Surfactants Monthly – July 2023

Surfactants Monthly Review

It's a hot blog summer and we are unashamed about it. While our peers in publishing, like The Economist, are putting out a summer double issue (ie skipping an edition), we’re grinding it out in the hot humid months, giving you supreme value for your subscription dollars. So, we have the news then music, followed by personal notes.

We take inspiration where we can find it

The News

As always, credit for almost all our news goes to my partners, the great ICIS. I’m a long-time subscriber. Why not you?

The news theme for this week is uptick (price wise not necessarily sales or volume-wise.) Not sure why or what this means but it's there.

Are those prices rising up there?

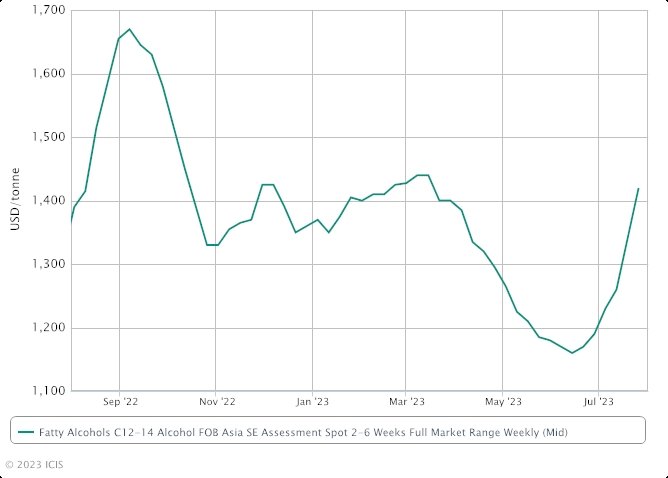

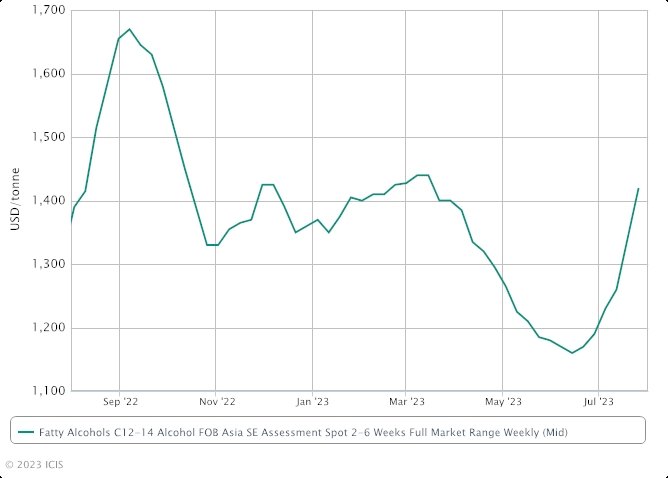

Finally a rebound in Asia prices as ICIS great Helen Yan reports that the Asia fatty alcohols ethoxylates (FAE) market continues to face tightened supply and escalating cost of feedstock fatty alcohol mid-cuts C12-14.

Aug-Sept plant turnarounds tighten supply

Feedstock C12-14 mid-cuts fatty alcohols spot prices surging since mid-June

China stimulus measures to boost regional demand

On 3 August, FAE mols 7,9 spot prices were assessed at $1,450/tonne CIF (cost, insurance & freight) SE (southeast) Asia, up $25/tonne from the previous week, ICIS data showed. A regional 85,000 tonne/year FAE plant is scheduled to shut in H2 August for about a month, at the same time its upstream 75,000 tonne/year ethylene oxide (EO) plant is shut for maintenance. Spot prices of feedstock fatty alcohols C12-14 mid-cuts had increased by about $300/tonne since mid-June, market sources said.

On 2 August, fatty alcohols C12-14 mid-cuts prices were at $1,460/tonne FOB (free on board) southeast (SE) Asia on 2 August, compared with $1,160/tonne FOB SE Asia on 14 June, ICIS data showed.

“We have no choice but to increase our FAE offers for September shipments due to costs pressure and limited spot supply,” a regional supplier said. In view of the rising feedstock fatty alcohols mid-cuts, buyers have started to make enquiries for September FAE shipments. “We have been getting more enquiries for September shipments,” another supplier said. Demand in Asia has been tepid due to macroeconomic headwinds and eroded consumer confidence amid global recession fears and inflationary pressures. However, China’s latest stimulus measures to boost domestic consumption and shore up its property sector are likely to lift sentiment and bolster regional demand. Regional buyers in southeast Asia may soon start to restock given dwindling inventories on hopes that the latest stimulus measures could fuel some recovery in the world’s second-biggest economy in the fourth quarter.

And an uptick in EO as ICIS reports that US July ethylene oxide (EO) contracts were assessed at 57.15-59.15 cents/lb ($1,259-1,304/tonne), as upstream ethylene contracts rose due to higher cash costs. Additionally, key feedstock ethane prices have been rising since early June. Supply of EO has become tight due to a recent deflagration and subsequent force majeure at Dow’s Plaquemine, Louisiana, EO unit. As a result of this, disruptions in downstream ethanolamines supply is expected as the Plaquemine site is expected to remain down for an extended period of time.

Additional EO reporting notes that US ethylene oxide (EO) Q2 production dropped 10% year on year and was relatively unchanged quarter on quarter, according to data from the American Fuel and Petrochemical Manufacturers (AFPM). Demand has been weak for EO through the first half of 2023, with downstream surfactants demand an estimated 10-20% lower compared to last year. Additionally, downstream monoethylene glycol (MEG) demand has been lacklustre as a result of lower-than-expected bottle-grade polyethylene terephthalate (PET) demand, despite the peak summer season.

Significant trend right?

Sticking with our uptick trend: ICIS’ Helen Yan turns her attention to Asian Fatty Alcohols and notes that: Asia’s fatty alcohols market for the core product, mid-cuts C12-14, may see more spot interest due to the tightened supply from plant shutdowns and a potential curb on palm oil supply due to El Nino. Supply is expected to tighten due to upcoming plant shutdowns from late August until mid-November. A 210,000 tonne/year fatty alcohols plant in Malaysia will shut for two months from 20 September-19 November for maintenance. It was originally scheduled to shut for about a month.

A 100,000 tonne/year fatty alcohols plant in southeast Asia is scheduled to shut in late August for a two-week maintenance while another 100,000 tonne/year plant in China will run at a reduced rate of around 70% capacity for two weeks in early August. In Europe, a fatty alcohols producer declared force majeure on 25 July due to equipment failure at its 120,000 tonne/year plant at Rozenburg in the Netherlands. It is not known when it will restart. “We are getting more enquiries for September and even fourth quarter shipments, but we are only discussing September shipments, given the uncertainty of the feedstock outlook,” a supplier said. The feedstock palm kernel oil (PKO) price is now hovering around $930/tonne up about $70/tonne from mid-July, but the potential impact of El Nino on supply disruption has prompted suppliers to hold back any firm offers for fourth quarter shipments, market sources said.

“There are more spot enquiries from China and India but it is difficult to discuss and commit for fourth quarter shipments due to the potential El Nino impact on the feedstock supply,” another supplier said. There has been talk that the hot dry weather and a prolonged drought due to El Nino will likely curb palm oil output and supply early next year. This has spurred demand and heightened spot interest for fourth quarter shipments. Meanwhile, adding to the upward price pressure is China’s stimulus package to boost consumption. The National Development & Reform Commission (NDRC) announced on 31 July, 20 measures to resume and expand domestic consumption.

Some unsurprising news given what we’ve been hearing from the market in general: Stepan's Q2 net income fell 75.7% year on year to $12.7m as sales volumes fell 19%, the US-based producer of surfactants, polymers, and specialty products reported on Wednesday.

Three months ended 30 June:

Surfactants

Operating income was $15.1m, down from $48.2m in Q2 2022, primarily due to a 15% decline in global sales volume amid overall lower demand and customer and channel inventory destocking. Unit margins were slightly lower due to less favourable product mix, high-cost inventory carryover and increased competitive pricing pressures in Latin America.

Polymers

Operating income was $16.3m, down from $33.9m in Q2 2022, primarily due to a 29% decline in global sales volume, including a 28% decline in rigid polyols, amid lower demand, which reflected continued customer and channel inventory destocking and reduced construction-related activities. Global rigid polyols volume improved sequentially each month during Q2 and was up 9% from Q1 2023.

Specialty Products

Operating income was $3.8m, down from $9.9m in Q2 2022, primarily attributable to lower unit margins and sales volume within the medium chain triglycerides (MCT) product line. For the first six months of 2023, total company sales volume was down 17% year on year.

OUTLOOK

“Looking forward, we continue to believe second half of the year volume and margins will incrementally improve versus the first half of 2023, driven by the continued gradual recovery in rigid polyol demand, growth in surfactant volumes associated with new contracted business and sequentially lower raw material costs," said Scott Behrens, president and CEO of Stepan. "Further cost control and cash management initiatives are underway given the current business performance and include a voluntary early retirement programme for eligible employees at our corporate headquarters and a plan to reduce inventory levels by an additional $40m during the remainder of the year,” he said. “While we acknowledge the current environment has been challenging, we remain confident in our long-term strategic growth and innovation initiatives," the CEO said.

You’ve probably read about the Dow fire already, but here’s a piece on the financial impact by Joe Chang: Dow expects to take a hit of around $100m to earnings before interest and tax (EBIT) from the outage at its ethylene oxide (EO) operations in Plaquemine, Louisiana, following a fire on 14 July. A restart will take months, its chief financial officer (CFO) said on Tuesday. A fire started at Dow's Glycol 2 unit at its complex in Plaquemine, according to the company. “It’s highly preliminary but we’re doing the root cause investigation now and then obviously we are still in the planning stages of the rebuild and the recommission. It’s going to take months – this is not weeks of an outage but months,” said Howard Ungerleider, president and CFO of Dow, in an interview with ICIS. The final figure on cost will depend on finalising the rebuild plan, he added. “The biggest [part of the number] is really going to be lost sales, and most of that will be in Q3,” said Ungerleider. Dow has declared force majeure on ethylene oxide (EO) and derivatives from the Plaquemine site. In a 24 July letter to customers, Dow declared force majeure on a series of alkyl alkanolamines, polyglycols, isopropanolamines, ethyl glycol ethers and TERGITOL NP-Series surfactants. Dow’s EO unit also transports EO via pipeline to a downstream ethanolamines producer. This ethanolamines capacity accounts for roughly 25% of monoethanolamines, (MEA), diethanolamines (DEA) and triethanolamines (TEA) capacity in the US, according to the ICIS Supply & Demand Database. INEOS Oxide declared force majeure on ethanolamines from its Plaquemine plant following the incident at Dow’s EO operations.

In contrast the US market, the European market for EO is rather flat to down, as noted in an insightful piece from ICIS’s Melissa Hurley. European ethylene oxide (EO) demand is expected to remain low in the third quarter, with some end-user shutdowns during summer expected to limit EO consumption.

There are expected EO turnarounds at the end of the third quarter and the beginning of the fourth quarter but not all are officially confirmed.

Muted demand expectations for Q3 and Q4

Recovery timeline unclear

Well-supplied market ahead of Q3/Q4 turnarounds

Some EO consumers have taken lower volumes or revised down forecast consumption for the second half of the year because of lower demand.

The biggest share of EO output is into monoethylene glycol (MEG) for polyester fibres, resins and anti-freeze formulations and PET film for packaging. Downstream monoethylene glycol (MEG) demand has been a real challenge, especially for the downstream polyethylene terephthalate (PET) sector. MEG margins have been struggling for some time and there has been significant pressure on spot prices.

Diethylene glycol (DEG) and triethylene glycol (TEG) demand pressure mounted at the start of the third quarter. DEG supply could lengthen in August due to incoming US material. More than 7% of EO output is used in diethylene glycol (DEG) and triethylene glycol (TEG). DEG is used in polyols, unsaturated polyester resins and plasticizers.

“During Q3 we do not expect a pick-up. As well for Q4, due to the long period of weakness”, added a market source in July.

There has been a drop in surfactants demand, shifting towards the end consumer. High inflation rates are resulting in curbed end-user spending, even in the personal care sector.

The second largest EO derivative market is ethoxylates, used in applications such as shampoo and kitchen cleaners. Downstream ethanolamine, glycol ether and ethylene glycol (EG) demand expectations are also reserved for the third quarter. There is a wait-and see attitude towards recovery in the closing quarter of 2023. Better demand might not arrive until 2024, downstream sources have said. Supply wise, ethanolamine market players are monitoring the supply situation due to the unplanned issues in France at Lavera and varying levels of imports. Glycol ether supply is expected to remain balanced to long. European EO supply was readily available in the second quarter which is expected to continue in the third quarter. Operating rates could have been reduced to deal with lower-than-expected demand. Second-quarter maintenance tunrarounds that took place did not impact availability because consumption was lower, as stocks were built in advance to cover contracts. A cluster of planned EO/EG turnarounds are expected at the end of the third quarter, and the beginning of the fourth. Usually, maintenance turnarounds are well prepared for, and stocks are built up in advance. Given the poor demand situation experienced in the first part of the year, EO supply length could remain a key feature of the market. The market has experienced a period of relative stability in terms of energy costs, compared to 2022. Feedstock costs have also eased as upstream ethylene contract prices have dropped 4.7% in the first six months of 2023, easing EO contract prices slightly. Due to the unprecedented increase in gas prices, suppliers and consumers adopted varied formula methods in 2023 contracts to better reflect costs. Some implemented hardship clauses in case gas prices became unmanageable. Methods adopted to reflect the added energy costs varied greatly depending on contract, starting point and account. In some cases, variable costs are being reflected should European gas prices go above a certain threshold and use an average movement in gas prices from the previous month. Gas prices gradually came down to more manageable levels in the second quarter. Production cost uncertainties for the second part of the year remain as there are still concerns that gas prices could spike during the colder months.

Even the world’s largest volume surfactant intermediate in the world’s most competitive market is starting to tick up : In Asia - Some sellers of linear alkylebenzene (LAB) have raised offers as raw material costs have increased in recent weeks on the back of buoyant crude oil markets.

Offers rise after months of price downtrend

Some buyers maintain wait-and-see stance

Scheduled maintenance, output cuts help keep supply balanced

The higher offers continue to face the tough hurdle, coming from a general downtrend in prices for many months.

“Some offers have increased, but it remains to be seen if buyers will accept,” said a trader in Asia. Other suppliers have kept offers unchanged this week, although most have mulled the idea of raising them in the near term. “Upstream costs have increased, and margins are squeezed, hence, some upward revision in offers is necessary,” said a supplier in Asia. LAB supply in east and south Asia remains ample as the market entered a weaker third quarter, with demand remaining in a low ebb. However, scheduled plant turnarounds in China in June and July have kept supply in check to some degree. Another key manufacturer in Asia has a planned maintenance in October which will last more than a month. This will also prevent a supply overhang in the regional LAB market. At the same time, some makers in India and the Middle East have been running their plants at lower rates to keep problems of elevated inventories at bay. Buyers of LAB are sitting on lean inventories, a sound strategy to adopt in a downward trending market, market sources said. Most buyers hope to pick up cargoes at increasingly lower prices as was their experience in trecent past.

Workhorse turning?

The Music

This month, I want to try a live experiment with the YouTube algorithm. I’ll share first what I’ listening to right now – that is what is on Youtube now, left over from what I was listening to probably on Friday afternoon, during a deep work session. Then I’ll test the hypothesis that the most interesting stuff is 1/3 - 2/3 of the way down the list on the right hand side of the page. A list which gets refreshed with every new video watched. Let’s see what we get:

First up – from Friday PM – the great King Weed, French instrumental psychedelia. They’ve been featured in these pages before, but not this album.

Right – so now – some way down on the right hand side – listing. Wasteland Haze with their album Welcome to Wasteland Haze. I realize that I may have lost most readers with this this instrumental stoner music from Dusseldorf, but give it a listen. You never know.

Now, from half- way down the list again – an album from the Riding Easy record label. A label we have featured many times here. The band is Spelljammer. Album – Abyssal Trip. If you are fan of Sleep (the band ), I think you’ll like the opening track.

OK let’s see if can access something a little more mainstream, while again, sticking only to recommendations from the YT algo down the right hand side of the page. Ah here we go, Marquee Moon by Television. Musta listened to this thousands of times in the 70’s because I thought it was intellectual. Got to like it though: I’ll start it at the title track.

Now – interestingly the side listing serves me, among other things the Ramomes Rocket to Russia and the album Impeckable by Budgie. I think you guys know the Ramones very well so let’s check out those great Welsh proto-metal rockers, Budgie.

OK – end of experiment. – Now let’s wrap up the music with Budgie’s most famous song and its most famous cover version by Metallica. Goes to show, something or other not sure what. I do like how Metallica definitely acknowledged and paid tribute to their roots and influences though.

So – here’s Budgie from 1973

And Metallica from a 1989 live show.

So – you can see how the song itself is quintessential metal -and good enough, I think to appeal to a crossover audience. (crossing from what ? - Punk obviously) Let’s see who else has covered it. Apparently Florence Black has. Not heard of them. Here they are:

Surprisingly I could not find any others, except from actual cover or tribute bands. Very surprised that Lemmy never sang it in some form (readers – help me out!). In the meantime here’s an Australian busker with some cojones to play this solo, without a safety net in a subway station. Nice. Honestly we could all learn a thing or two from this dude

Personal Notes:

You may have noticed on Linkedin that I retired from the CEO role at P2 Science. Reactions ranged from (paraphrasing here) “Enjoy gardening and golf” to “Can’t wait to see the incredible new business things you do next!”. I’ve not conducted a quantitative analysis but, just eyeballing the 70+ comments and it’s seems to be American readers that are like “OK what’s next”. So to put it in culturally relevant terms, my plan is to have a European vacation; or more accurately a European-style vacation. That’s one without email or texts or calls and with fresh-air, exercise and decompression. Followed by an American retirement; that’s American-style retirement, which, as some readers know, is largely indistinguishable from working-life. So far so unsurprising. Rest of the year, I’ll be in Canada, Panama, UK, Malaysia and Chile. I’ll leave you to figure out which is Euro-vacation vs Amero-retirement.

Yeah but what’s next? Forget the travel-bragging. What's actually next? Well, the easy stuff: The blog continues as do the conferences. (save the date May 9th and 10th ’24 – Jersey City). Boards have always been fun and fulfilling from silicones to rail-track services. So a couple of those most likely. I have other passions and ideas - loosely centered around a theme of human potential. Fulfilment of human potential has been a big thing for me in recent years. It’s something I’ve tried to incorporate into my day job. Going forward, it’s at the center of things. Someone fulfilling their potential is a wonderful thing. Ignoring, or worse, denying, that potential is a tragedy – especially if it’s done to you by another person, country, government, society, group or what have you. That’s about as much detail as I want to put out there at the moment. Except to say, of course, that we’ll be staying close to the world of chemicals and particularly those with amphiphilic natures.

American Retirement