, prompting sellers to potentially recalibrate quotations lower to compete. “Buyers are looking for lower prices as more sellers are likely to emerge near term,” said an end-user in India.

While sellers in Asia welcome an alternative outlet in India, given the lukewarm demand in other markets such as Southeast (SE) Asia; some raise concerns that intensifying competition into India and a potential weaker market as a result, could have a spill-over effect in Asia. “Lower prices in India could weigh on sentiment across Asia, as demand here is average,” said another trader in Asia. Demand has been slow in SE Asia due to surge in pandemic cases and restrictions in Q3. There are general expectations for improving demand following tapering off of cases and gradual reopening of economies but thus far, no significant jump in demand has been seen.

Trend looking familiar?

Meanwhile for LAB in Asia: The Asian linear alkyl benzene (LAB) market was largely steady week while some sellers continue to pivot to the India market. Sellers noted that the subcontinent has become another viable outlet for their cargoes as southeast Asia continues to see lukewarm demand. Previously, some sellers have kept away from India as they could not meet the certification deadline. While selling competition to India is expected to increase, selling indications have been quite wide with one Middle Eastern seller quoting lower prices to engage buyers, while a separate seller was eyeing $100/tonne higher than the former on the back of firm raw material costs. Selling indications came in from the high $1,700s/tonne CIF India to the high $1,800s/tonne CIF India, ICIS data showed. “The selling numbers are quite far apart as some customers prefer one source over another,” said a trader in India. Asian sellers are also monitoring the India market closely and are expected to make quotations in the near term.

In southeast Asia, offers of LAB parcels were also heard in a wide range depending on origins. Quotations ranged from the high $1,700s/tonne CIF SE Asia to the high $1,800s/tonne CIF SE Asia.

And again..

Buyers remain unhurried and bought on a need-to basis. Ongoing and upcoming scheduled maintenance in northeast Asia in the fourth quarter is expected to tighten availability to some degree, while relaxation of pandemic restrictions could potentially lift demand also. “The SE Asia market remains stable for now but demand could pick up subsequently,” said a trader in Asia. Chinese suppliers continue to focus on the domestic market, as output has been curtailed by earlier plant incidents, as well as ongoing turnarounds.

Prices for fatty alcohols in Asia have risen on the back of surging cost of feedstock palm kernel oil (PKO), prevailing tight supply and strong buying interest for spot cargoes – ICIS reported. Spot offers for mid-cut C12-14 blended and long-chain C16-18 blended grades spiked by about $200/tonne this week on costs pressures, and as a supply crunch coupled with rising demand followed the return of Chinese players from a week-long holiday in early October. Several fatty alcohol plants in southeast Asia and China were either recently shut for maintenance or running at reduced rates, tightening supplies at a time when buying interest for prompt cargoes intensified amid the upward trajectory of the feedstock PKO price. “Enquiries from China have picked up due to the current short supply. Generally, sentiment is bullish and Chinese spot buyers are keen to lock in some grades due to supply security concerns,” a regional producer said.

“The $150-200/tonne surge in the feedstock PKO price to more than $1,800/tonnne amid the current tight market has lifted offers for C12-14 and C16-18 blends by around $200-300/tonne this week due to eroded margins and costs pressures,” another supplier said.

Feeling sick yet?

Some buyers are holding back and cutting down on their spot volumes to wait for a clearer market picture. Meanwhile, some fast-moving consumer goods (FMCG) companies worried about supply security are looking at locking in their first-quarter 2022 supplies amid expectations that demand will pick up with the global economy opening up, market sources said. “We are sold out for the year due to contractual commitments and have closed our books for the year. We have no spot [cargoes] available,” another regional producer said. Demand from the downstream tourism, hospitality, home personal care, and food and beverage sectors are expected to spike when the regional economies in Asia open up by the end of this year. Adding to the upward price pressure on the fatty alcohols market are logisticial issues, including high container freight rates, limited vessel space, delayed shipments and demurrage.

It will come as no surprise, then, that ICIS reported that Asia’s fatty alcohol ethoxylates (FAE) market is likely to face upward pressure in the near term on Chinese demand amid soaring feedstock ethylene oxide (EO) and fatty alcohols prices. Chinese spot appetite for FAE imports has increased following the National Day holiday on 1-7 October. Regional producers in southeast Asia have increased their spot offers by $100-150/tonne due to eroded margins from rising feedstock costs.

As expected..

“We have no choice but raise our offers by at least $100/tonne for November shipments to China due to the surge in the feedstock fatty alcohols costs,” a regional producer said. Fatty alcohols C12-14 blend prices surged by $170/tonne to $2,210/tonne FOB (free on board) southeast (SE) Asia in the week ended 13 October, ICIS data showed. In the Chinese domestic market, limited supplies and rising domestic prices had prompted enquiries for imports. “Chinese domestic feedstock EO prices and FAE prices have gone up sharply by about yuan (CNY) 800-1,000/tonne in the past week because of limited local supplies. Plants were shut or were running at reduced rates due to the dual control policy, so demand for FAE imports has strengthened,” a trader said. “Transportation and delivery costs are expected to go up in China due to difficult road conditions and logistics issues during the cold winter season, so this will also add upward pressure on prices,” another trader said.

Several feedstock fatty alcohol and ethylene oxide (EO) plants in China were shut or were running at reduced rates following the implementation of the dual control policy. The dual control policy places tighter limits on energy consumption and intensity in parts of China to enable the nation to reach a 'carbon peak' in 2030 and carbon neutral by 2060.

Blog favorite, Stepan made a lot of news this month. First up – the announcement that Stepan plans to invest $220m to build a new alkoxylation plant at its site in Pasadena, Texas. The new plant will provide a flexible capacity of 75,000 tonnes/year, capable of both ethoxylation and propoxylation, and better position the company to serve growing global demand in its surfactant and polymer businesses. The plant is expected to come online in late 2023. When operational it will bring Stepan's alkoxylation network to three plants and position the company with a footprint in the globally strategic US Gulf Coast. Nice. Of course, readers will remember that this has been the plan since the acquisition of the Pasadena site from (then) Sun and the simultaneous shelving of the Geismar, EO pipeline project.

As always, Stepan’s quarterly earnings announcement makes informative reading. The company’s Q3 sales rose 30% year on year while gross profit and operating income fell as cost of sales jumped 39% because of the ongoing supply chain disruptions.

Surfactant operating income fell 16% largely due to North American supply chain disruptions, higher planned maintenance costs, and the non-recurrence of an insurance recovery recognised in Q3 2020, related to the 2020 Millsdale, Illinois plant power outage

- A 6% decline in Stepan’s global surfactant sales volume, mostly related to the company’s consumer products business, was offset by improved margins, product and customer mix.

- Polymer operating income dropped 12% mostly due to the non-recurrence of the Millsdale insurance recovery, as well as compensation received from the Chinese government in Q3 2020 related to the government-mandated shutdown of a joint venture in 2012.

- The company’s global Polymer sales volume rose 27% largely due to the acquisition of INVISTA's aromatic polyester polyol business in Q1 2021.

- In the Specialty Product business results were up due to higher volume and improved margins.

- Net income rose year on year as Stepan’s Q3 2021 provision for income taxes was much lower than in Q3 2020.

Looking at Q4 and beyond, Stepan believes that its Surfactant volumes in the North American consumer product end markets will continue to be challenged by raw material and transportation availability, said CEO F Quinn Stepan. While Stepan believes industrial and institutional cleaning volume will grow versus prior year in Q4, it does not believe that this will compensate for lower consumer consumption of cleaning, disinfection and personal wash products, he said.

However, demand for surfactants within the agricultural and oilfield markets is expected to exceed prior year demand, the CEO said. Meanwhile, Stepan’s Polymer business is expected to grow, due to the ongoing recovery from pandemic-related delays and cancellations of re-roofing and new construction projects and the INVISTA acquisition. “We continue to believe the long-term prospects for rigid polyols remain attractive as energy conservation efforts and more stringent building codes are expected to continue,” Stepan said.

Stepan’s Specialty Product business results will improve slightly year-on-year in Q4.

“Despite supply chain disruptions continuing to impact the company, we remain optimistic about delivering full year earnings growth," the CEO added.

Not just at the supermarket..

The company made additional comments on inflation during the earnings call. Stepan expects additional inflation in Q4, the CFO said. Luis Rojo, vice president and CFO, cited current oil prices around $83/bbl that could pressure production and transportation costs, though perhaps at a slower rate than in previous quarters. "In a high-inflation environment, of course, you always have a lag between pricing and cost," he said. In Q3, Stepan saw significant impact to its polymers margins due to raw material availability and escalating costs, said Scott Behrens, president and COO. The company announced price increases in October for CASE polyols and surfactants, to continue recovering margins, Rojo said. "Inflation is still out there but we, of course, are planning to recover our margins on a gradual basis."

ICIS went on to elaborate on the comments Stepan made regarding the oilfield and agriculture markets. Demand for surfactants within the agricultural and oilfield markets is expected to exceed prior-year demand, US-based Stepan said in its Q3 earnings call.

With crude oil prices in the $80s/bbl and natural gas prices expected to be 27% higher than last winter, oilfield activity has increased throughout 2021, increasing demand for commodities such as surfactants and triethylene glycol (TEG). In agricultural applications, high commodity prices and a favourable currency impact on exports are driving increased planted areas of major crops in Brazil, the company said. In North America, high commodity prices for corn and soybeans, as well as increased planted acreage for the 2021 growing season, drove strong crop protection sales, Stepan said.

Agriculture still attractive

We don’t normally report what exactly goes at our conferences, because, you know – you gotta be there! However, ICIS wrote a piece on the great Norm Ellard's overview of oleochemicals, so I figured it was OK to excerpt it here: The global oleochemicals market is facing major supply-side and cost issues that will continue to affect the industry as it grapples with logistical challenges stemming from the COVID-19 pandemic, Norm Ellard the president of trading firm IP Specialties Asia noted – at the conference. “Force majeure is now a way of life [in the oleochemicals industry], nothing is immune,” he told delegates at the ICIS European & Asian Surfactants Conference. “We have enforced lower running rates due to COVID, we have lack of people [manpower]. In the plants raw materials even basic building blocks like ethylene has been tight, and now even hydrogen has been tight,” he said. The energy shutdowns due to high costs such as in China are also impacting production and supply, Ellard said. “We are finding out that the cost is king approach has not served us well in today’s market as we go through these supply crunches,” he said. Getting the material to the market remains a major challenge, with ports being shut due to COVID-19.

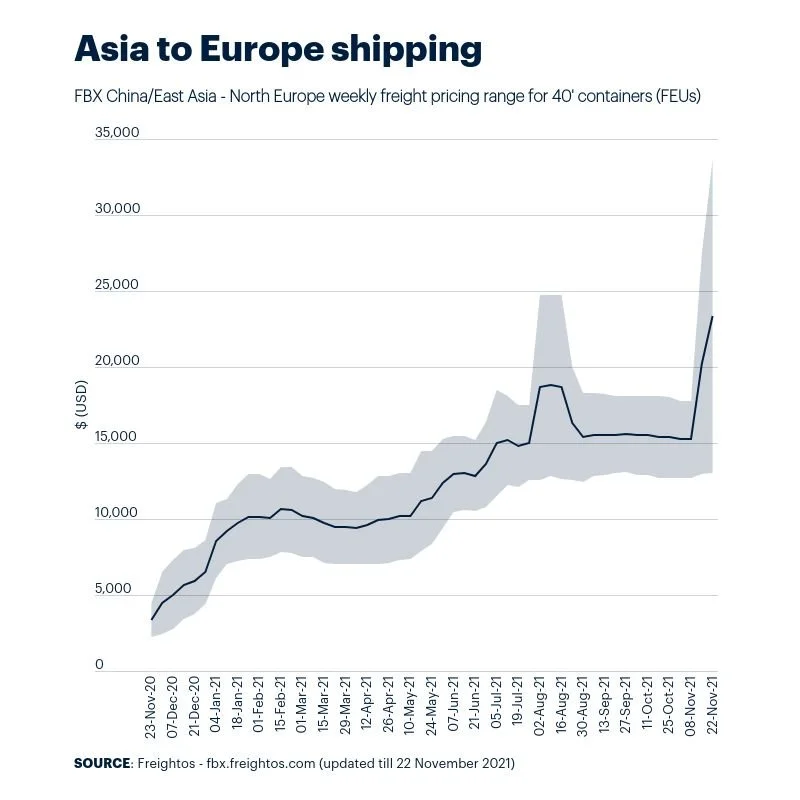

“We are finding out that the real essential services are truck drivers, ship captains, air pilots,” Ellard said, adding that some 13% of the world’s cargo shipping capacity is now tied up in delays. On the cost side, the oleochemicals space is facing raw material prices at record highs, or highs not seen for many years, he said. “Suddenly logistic costs are now a significant part of the cost of goods. We used to [be] able to ship a container from Asia to the US for $2,000-3,000, now in some cases we are getting estimates of $18,000-20,000,” Ellard said. Supply chain issues have now overshadowed the importance of being a low-cost producer, with having the ability to ship on time to the customer at reasonable costs being more crucial, he said. Southeast Asia, for instance, has lost its advantage to be a global supplier of oleochemicals to the world unless they shipped by bulk, Ellard said. “But the irony is that there is where most of the production [oleochemicals] is,” he added.

Shipping problems..

Finally: As readers know, we like to spend time on YouTube plumbing the back catalogues of, mainly, heavy rock bands. This month, however, it’s worth pointing out that there are some great videos on there featuring Sasol and in particular, Fleetwood Groebler and Brad Griffiths, both friends of the blog. The event was Sasol’s Capital Markets Day – for which there is a webpage that you should check out here. https://www.sasolcapitalmarketsday.com/content.aspx#a There are links to the slide presentations and the videos.

But over to YouTube. First up, let’s hear from Fleetwood, who is now CEO of Sasol.

Next up – homing in on the chemicals business and in particular the surfactants and feedstocks area – Brad Griffiths.

I also wanted to highlight this one from Marius Brand that covers Sasol’s Fischer Tropsch technology and the formation of a new Sasol business unit, Eco-FT - formed as of the day of the capital markets event. Interesting.

That, then is the end of the news and so now to some music. What seems relevant? The 70’s and early 80’s of course. Our tribute to the New York City of the Warriors

Nothing says New York like the Ramones at CBGB’s

or Blondie at CBGB’s

Or.. who remembers that great New York heavy rock band, Riot? This was a truly great band. Their album Narita - a classic with not a bad song on it. How are they not better known? Not sure - but see last month's blog re Metallica..

So… I'm still not done with the urine and the marijuana. The marijuana I get. It’s pretty much legal and folks want to toke so, even though they are not “15 feet away from the building” like the hapless Marlboro men, it’s somewhat socially acceptable, I suppose. The urine though: Let’s stick with the homeless theory. If you live on the street, chances are that your bodily functions will need to be performed on or in the street. What struck me as ironic though during our weekend – as a person with a house and also a hotel room, I was able to use the restroom anywhere I wanted. I who had the least immediate need had by far the greatest access. Why? I honestly think it’s because I wear nice jackets (Paul Stuart or Charles Tyrwhitt, if you’re curious). I can and do walk into anywhere (even those places that have “restrooms for customers only”), ask where is the restroom and use it. No-one dares challenge or worse yet, evict, the man in the nice jacket. Now, I imagine that on becoming homeless, one of the first things to go is the jacket, if you even had one in the first place. So restroom access becomes a little trickier. I’m not being flippant. This is a problem. Human dignity is being depleted in our cities. Citizens are being classified and separated from each other in many ways. Restroom access is merely one of them.

Singapore is a big city and this sort of thing doesn't seem to happen there. Should New York become like Singapore. Maybe. If its residents would like to. Although they may find that some pesky amendments to the US constitution prevent some Singaporean measures being applied in the big apple. I have no answers. Just thinking and sharing those thoughts. What do you think ?

Surfactants Monthly – September 2021

September 2021 – Surfactants Monthly For Blog Readers Only We’re starting with a commercial for the upcoming European and Asian Surfactants Conference – Online – October 26th and 27th. I have a $100 promo-code only for readers of this blog only. Just use WSC21NB500 at checkout and you get $100 off the registration. I’m told that this is now the only way to get registered at less than the full price. So – don’t say I never give you nowt! Check out the conference here or just go straight to registration here. We have some great new speakers and panelists from companies including: Sasol Reckitt Benckiser Clariant Ecover / Method IP Specialites Vespucci Locus Jiahua Godrej Arzeda ICOS Capital (invested in Holiferm) Mintel Flini Colt & Willow So register here and use the promo-code WSC21NB500 to get $100 off. Great right? Blog readers only. I’ve always wanted to say that. As always, of course, I am producing and chairing the event and we will learn a lot and have a bit of fun along the way. See you there. End of commercial. Start of some pre-news musings. I’ve spent a bit of time listening to 2 heavy metal bands this…

September 2021 - Surfactants Monthly

For Blog Readers Only

We’re starting with a commercial for the upcoming European and Asian Surfactants Conference – Online - October 26th and 27th. I have a $100 promo-code only for readers of this blog only. Just use WSC21NB500 at checkout and you get $100 off the registration. I’m told that this is now the only way to get registered at less than the full price. So – don't say I never give you nowt! Check out the conference here or just go straight to registration here. We have some great new speakers and panelists from companies including:

Sasol

Reckitt Benckiser

Clariant

Ecover / Method

IP Specialites

Vespucci

Locus

Jiahua

Godrej

Arzeda

ICOS Capital (invested in Holiferm)

Mintel

Flini

Colt & Willow

So register here and use the promo-code WSC21NB500 to get $100 off. Great right? Blog readers only. I’ve always wanted to say that. As always, of course, I am producing and chairing the event and we will learn a lot and have a bit of fun along the way. See you there.

End of commercial. Start of some pre-news musings. I’ve spent a bit of time listening to 2 heavy metal bands this past month, Diamond Head and Metallica. Who? you might ask..Ah sorry, Metallica is an American heavy metal band that achieved prominence in the 80’s and 90’s and sold a few tens of millions of records over the past few decades. Anyhow, there’s something interesting that we might learn from Metallica’s history that's applicable to our work. And it’s not what you think.

You can learn from these fellows

Let’s do this: Listen to the next two songs as I present them here (courtesy of YouTube) and then we’ll pick up the discussion after the news section. If metal is not your thing – just listen to the first couple of minutes of each song (up to where the singing starts).

End of pre-news musings. Start of the News:

First – there continues to be a lot of Hurricane Ida outage and restart developments that I will not detail here. Your best resource is the great ICIS topic page at this link. It’s updated pretty much in real-time. Check it out (subscription may be required) .

In last month’s blog we wrote about the sale by the owners of Emery of Emery’s Asia business. Some helpful readers have provided me with some more information. First the filing by Mega First Corporation – which I link here [insert link] – notes the following:

“The Board of Directors of Mega First Corporation Berhad (“MFCB”) wishes to announce that Edenor Technology Sdn Bhd (the “Purchaser” or “Edenor Technology”), a 50:50 joint venture company between MFCB and 9M Technologies Sdn Bhd (“9M Technologies”), has on 19 August 2021 entered into a conditional Sale and Purchase Agreement (“SPA”) with Sime Darby Plantation Berhad and PTTGC International Private Limited (collectively, the “Vendors”) to purchase the entire issued and paid-up capital of Emery Oleochemicals (M) Sdn Bhd (“EOM”) and Emery Specialty Chemicals Sdn Bhd (“ESC”) for a Target Equity value of RM38 million (the “Proposed Acquisition”). “

Now – the name Edenor may well ring a bell for some readers. It’s a tradename used by Emery for some fatty acids and glycerine. It is also used by KLK for glycerine. Interestingly, reading the Mega-First filing further, we learn about 9M Technologies (and I am quoting here). “9M Technologies is a private limited company incorporated under the laws of Malaysia with an issued and paid-up share capital of RM14,950,000, comprising 14,950,000 ordinary shares. Its business is in investment, mergers and acquisitions and technical advisory services. The founder of 9M Technologies is Mr. Yeow Ah Kow who has more than 35 years international experience, mostly in the leadership role in oleochemicals, edible oils and specialty chemical business and manufacturing.” So – there we have it. AK Yeow, who many of our readers know, spent a large part of his career, running the oleochemicals business at KLK, is behind the buyout. Kudos to AK. We wish him much success.

In US Ethylene Oxide, ICIS reported at the beginning of September that August ethylene oxide (EO) contracts edged lower, tracking same-month feedstock ethylene contracts. ICIS assessed EO lower by 0.80 cents/lb ($18/tonne) from the previous month. US August ethylene contracts decreased by 1 cent/lb from the previous month, on resolved production issues and lower cash costs.

Unusual to see a downward tick

The majority of EO contracts are formula-based, and price movement comprises 80% of the change in the ethylene price and an additional conversion fee, or adder. As you probably know, like ethylene, EO contracts are settled at the beginning of the month for the previous month’s price.

In addition, ICIS noted that, following Hurricane Ida, no significant damage to ethylene oxide (EO) units in Louisiana was reported. Still, producers awaited the return of third-party utilities and feedstocks, and largely have no estimate for restarting plants. The storm affected nearly 60% of US EO capacity, according to the ICIS Supply and Demand Database. In addition to significant EO capacity being affected, 18% of US downstream polyether polyol capacity and 14% of US capacity for co-feedstock propylene oxide (PO) is located in the area impacted by Hurricane Ida. This shortage could temporarily dampen demand for EO in this segment. A complementary feedstock for polyurethanes (PUR), methylene diphenyl diisocyanate (MDI), also could tighten further because of Ida, and thus could decrease demand for EO-derived polyols into PUR.

Around mid-month, Stepan, in the US, declared force majeure on surfactants-related products including ethoxylates and ethylene oxide/propylene oxide (EO/PO) polymers effective 15 September, according to a customer letter. The company cited shortages in the availability of multiple raw materials, and disrupted logistics. "Several of Stepan Company's suppliers have declared force majeure and confirmed limited allocation of their products impacting our ability to obtain key raw materials. We are working closely with our suppliers to understand their capabilities and continue to assess the overall impact on product availability," the letter said. Stepan did not immediately respond to a request for comment. The product lines included in the force majeure are: ethoxylates, EO/PO polymers, olefin sulfonates, synthetic sulfonates, synthetic ether sulfates, hard and soft sulfonates, amides, dry flowable dispersants, Chem-Specialties, phosphate esters, softeners, Sulfites-Specialties and blends containing these products.

In real life too

Around the other side of the world, ICIS’s Helen Yan reported that Asia’s fatty alcohols market may see upward price pressure from increased Chinese spot interest amid limited local supplies, prevailing logistics issues and higher packaging costs. Chinese buyers are back in the spot market and seeking to replenish their dwindling stocks due to limited domestic supplies, market sources said. “We are seeing a pick-up in spot interest from China and they are looking for December cargoes due to reduced local production output,” a regional producer said. The ongoing environmental inspections of plants in China have curbed production output, market sources said. Upward costs pressures from logistics issues, including soaring container freight rates for regional and deep-sea trades, delayed shipments and congested ports, as well as rising packaging drum costs, are also bolstering the Asian fatty alcohols market.

This is the third time I've published a graph like this..

..and it still blows my mind!

Meanwhile, China’s month-long environmental inspections of five provinces housing industrial hubs have prompted independent refineries and some plants to either reduce operating rates or shut production. [Only in China right? .. Right? ..??] On 25 August-2 September, the country's Ministry of Environment and Ecology (MEE) dispatched working groups [ carry sticks and leaving the carrots back in the office] to Jilin (northeast), Shandong (east), Hubei (central), Guangdong (south) and Sichuan (southwest), to check on the provinces' compliance with environmental regulations. China's second round of crackdown on non-compliant industries across more than 30 provinces started in July 2019. [great thing, compliance isn’t it? I mean without that, where would we be..?]

ICIS’s great Lucas Hall provided the monthly North American Fatty Alchol update as follows: US Q4 fatty alcohols contract negotiations are largely finished, against the backdrop of ongoing supply-chain disruptions in the US and southeast Asia, healthy-to-strong demand and volatile feedstock and freight markets globally. Freely negotiated contracts for mid-cut alcohols have largely been heard at a decrease from Q3. Contracts have largely been heard lower now that demand has stabilised from the panic-buying seen at the start of the pandemic, with many players having carryover volumes from Q3. Demand is typically slowest in Q4. That said, Shell's ongoing force majeure has prompted an increase in synthetic alcohols demand in the near term. Demand into Mexico has also picked up on increased ethylene oxide (EO) availability from the local producer. Shell remains on force majeure into October because of feedstock constraints, but has increased its allocation levels from September.

Freely negotiated contracts for long chain alcohols have largely been heard at an increase from Q3. Demand in these markets is largely outpacing supply amid ongoing supply-chain disruptions in southeast Asia because of the pandemic, ongoing supply-chain disruptions globally - particularly in shipping container markets - and overall strong demand in industrial end-markets.

Demand outpacing supply!?... a while since we heard that story.

Heavy chain alcohols are more susceptible to import disruptions because they are often shipped by container. A limited number of suppliers have tank storage capacity in the US to process and store heavy chain alcohols in bulk. Mid-cut alcohols are less susceptible to these disruptions, as they are largely shipped in bulk.

Prices

Q4 discussions

In mid-cut markets, freely negotiated contracts have largely been heard at a decrease from Q3. In heavy chain markets, freely negotiated contracts have largely been heard at an increase from Q3. vIn the wider market, multiple producers have switched their contract terms from a DEL (delivered) to an FOB (free on board) + freight basis because of volatile and bullish freight markets.

Mass balance (MB)

Premiums were held steady at a 7-13 cent/lb premium over standard balance material.

Q4 prices have been heard slightly above the posted range. Supply continues to tighten because of pandemic- and customs-related disruptions across the wider market.

US sanctions against Malaysian palm oil giants Sime Darby Plantation Berhad and FGV Holdings Berhad in 2020 have significantly tightened Roundtable on Sustainable Palm Oil (RSPO) MB markets since then. US Customs and Border Patrol (CBP) has denied entry to at least two Malaysian-origin vessels carrying oleochemicals over the August-September period. While the latest disruptions did not largely impact fatty alcohols availability, there is growing concern among market participants of expanding scrutiny against Malaysian-origin material as RSPO MB markets continue to tighten.

Rising premiums are making MB material competitive with coconut-based material, in turn increasing demand for coconut-based fatty alcohols. In the meantime, market players in Malaysia are working to reorganise their supply chain to avoid further disruptions, given the latest CBP action.

Customs and Border Patrol to the Rescue

Meanwhile in Asia, Helen Yan of ICIS reports that Asia’s fatty alcohol ethoxylates (FAE) market is likely to face upward pressure in the near term due to tightened supply in China following its dual control policy on environmental protection. Chinese spot interest is also expected to gather momentum ahead of the Chinese National Day holidays from 1-7 October, as buyers need to replenish their dwindling inventories.

“We are getting enquiries, and discussions are ongoing with the Chinese buyers for October shipments,” a regional producer said. Selling indications for October shipments have increased to $1,600-1,700/tonne CIF (cost, insurance and freight) China for drummed product, tracking the Chinese domestic prices and higher feedstock ethylene oxide (EO) and fatty alcohols C12-14 costs, market sources said.

More familiar upward pressure

“Local FAE prices have increased to more than Chinese yuan (CNY) 12,000/tonne ex-warehouse this week, up by about CNY500/tonne from the previous week,” a trader said. In the week ended 23 September, FAE spot prices were up $50/tonne week on week to $1,500-1,550/tonne CIF China, ICIS data showed. Feedstock fatty alcohols C12-14 spot prices rose to $1,875/tonne FOB (free on board) southeast (SE) Asia in the week ended 22 September, up by $25/tonne from the previous week, ICIS data showed. Several feedstock fatty alcohol and ethylene oxide (EO) plants in China were shut or running at reduced rates following the implementation of the dual control policy. [oooh that sounds nice doesn't it? Dual control – just like a nice safe aeroplane or one of those drivers instruction vehicles. Very safe and responsible and eviscerating your property rights – if you had any in the first place, which you probably didn't so.. ]

The dual control policy places tighter limits on energy consumption and intensity in parts of China and has prompted plant shutdowns or cuts in operating rates, raising concerns of curbed production and supply. FAE is used mainly in sodium lauryl ether sulfate (SLES), a surfactant found in many home and personal care products such as soaps, shampoos and detergents.

Relax comrade. We'll take it from here.

And in Europe, ICIS’s Sam Wright reports that European fatty acids and fatty alcohols fourth quarter negotiations are ongoing, with shortages still plaguing both markets. Most settlements are expected to take place for both products during early October. In the palm fatty acids market, some final fourth quarter contracts are being settled, although most players are fully committed for the fourth quarter and are now looking at first quarter material. In the tallow fatty acids market, negotiations got off to a slower start, as players were waiting to hear of available volumes from producers. Discussions are now underway for the fourth quarter.

Fatty alcohols fourth quarter contracts have started, and some settlements have taken place, but most are yet to conclude. Logistical issues surrounding shipments from Asia continue to be the biggest problem for both the palm-based fatty acids and fatty alcohols markets. These shipping constraints are unlikely to ease before the end of the year, with most players also bracing for tightness during the first quarter of 2022.

Tallow fatty acids shortages are still caused by lower slaughter numbers and strong tallow biodiesel demand. There is very firm demand for fatty acids and fatty alcohols heading into October, caused largely by the lack of volumes. In the fatty alcohols market, some downstream ethoxylates customers are said to be requesting six-month contracts currently, to ensure security of supply.

Worth paying up for

End of the news. Beginning of the “music section”. We’ve had the bulk of this month’s music already up front but here is part 2 of the discussion about Diamond Head and Metallica that we started above. If you haven’t done so already, go back and listen to the two songs (and if you’re not that partial to heavy metal, at least listen to the first 2 minutes of each). OK? So – Diamond Head formed in 1976 near Birmingham England and in 1980 released their first album on which was the song Am I Evil. As you have heard, it is a decent, solid, heavy rock song. Your blogger saw them live at Sunderland Poly in ’79. Pretty good. In 1984, Metallica covered the song, putting it on a B side. Over the years it became a staple of the Metallica live shows and often would the last song played. A real crowd-pleaser. Diamond Head is still plugging away today and they have had zero commercial success, nothing – which is why you’ve never heard of them. Metallica – one of the top selling artists of any genre. Interestingly Diamond Head have said that they are grateful for the royalties that have come from Metallica’s performance of the song. The money has enabled the group to keep going. Those royalties have been Diamond Heads biggest revenue source.

What’s fascinating to me is that the songs are the same. It’s not like Metallica did a metal version of an English folk song. It’s the same song in the same style played on more or less the same instruments. Except that Metallica… well it’s hard to put your finger on it. I’ll let you judge for yourself.

So – who would you rather be? No not the actual band necessarily. Think metaphorically. Who would you rather be? This is not a trick question. If you’re trying to calculate what the royalties might be, then I already have your answer. And that’s OK. Playing at the highest level every night is not for everyone. Thing is though, if you think you want to be Metallica, then having a great song, played well, is not enough. It’s all the other little things executed consistently with excellence year after year that count. Think about it.

By the way, this is not some rant about how the plucky Brits invent things and then the Americans always steal it, dress it up with a bit of marketing and make a fortune. And what can we learn? No… that old trope doesn't apply here. What about (English heavy rock band) Iron Maiden whose first album also came out in 1980? Still a multi-platinum, stadium filling, global act. Actually it’s hard to imagine anyone covering a Maiden song. I can’t think of such an instance. Of course now I’ll hear of several such covers from our avid readers. But there are definitely no well-known covers. I wonder why? Probably because there is such a high degree of originality baked into those songs. But I’m digressing. The question is who would you rather be?

If you answer Metallica only after estimating what the royalties from Am I Evil could be, then no, not really. You don't want to be Metallica. You’re not up for it. If you answer Diamond Head, while briefly thinking how cool it might be, though, just once, to fly (private) down to Rio to play in a stadium, then no. You’re wrong.