Surfactants Monthly - April 2024

April 2024 Surfactants Monthly

Quick Promos :

We have freed up a batch of additional delegate places for our May 9 – 10th Conference on the top floor of the Jersey City Grand Hyatt. You can register here and the full agenda is here.

The entire event is fueled with a supercharge of focus and mindfulness delivered in a kick-off seminar (included with the price of admission to the conference) by legendary coach and transformational retreat leader, Nicole Smith-Levay. This is a first-of-its-kind session at one of our conferences, which should not be missed.

Our closing session is also a first. A detailed, live on-stage interview with a transformative leader; David Plimpton, CEO of Inolex. Learn about his personal journey in our industy and about the company’s over 100 year history. His unique perspectives will make for a fascinating look at one of our surfactant world’s great success stories. Don't miss it.

Don’t worry you’ll actually have a chair - and table, probably.

The News

The investment bank, Evercore, publishes a periodic review of the macroeconomics of the chemical industry. It’s worth getting on their list. Some key points from the latest issue:

The US economy showing signs of robust growth, including increases in state tax receipts and PMIs (Purchasing Managers Indexes), S&P earnings estimates for 1Q, bank loans and deposits

U.S. payroll employment increased with sustained job gains averaging 276,000 over the past three months

The Baa spread turned positive, reflecting investor confidence

Hence Evercore ISI analysts are pushing out their recession forecast from 3Q to 4Q 2024

The global composite PMI bounced to a nine-month high of 52.3 in March

India continues to grow with a 16-year high Manufacturing PMI in March, on the back of stronger growth of new orders, output and input stocks and renewed job creation

Evercore ISI US Company Surveys fell slightly from 51.3 to 51.1 after improvement in March due to event shopping around Easter, better weather, and catch up in tax refunds. ( I Googled around a big to find out what this means. Apparently, according to a 2018 article in Medium it is “a term …. to describe a sector transformation in which the physical retailer is recast as an entertainment platform to make shopping more attractive, easier, engaging — simply more fun than online!” Example? Well according to the article, Harvey Nichol has “…created an amazing space to host a calendar of experiences — not necessarily retail led — from wine tastings to gin workshops, supper clubs and fashion shows. We think our new Sunday School will prove popular, starting before the store opens, we’re going to help customers make the world a better place — early topics include sustainability in fashion and vegan cosmetics. We’re calling this retail theatre!”. Ugh so this sounds ghastly to me and something I would pay handsomely to avoid. But I guess I’m not the demographic they’re after.

Improvement seen in 1Q24 across both Europe and China Sales Surveys also supported by improvement across Manufacturing PMIs

Chemical companies' inventories were broadly too high in 2Q23 but have now fallen to “about right”

The Evercore ISI US Trucking Companies Survey held steady at 43.8. After finishing the 1Q a little stronger, 2Q is beginning a little softer. While still depressed the survey is showing signs of stabilization

China Real GDP growth at +5.3% y/y in 1Q24, vs. consensus +4.3% and Evercore ISI forecast of +4.5%

I was struck by this chart on trucking. Does it surprise you?

Looks quite strong right?

Ah .. ok, wait a sec. This graph puts it in context. Not the x – axis. (gotta pay attention to the axes and scales !). Makes more sense right ?:

Always pay attention to the scales and axes !!

Evercore notes that “While still depressed the survey is showing signs of stabilization with destocking largely behind us.” OK then.

The letter ends up with a survey of trading valuations for chemical companies. Here’s the composite. Look at the ranges! That always fascinates me.

Huge ranges right? A dollar of EBITDA is not just a dollar…

Here’s some 2023 EV/EBITDA Trading Multiples for companies that may interest you.

Interesting right?

We don’t often write about the Japanese consumer product and chemicals company, Kao here, but I got a press release that talks about a major new investment in the US. And it reads, part:

Kao Corporation has decided to build a new tertiary amine production plant in Pasadena, Texas, United States, mainly to meet growing demand for sterilizing/cleaning applications but also for wide range of other industrial applications.

.. Kao has the world's largest production capacity [of tertiary amines][ with three production sites in Japan, the Philippines, and Germany.

By establishing a new production plant in the U.S., Kao will strengthen its stable supply system for the U.S. market, which is expected to grow in the mid- to long-term. ..The new U.S. production plant is scheduled to begin operations in January 2025 and will have an annual production capacity of 20,000 tons.

About Kao :

.. Through its portfolio of over 20 leading brands such as Attack, Bioré, Goldwell, Jergens, John Frieda, Kanebo, Laurier, Merries, and Molton Brown, Kao is part of the everyday lives of people in Asia, Oceania, North America, and Europe. Combined with its chemical division, which contributes to a wide range of industries, Kao generates about 1,420 billion yen (almost US$9 Billion) in annual sales. Kao employs about 33,500 people worldwide and has 135 years of history in innovation.

Yep - It’s Pasadena

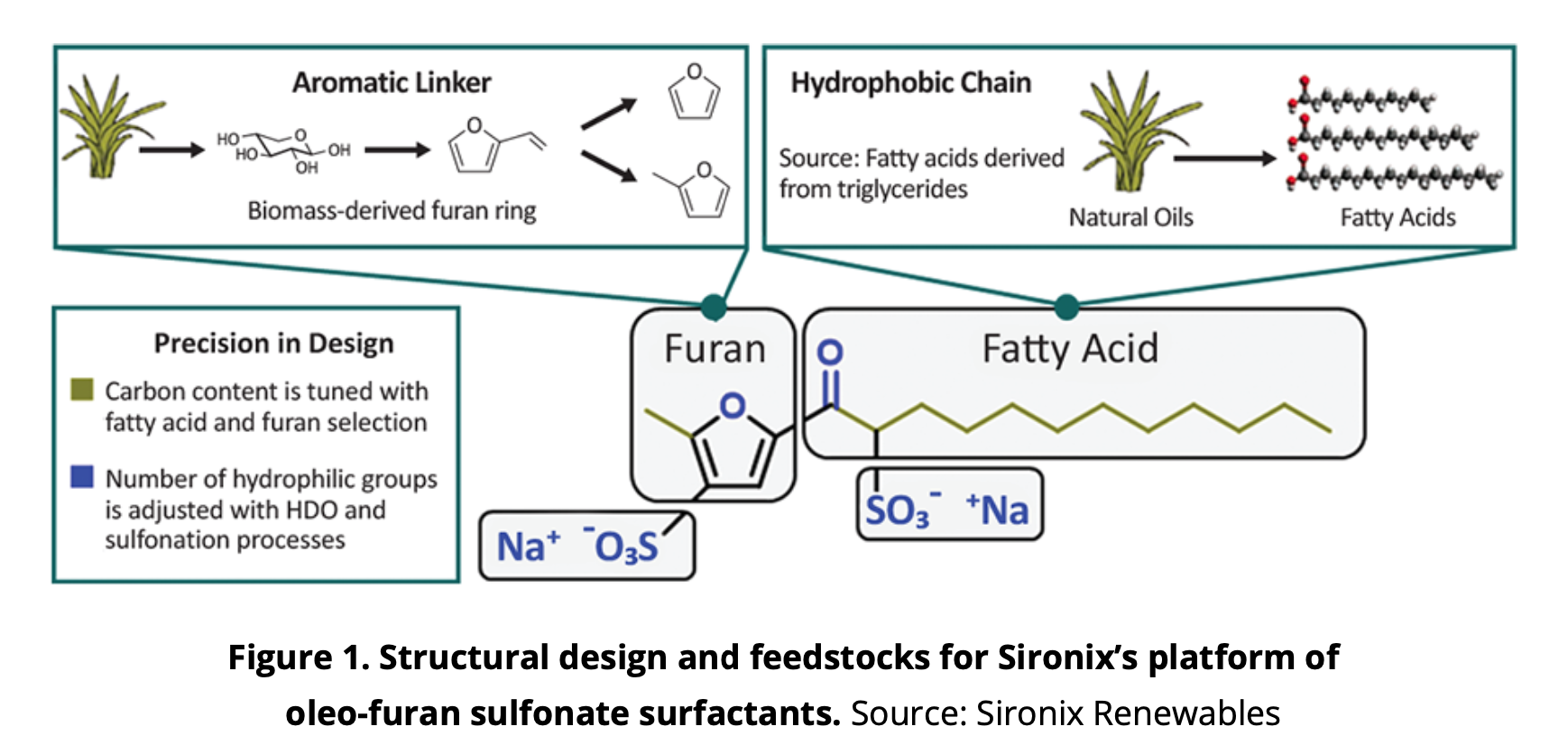

Sironix: It’s been a while since we have written about them also. They had an article in the great INFORM magazine (from AOCS). As a reminder they are building a surfactant platform on oleo-furan sulfonates. This graphic gives you a good sense of what they are:

They’re tunable

The most interesting piece of news however, is that Sironix has developed fully functional personal care product prototypes featuring their OFS surfactants in popular product brands. They are currently working with an established personal care, consumer packaged goods company to rollout the OFS surfactants known as Eosix®. In contrast to ether sulfates, OFS surfactants can be produced as 100 percent active solids, allowing Eosix® surfactants to be shipped in a lightweight format, decreasing costs and carbon emissions. This also facilitates the use of OFS surfactants in water-free personal care product formulations, providing opportunities for refillable personal care products like Blueland® [we wrote about them a couple of blogs ago], reducing consumer reliance on single-use plastics [not sure if this means that Sironix is going to be marketing consumer products or that they are going to so a sort of “Sironix Inside” kind of deal with a CPG company. Let’s see. Exciting stuff either way]

More trouble in EO-Land. I first read it in an article in the AP (Associated Press). Here’s the link. More than 200 chemical plants nationwide will be required to reduce toxic emissions that are likely to cause cancer under a new rule issued early April by the Environmental Protection Agency. The rule advances President Joe Biden’s commitment to environmental justice by delivering critical health protections for communities burdened by industrial pollution from ethylene oxide, chloroprene and other dangerous chemicals. When combined with a rule issued last month cracking down on ethylene oxide emissions from commercial sterilizers used to clean medical equipment, the new rule will reduce ethylene oxide and chloroprene emissions by nearly 80%, officials said.

It looks pretty serious for anyone using or making EO. There is a lot more information on the EPA website, which I encourage you to study. A number of the pdf’s are intended to sell the regulation to the press. However, one provides the full text of the rule and another some good key points, some of which I reproduce here:

· EPA’s final rule requires plants to conduct fenceline monitoring if any of the equipment or processes covered by the rule use, produce, store, or emit EtO, chloroprene, benzene, 1,3- butadiene, ethylene dichloride or vinyl chloride. Fenceline monitoring is used to measure levels of pollution in the air around the perimeter of a facility.

· The fenceline monitoring provisions of the rule require owners and operators to ensure that levels of these six pollutants remain below a specified “action level.” Fenceline monitoring provides owners and operators the flexibility to determine what measures to take to remain below the action level, while ensuring that they are effectively controlling toxic air pollution.

· For each chemical, if the annual average concentra�on at the fenceline is higher than theb “action level” for the chemical, owners and operators must determine the cause and make necessary repairs. The monitoring requirements include procedures that account for background levels of the six air toxics.

· The final action levels vary depending on the chemicals and type of source emitting them. For EtO, EPA is issuing an action level of 0.2 micrograms per cubic meter of air.

There is a list of facilities covered here. You’ll see some familiar names on there.

Finally – you should know that the American Chemistry Council has a EO group and resource page. Worth checking back often.

Finally, finally: This issue has reached the mainstream press – “Biden admin facing legal challenges after declaring war on chemical industry” .

Say it again..

In Biosurfactant news: I talked about this in one of my YouTube videos (the one from In-Cosmetics that got 4,000 views, actually – still not sure why), but it’s worth repeating here..(here is the press release)

AmphiStar secures €6 million to launch eco-friendly and cost-effective biosurfactants derived from waste

Ghent, Belgium - European Circular Bioeconomy Fund (ECBF), Qbic III and Flanders Future Tech Fund (FFTF) have joined forces to provide a significant boost to Ghent-based start-up AmphiStar. The funding round, led by ECBF, raised €6 million. This will allow AmphiStar to accelerate the industrialization of its biosurfactants range and strengthen its team. To manage this accelerated transition, Pierre-Franck Valentin joined the team as CEO. As AmphiStar gears up for full commercial deployment, the company is laying the groundwork for future expansion with plans for the construction of a 1.000 tonnes (100% active) per annum launch plant.

Waste derived biosurfactants to revolutionize sustainability in everyday products

Surfactants play a pivotal role as functional components in numerous products in our daily lives, ranging from shampoos to toothpastes, cosmetics, inks, paints, agrochemicals, food and feed and even construction materials. Over 20 million tonnes of surfactants are produced every year, of which the vast majority are relying heavily on unsustainable fossil- and/or palm oil feedstocks and are produced using harsh traditional chemical manufacturing processes.

AmphiStar is revolutionizing the surfactant market by introducing microbial biosurfactants produced from locally sourced waste- and side- streams from the agri-food industry, such as supermarket food waste. These innovative, circular biosurfactants do not compete with food production nor do they directly impact land use. Moreover, mild and safe biological processes similar to brewing beer are applied for their production. AmphiStar offers a comprehensive portfolio of biobased, biologically produced, and biocompatible glycolipids, such as sophorolipids, to brand owners of cleaning- and cosmetic products seeking genuinely sustainable, high-performing, and affordable alternatives. These biosurfactants come in various forms and purities, serving as perfect drop-in replacements for existing formulations while significantly reducing the carbon footprint of finished products. This is only the start as AmphiStars’ biosurfactants have the potential to be used in many different markets and applications using surfactants as such revolutionizing an entire sector.

Investment accelerates market penetration of new biosurfactant generation and fuels Amphistar’s expansion plans

The infusion of €6 million in new capital from ECBF, Qbic III and FFTF will empower AmphiStar to kickstart commercial biosurfactant production in collaboration with external partners. The investment will also be used to enhance R&D efforts to further refine and optimize its biosurfactant platform, complete the regulatory and certification dossiers and engineer its own state-of-the-art production facility. AmphiStar will raise more funding in 2025 for construction of the production facility and plans to hire 15 new employees within the year to bolster its expansion efforts.

AmphiStar, a pioneer in waste based biosurfactants

AmphiStar, established in 2021, is a spin off company from Ghent University and the Bio Base Europe Pilot Plant. The company builds on over 15 years of world class deep tech research and scaling expertise and has a strong IP base. The company is considered as one of the world references and pioneers in this field and is run by a strong team with a broad complementary skillset, including industrial and start-up experience, synthetic biology, process development, scale up, formulation and commercialization.

CEO with experience in surfactants and chemical industry

Last but not least, AmphiStar was able to attract an experienced business leader to strengthen the team. Pierre-Franck Valentin has 25+ years of business experience in the surfactants and chemicals‘ industries and will join the team as CEO. His experience and network will allow the company to speed up its market traction and fulfill its ambitions to become a world leader in the (bio)surfactant space.

Sophie Roelants, AmphiStar: “AmphiStar will revolutionize the surfactant market. We have developed a unique platform technology and are the only company in the (bio)surfactant space successfully combining a set of different key technologies: waste- and side stream technologies, synthetic biology, bioprocessing, purification and scaling expertise. With this capital injection and extended support of these prominent investors we will bring our unique waste based biosurfactant products to market and aim to make biosurfactants mainstream. We have had a first market introduction of one of our waste based biosurfactants with Ecover last year, showcasing the performance, safety and sustainability of our waste based sophorolipids. We are looking for more sustainable partnerships and are open to collaborate. We are also looking for enthousiastic new talent to strengthen our team.”

Jowita Sewerska, Investment Director European Circular Bioeconomy Fund (ECBF): “There is a clear market need for a better biosurfactants’ offer from the producers – in terms of performance, sustainability and price points. AmphiStar has great cards to play here and is now at an exciting point of accelerating the commercialization of its products.”

Sofie Baeten, Managing Partner Qbic III: " As an early supporter of AmphiStar, we are thrilled to continue our shared mission of driving sustainable innovation. Leveraging over 15 years of cutting-edge research at Ghent University, AmphiStar’s technology enables the cost-efficient and ecological production of biosurfactants from renewable feedstocks, advancing the transition to a circular economy. We proudly support their efforts to drive a greener, bio-based industry, and look forward to the impactful outcomes of our collaboration in shaping a sustainable future.”

Vincent Hebbelynck, Business manager FFTF: “This round financing will enable to further develop the promising sustainable technology of AmphiStar, originating in Flemish universities and research organisations, towards broad market adoption. It hits the sweet spot of the investment focus of Flanders Future Tech Fund.”

I wish the company much success and – of course – you will hear more from them in person at our conference in Jersey City. \

Mega - Congrats to Sophie. Been at this a long time..

Bio Mass Balance continues to make an impact on the supply chain – at least in terms of product offerings from major companies. I realise a number of you curl your lip at the concept (that’s not a good thing, by the way. It’s kinda like a sneer) but my sense is that many of the publicly proclaimed sustainability goals will not be achievable in the the near term without it.

Grr.. BMB..

So BASF has launched a range of products based on the Biomass balance concept, called Ecobalanced. There are a number of surfactants in there. You can see the list on this page along with some pretty good explanatory material.

I was sorry to read about the final demise of The Body Shop in a range of newspapers. They were way ahead of everyone else in the world in the natural trend for personal care products. Cosmetics Business had a pretty good summary of the matter: The final nail in the coffin was running out of money (isn’t it always?). The company’s owner Aurelius Group failed to secure new funding, according to reports in The UK Daily Telegraph Aurelius purchased the British beauty brand for £207m in November 2023 from Brazilian cosmetics giant Natura. HSBC, the company’s bank, withdrew its line of credit following The Body Shop's sale which contributed to a shortfall of at least £100m, according to The Telegraph. The financial gap is said to have caused the 48-year-old brand to fall into administration in February just three months after the purchase. HSBC gave The Body Shop at least 18 months’ notice following its withdrawal, during which time Aurelius did not secure new funding for the business. However, a source told The Telegraph that Aurelius was never made aware of HSBC’s decision to stop lending and only discovered the extent of The Body Shop’s financial troubles after completing the acquisition in January 2024. “Following completion of the sale, the company was informed by its bankers that they intended to cease providing banking facilities,” stated documents released by The Body Shop’s administrators FRP. The Body Shop was subsequently cut off from tens of millions of pounds of credit, which was said to result in a “substantial unplanned cash outflow from the business”. “These events combined gave rise to a forecast peak funding requirement for the company in excess of £100m, significantly greater than the requirement identified as part of the acquisition process,” added the administrators.

“The substantial difference between the anticipated funding requirements and the reality of the company’s position, combined with the business’ poor trading performance, meant the shareholders could not commit to the required level of funding.”

The news follows claims that millions of pounds were taken out of the business before its collapse into administration, which FRP is currently investigating. The Body Shop’s downfall has seen the retailer shutter 197 stores across the UK, resulting in approximately 489 job losses.

[I suspect this is not the end of the story. I find it incredible that Aurelius was surprised by the pulling of the credit as this would have been one of the first things covered in due diligence before the purchase.]

Happier days..

Sugar-based Surfactant Optimizers: Not sure we have written about this type of thing, but I got some unsolicited information from a company called Paramount Minerals and Chemicals Limited of India. The tout a new product, Dolobul, as a Bio-based polyols based surfactant that optimizes the cost of laundry detergent formulations by reducing surfactant percentage and eliminating acrylic polymers. In a technical bulletin, the company claims (among other things):

· Substantial reduction in LABSA and Non-Ionic surfactants like Alcohol Ethoxylates usage in detergent formulation up to 50%

· Elimination of Acrylic Polymer/Copolymer without sacrificing detergency, in fact with Dolobul AF you are getting relatively increased detergency

· Reduction in the quantity of Sodium Carbonate (Soda Ash) required in the formulation as LABSA would be reduced and lesser quantity would be required for neutralization.

I have no personal experience with the product or the company. However the materials look interesting. If you want to learn more, you should get in touch with the company directly.

Speaking of innovation, there was an excellent article in C&E News, titled Biomanufacturing isn’t cleaning up chemicals, written by Matt Blois. The basic thesis of the article was – a lot of promise, but very few actual results. It goes back to the first wave of efforts from companies like LS-9, Amyris and Solazyme. A tremendous chapter heading reads “Fermentations Graveyard”. The article then goes on to outline current efforts by companies like Geno (who owns the legacy assets of LS-9 and who seems to be taking a run at commercialization of the technology via a subsidiary, Future Origins) and Lanzatech. It’s a great article, well worth a read. Here’s a link. In our biosurfactant panel at the Jersey City conference, we’ll be specifically addressing some of the points in this article. Good stuff.

Hmm .. not really cleaning up.

BTW – here is the press release about Future Origins. The other owners are Kao, Unilever and L’Oreal ( promising..) and the site is here – worth reading over. They will be represented at our conference. Priti Pharkya who is in this page, will be there.

Following on from last month’s blog where we talked about the new Tide Evo product (go back and read it if you missed it!), one of our avid readers, who wishes only to be identified as “Thomas W”, pointed me in the direction of what looks to be one of the key patents underpinning this new product category. Thanks Thomas! Here is the link to the patent on Google patents. Let me know if you have trouble downloading it and please let me know your thoughts.

Not sure what’s happening here…

Now to the market news:

With appreciation to ChemAnalyst for some of the news and information used herein.

LAB and LAS:

The US market saw a slight decrease in price for LAB to around USD 2,080 per MT . Prices in the rest of the world were mixed and remained below that in the US as is usually the case.

Spot prices for LAB in Asia continued to trend up in the range of USD 1,425 to USD 1,75 per MT.

Spot prices for LAS in Asia up slightly to – USD 1,260 – 1,350 per MT

Ethylene, EO and Ethoxylates:

EO in the US: Prices remain steady at 57 – 59 clb

EO in the US : Also steady at USD 1,430 – USD 1,600 per MT.

In Asia, Ethoxylates trended up to USD 1,180 – 1,430 per MT.

Detergent Range Alcohols:

Reminder. We’re talking here about alcohol’s in the carbon chain length range 12 – 18, regardless of provenance – means they can be petrochemical, oleochemical or other (that would be coal mainly)

In Asia – increased demand and lower stocks along with upward pressure in PKO have continued to push up pricing. Mid-cuts up around USD 1,600 per MT.

A portion of the US fatty alcohol market is served by import and freight disruptions through the Middle East are being felt. Freight rates and lead times are going up. Prices are continuing to move up. Mid-cuts are around USD 1,800 – 2,000 per MT.

In Europe, a similar story, but weaker demand. Midcuts around USD 1,700 per MT.

AI Corner

This snippet from a press release sent to me by BASF, caught my attention it says: “Furthermore, the “Emollient Maestro” presents dimethicone alternatives driven by Artificial Intelligence..,” Hey, I don’t care what you say. I think it’s cool. Cheesy but cool. Maybe it’s just me. Anyway, you can meet the maestro at the “Smart Formulas Zone” – which I guess is at their booth. I dunno. I didn't read the whole thing. Rest assured though, I’ll be seeking out the maestro who I imagine having a beautifully shaped and waxed (without any silicone) moustache, along with a large context window to deal with all the formulators queries.

Let’s see what he really looks like…

Music Section:

For those attending the conference, you have some homework before you arrive– (for those not attending – WT… well I assume you have a good excuse). Anyhow here’s the homework for attendees. You need to listen to the following 2 piece of music. Really listen, please. Yeah – I know you’re busy. We’re all busy. So just make the time - like how about right now. ..You’ll thank me.

First up – Hemispheres by Rush – it’s only 18 minutes.

Then - The Garden – also Rush

The connection to surfactants? We’ll find out, together, on the day.

Some other non-homework listening. I’m not sure we’ve listened to much Judas Priest on this blog and that is a sorry omission by your author. Here’s a few tracks from their early (and best ) days that were responsible for a great many strained necks and expired braincells. Ah Rob… we hardly knew ye..

Victim of Changes (1976) – established them as the heirs to Black Sabbath – for a while

Sinner (1977) – A personal favorite.

Genocide – Live (1978) – Those great duel guitars of KK Downing and Glen Tipton

Dissident Aggressor (1977) – has a credible claim on being the heaviest metal song ever..

Beyond the Realms of Death – I actually found this song quite scary ..

That’s it for this month! So – if you like what you read (and listen to) here, join a couple hundred of your friends and colleagues at the biggest and best, soon to sell out, surfactant event of the year, May 9 – 10th in Jersey City. Go straight to registration here.