Surfactants Monthly - September 2024

September 2024 Surfactants Monthly

Promos:

We have confirmed Dr.Ahmad Parveez Bin Ghulam Kadir the Director General of the great Malaysia Palm Oil Board as our morning Keynote Speaker in KL. You will not want to miss this. The entire surfactant value chain will be there also (of course). November 20 – 21 (Training on the 19th)

Register here: https://events.icis.com/website/14105/home/

Take some time out while you’re there.

The News

Macroeconomics:

From our friends at Nomura Greentech, Investment Bankers:

• In August 2024, the S&P Chemicals Index was up 3%, the S&P Commodity Chemicals Index was down 1%, and the S&P Specialty Chemicals Index was up 3% on the month - this compares to the overall S&P 500 which was up 2% on the month.

• On a 2024E TEV / EBITDA multiples basis, in August 2024, the S&P Chemicals Index was up 0.3x from 12.3x to 12.6x, the S&P Commodity Chemicals Index was flat at 7.6x, and the S&P Specialty Chemicals Index was up 0.4x from 13.7x to 14.1x

• YTD 2024 versus YTD 2023, M&A volumes in the advanced materials & chemicals sector were off (23%) on a number of transactions basis and off (20%) on a transaction size basis.

On the feedstock front, ethylene and polyethylene are up 8% and flat respectively on the month at 29 c/lb and 50 c/lb.

And in veges, corn and soy are down on the month by 3 and 5% at $3.70 and $9.60 a bushel respectively.

Something we don't look at that often

Ok so this may be the first mention of a bushel in over 10 years of the blog, so in celebration here’s this. It’s not the original (Google tells me) but ..

Overall, Nomura is painting a broadly optimistic macro picture with cooling inflation, albeit above the Fed target, continue rate cuts, decent S&P 500 earnings growth, lowered volatility and an IPO pickup. Me, I’m not so sure. The election results matter, but maybe the markets have already priced a certain result in? Beyond my pay grade to speculate on that one.

This detailed trading multiple chart is one we like to visit occasionally. If you open it in a separately in a new tab and magnify, you should be able to read it in detail. Some food for thought:

I know we have discussed this concept: But I still like to consider - how is it that a dollar of EBITDA at Ecolab, a formulator of surfactants is worth more in terms of Enterprise Value than a dollar at the following companies by the indicated percentage?

Croda, a manufacturer of surfactants 38%

Stepan, a manufacturer of surfactants 107%

Henkel, a formulator of surfactants (with some cool brands) 159%

Brenntag, a distributor of surfactants (and other things) 186%

Syensqo, a manufacturer of surfactants 247%

Fascinating right?

Hey – if you have a large-ish business to sell, finance or buy and would like a warm intro to Nomura, just drop me a line.

By they way, I got a slightly different macro read at an Societe de Chimie Industrielle in NYC recently. Speakers from ICIS, Young and Partners, DC Advisory and American Securities all opined on the state of the chemical industry and M&A in particular. Specialty demand is weak and therefore deal volume is weak. China especially is a concern due to weak demand. Europe is however, also very bleak.

US ahead of China and Europe...

Other News:

The great HAPPI magazine noted this month that Branch Basics has added a new laundry detergent powder. It is free of 1,4-Dioxane, phosphates, sulfates, VOCs, optical brighteners, fragrance and dyes. Branch Basics says it tackles tough stains and odors while brightening whites and enhancing colors. The biodegradable formula contains protease and amylase for stain and odor removal; sodium carbonate (48% of formula) for anti-redeposition; sodium lauryl sulfoacetate and poly (itaconic acid co-AMPS) sodium salt to lift and remove stubborn stains; and TAED (4% of formula) paired with sodium percarbonate. And I might have just it left it there except I clicked the link to the company page. There I learned about the founders, most of whom by the way, have astonishingly good teeth, although this is not an oral care company. Anyway it seems that the group between them endured an incredible run of poor fortune, followed by redemption. One of the founders (Let’s call her Founder 1), at age 23, avoided a kidney transplant using food as medicine, then later, her 10 year-old son was chemically injured by pesticides and doctors said his brain and immune system damage was irreparable. Founder 1 refused to accept that diagnosis. And nursed him back to full health after removing all harmful products from his diet and environment. [According to the accompanying photograph, the son later joined the Navy]. In high school Founder 2 was diagnosed with PCOS (I googled this. It’s Polycystic ovary syndrome, or polycystic ovarian syndrome (PCOS), and is the most common endocrine disorder among women of reproductive age) and she suffered chronic, mysterious pain through college. After years of seeing medical specialists and a laundry list of drugs, Allison was desperate for relief and turned to her Aunt (Founder 1) in the Texas Hill Country. After two months at Founder 1’s home, eating only real food, using safe products, and staying in a healthy home, her life was transformed. Founder 2 was free of pain and got her life back! Eventually her ovarian cysts disappeared, and she was able to get pregnant naturally...three times! Finally Founder 2’s best friend, Founder 3, joined her for the summer at Founder 1’s. Founder 3 was generally healthy, but by the end of the summer even “normal” complaints (painful menstrual cramps, dry eyes, headaches) completely disappeared. And so the 3 decided to start the company. Now, lest you think I have paraphrased what I found into some sort of parody, you can see from the site, these are all direct quotes with just the names disguised as my intent is not to embarrass anyone. I guess I put it all here for you to think about and ask the question. Have we reached peak – whatever this is? Or is there more to come? Please opine if motivated.

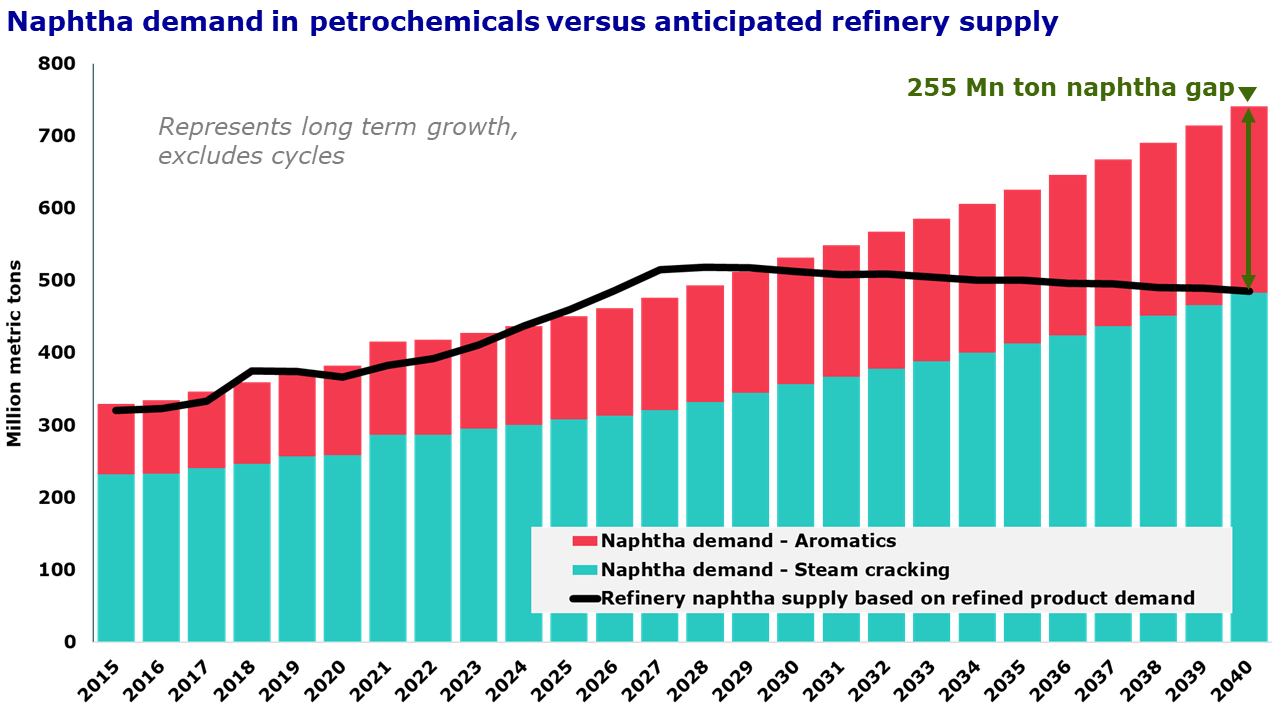

As makers, users, consumers of surfactants, we have to keep an eye on feedstocks – yes, all the way to the back of the supply chain. This piece on Linkedin by Paul Bjacek of Worley Consulting is worth a read. He predicts a naphtha refining gap impacting aromatics availability (Benzene for LAB included) in the coming 15 years. The key point is made in the chart below:

Mind the gap !

Paul goes on to recommend 5 things to do for the industry to address the issue:

· Many refineries do not currently extract BTX from naphtha. There is an opportunity to tap these resources, especially in high aromatics growth regions, like Southeast Asia.

· Crude oil-to-chemicals (COTC). The current global average of petrochemicals from crude oil refineries is about 10-12%. CTOC uses mainly conventional technology to almost flip this ratio. However, this may only make sense for a subset of refineries/locations.

· Advanced recycling. Up to 40% of plastics or 400 Mmtpy of capacity by 2040 are targeted for recycling. While there are complications with logistics and contaminants, recycling issues should be solvable.

· Alternative processes using other available hydrocarbons (like gases, C6-C8 molecules, etc.) to aromatics, such as Cyclar or Aromax.

· Other modifications/reconfigurations to existing refining operations to improve petrochemical yields.

The great HAPPI magazine also published a surfactant market update, in which I was quoted extensively. So take a read. My favorite quote is as follows: “It’s not that bad!” said Neil Burns, founder of Neil A. Burns, LLC. For more context on that one – read the article.

Kinda like the blog

HAPPI also had another interesting publication this month. Beauty IO. Favorite quote from that one? “Less is more for consumers who have grown weary of questionable chemicals and long ingredient lists” Think about it.

End of meme gifs

We had a number of big stories in the FT and WSJ this month about some big surfactant related companies. First a couple on Unilever:

An article titled “Unilever’s sustainability rethink cheers investors but unsettles staff” says it all. Of course the staff could be unsettled because a third of them in office jobs in Europe will be laid off; it’s not clear. Anyway, the article notes the previously announced walking back of various sustainability targets. After five years with the stock on a downward trend because of worries about financial performance and questions from some about whether Unilever had become too focused on sustainability, the shares have been in recovery since January as new plans have taken shape. This is under the new CEO and, let’s not forget a new board director, subject of another FT article.

In an article entitled in part “Peltz banks gains from Unilever” the paper relates how new director and so-called activist investor sold a bunch of stock to realize gains from the aforementioned run-up in price. I wonder how the laid off workers feel about that? Pretty bad I expect. But where should their anger be directed?

Spending daddy's realized gains. And actually that is not fair as the lass has her own gains from her own avocation. Lot of work, don't you think, to justify this photo?

Next up BASF. One of the largest surfactant companies in the world is having a really tough time this year. The FT noted in a headline that BASF slashes dividend amid worsening German industrial gloom. BASF shares have lost a third of their value since the start of the war in Ukraine and the stock fell just recently in reaction to a dividend cut. The article notes the company plans to list separately is Ag unit and consider for sale its coatings business. Could Care Chemicals also be on the block? I don’t know, obviously, but if folks are interested, now is the time to have that discussion. The WSJ has a similar article but speculates a little further about possible spinouts. Separately, BASF announced it is selling its interest in Wintershall DEA’s exploration and production business to Harbour Energy.

Many flags. Still one company.

And Evonik. The FT published a profile of CEO Christian Kullman and it mentions Rhamnolipids. How cool is that? Well, OK not that cool in absolute terms but in my world these days, yeah – kinda cool. The overall article was interesting for a number of reasons. I can’t quote the whole thing because the more popular this blog has become, the more copyright holders are reading it as well as you. But here’s a few quoted snippets. If you are a FT subscriber, it’s worth reading it all. There are some fascinating elements to it – not necessarily surfactants related - that are interesting - and the comments section has some good discussion.

• He gets up at 6.00AM and has breakfast with the family. (But often has dinner meetings that can stretch into the night hours, which might mean a not-so-early start.)

• Europe will lose in the next 15 to 20 years some 25 per cent of chemical production,” he predicts, due to the cost advantage non-European producers have on low-margin products made from oil.

• Here’s the Rhamnolipid bit. He says there is a“significant opportunity” for European companies to move towards higher-value and greener chemicals. Rhamnolipids, biodegradable active ingredients in soaps, are an example of a “brand new market” Evonik has opened..

Cool Soap...

In a not specifically relevant article to surfactants, The WSJ reports on Saturday, that “Having a Politically Partisan CEO Can Lead to More Company Misconduct..” “It boils down to an elevated sense of self-worth and a degree of entitlement,” says Thomas Fewer, an assistant professor of strategic management at Rutgers University and the paper’s lead author. He says people with strong political convictions tend to have an “us versus them” mentality that discounts the opinions of others, as well as an unwarranted sense of moral superiority. “They grant themselves a moral license,” through which they rationalize bad behavior, he says. Something to keep an eye on.

More controversy surrounding EUDR

Again in the FT – Indonesia warns of Chaos from the EU deforestation law. “There will be chaos if implemented,” Eddy Martono, chair of the Indonesian Palm Oil Association said. There are some EU member states that oppose the law because of the administrative burden it places on importers. If the law comes into force at the end of the year, Indonesia’s shipments to the EU could fall 30 per cent, he said. Indonesian producers shipped 4mn tonnes of palm oil to the EU in 2023. There are serious challenges in data handling. A single sales order of one product could involve multiple batches from refineries, mills and plantations, resulting in millions of data points for a single shipment.

Politico reports more high profile concerns about EUDR within the EU itself. None other than German Chancellor Olaf Scholz wants to postpone new EU rules. Scholz told a conference on Thursday in Berlin that he had discussed the EU Deforestation Regulation with European Commission President von der Leyen and “advocated … that the regulation be suspended until the open questions raised by the BDZV [German digital and newspapers publishers association] have been clarified.” In March, the publishers’ lobby wrote to the German government and the Commission criticizing “impractical requirements” and a “drastic bureaucratic burden on companies.” It asked the Commission to “mitigate the risks, sanctions and burdens” created by the new law, which is set to apply from Dec. 30. Now, I’m not sure how or why this publisher’s group got involved. Is this the press somehow doing its job under a united front (not sure I like that, by the way) or is there some enlightened self-interest. Can someone opine?

We’ve written a lot about Tide Evo and don’t worry were not doing so again here but it’s worth mentioning there is other activity in the waterless sheet laundry category. Venus Laboratories of Cypress, CA sells them and was just granted a US patent for a laundry detergent sheet comprising a water-soluble matrix with a solidified polymer mixture. It contains a detergent component, bound and suspended by the water-soluble matrix, of ionic and non-ionic surfactants; 0.2%-5% enzymes selected to break down certain molecules on soiled laundry; and activated charcoal that is comprised of particulate carbon having a porous exterior surface and an average surface area of at least 950 m2/g. it’s not for sale on their website yet, but other sheets are. Some of the marketing’s a bit iffy – e.g. Featured Ingredient – Coconut - but the actual ingredients listing and table is pretty solid. Here’s the listing: Water (solvent), Polyvinyl Alcohol (polymer), Sodium Lauryl Sulfate (plant-derived surfactant), Kaolin (mineral-based builder), Caprylyl/Capryl Glucoside (plant-derived surfactant), Silica (mineral-based builder), Cocamidopropyl Betaine (plant-derived surfactant), Glycerin (plant-derived solvent), Sodium Citrate (plant-derived water softener), Cocamidopropylamine Oxide (plant-derived surfactant), Phenoxyethanol (preservative), Dimethicone (polymer), Saponins (plant-derived surfactant), Citric Acid (plant-derived pH adjuster), Protease Enzyme Blend (enzyme stain remover). You can check the table out on the website. And nary a mention of miraculous cures in the Texas hill-country. And, you know, I kinda like the idea of activated charcoal, having spent some time working around aroma chemicals.

Some people put it on their teeth (Charcoal not Laundry Detergent!)

By the way; not sure if this relates to Evo but P&G announced it will invest $96.7 million to install new advanced production lines and increase production capacity at its Rapides Parish facility, according to a press release issued by Louisiana Central, the area's economic development agency. Construction is expected to take place over the next two years. The facility has produced fabric care products for P&G brands since 1969, including the laundry detergent brand Tide. In 2012 the facility was one of the first to produce Tide Pods. Someone can chime in if they like..

In other laundry news. Ewing, NJ -based Church & Dwight Co. on Tuesday announced a CEO transition plan. Richard Dierker, a 15-year company veteran, will be elevated to CEO and president, effective March 31, 2025. Current CEO Matthew Farrell will continue in his role until then, and remain as chairman of the board for a transition period.

Speaking of iffy marketing; apparently Dawn (sorry P&G) has enlisted Jennifer Hudson for its new campaign, with the actress, singer and talk show host starring alongside animated ducklings for the P&G dishwashing liquid brand. Midway through the ad, she’s greeted by a pair of talking animated ducklings – who appear to believe her name is “Jennifer Sudson.” Hmm, I dunno man...

I like this:

I’ve written ab out Potion.ai here before and I will probably continue until every blog reader is using their free and incredibly useful formulating tools. A recent upgrade, still in beta, allows you to analyse to extent to which any formulation meets the requirements of a range of lists such as Credo, Target etc. Incredibly powerful. Check it out.

AI checks twice

Now to the market news:

LAB and LAS:

The US market saw continued softness price for LAB to around USD 1,950 per MT . Prices in the rest of the world were mixed and remained below that in the US as is usually the case.

Spot prices for LAS in Asia down slightly to – USD 1,160 – 1,300 per MT

Ethylene, EO and Ethoxylates:

EO in the US: Prices continue to firm to 72c/lb due to supply disruptions and solid demand

EO in the EU : still soft on weak demand to around 1,410 per MT.

In Asia, Ethoxylates are still trading at unusually low levels

Detergent Range Alcohols:

Reminder. We’re talking here about alcohol’s in the carbon chain length range 12 – 18, regardless of provenance – means they can be petrochemical, oleochemical or other (that would be coal mainly)

In Asia –Mid-cuts supply seems to be constrained and pricing being forced up – above the ethoxylate price. This seems to be anomalous and reader input is solicited.

A portion of the US fatty alcohol market is served by import and freight disruptions through the Middle East are being felt. Freight rates and lead times are going up. Nonetheless demand continues week and prices are trending lower. Mid-cuts are moving around USD 1,800 - 1,900 per MT.

In Europe, a similar story, but weaker demand and downward pressure.

AI Corner

Whilst perusing my well-thumbed copy of Vekst Frederikstad magazine, I was pleased to notice a story featuring one of our favorite companies, Unger Fabrikker. In an article entitled Slik bruker bedriftene kunstig intelligens – the company describes how they used AI to help reduce process waste and to optimize drying conditions. As readers may know, dry products like NaLAS and SLS are a key area for the company.

For something more technical and for one of the best titles for a recent AI / Chemistry paper, I refer you to SmileyLlama: Modifying Large Language Models for Directed Chemical Space Exploration. Essentially supervised fine-tuning (SFT) of Llama (that’s Meta’s foundational LLM, largely open source) yields a model, SmileyLlama, with the ability to generate drug-like molecules that have properties specified in a prompt. The authors demonstrate that they can train an LLM to respond to prompts such as generating molecules with properties of interest to drug development. This overall framework allows an LLM to not just be a chatbot client for chemistry and materials tasks, but can be adapted to speak more directly as a Chemical Language Model which can generate molecules with user-specified properties. To me that’s cool as it represents a much more user-friendly way of getting AI enhanced synthesis power within reach of the bench chemist. BTW – the paper has 6 authors which, per our discussion last month, seems reasonable.

There are literally thousands of stock images of a smiling Llama and I didn't want to pay to license one so I went with this. You’re welcome.

Biosurfactants Update: I think I might have mentioned last time, that I have an article coming up in HPC Today on the state of the industry in biosurfactants and in there, list 26 companies that purport to make biosurfactants (via fermentation). Imagine my horror upon taking delivery today of the aforementioned HAPPI magazine and seeing the cover-wrap ad for one SC Group, who I did not list, claiming to be making sophorolipids in China. So – 27 maybe.

Ethylene Oxide Updates: My newsfeeds are picking up so many items about EO monitoring and discussion at council meetings and so forth, that I’m just going to put the links here and will refrain from commenting unless I see anything unusual. Oh – and I’m skipping all those mentions relating to food contamination with EO in Asia.

Things looking up in India as Moneycontrol reports that Shares of Galaxy Surfactants rose over 8 percent on September 16 to hit a 52-week high of Rs 3,325 on the [Indian] National Stock Exchange (NSE), driven by high volumes. The company reported a net profit of Rs 79.7 crore ($9.5 Million) in the quarter ended June 2024, up 6 percent (YoY). and EBITDA margins at 13.2 percent remained stable. The company's revenues at Rs 979.5 crore ($117 Million) grew 3 percent on-year. After the Q1FY25 earnings report, K. Natarajan, Managing Director, Galaxy Surfactants said that there are visible signs of improving demand.

Looking up in India

Music Section

At a dinner recently, the subject of Muscle Shoals (Alabama) came up. It is of course a famous music destination and the home of some legendary recording studios. So what better excuse for some cuts that I’m pretty sure we have not featured in our blog’s long history (so - no Rush here if that enables you to stop reading).

Now look, YouTube tells me these songs were recorded in Muscle Shoals. I did no further due diligence on the claims. If you have additional information, you know how to get in touch.

First up Bob Seger – Not bad right?

Etta James – absolute legend!

Percy Sledge – a true classic

Black Keys ? Never really a fan but some good stuff

That old Scottish crooner

This one – apparently. Not bad at all

And of course, you think I’d forgot this one? A few strained necks and eliminated braincells back in the day.

I don't know this guy:

Duan Allman - I know this guy.

Who have I missed?

That’s it for this month! Get signed up for the Asian Conference now. See you there in KL - November 20 – 21 (Course on the 19th).